How To Read And Use The Fibonacci Retracement Indicator Currency

How To Read And Use The Fibonacci Retracement Indicator Currency The charting software automagically calculates and shows you the retracement levels. as you can see from the chart, the fibonacci retracement levels were .7955 (23.6%), .7764 (38.2%), .7609 (50.0%*), .7454 (61.8%), and .7263 (76.4%). now, the expectation is that if aud usd retraces from the recent high, it will find support at one of those. Unlike other indicators, fibonacci retracements are fixed, making them very easy to interpret. when combined with additional indicators, fibs can be used to identify potential entry and exit points with high probability to trade on trending movements. fibonacci retracements are used to indicate levels of support and resistance for a stock’s.

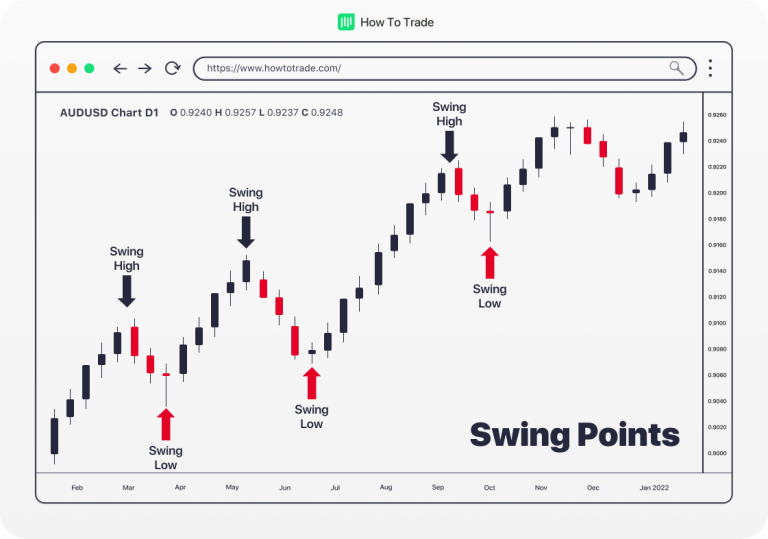

How To Read And Use The Fibonacci Retracement Indicator Currency The fibonacci retracement is created by taking two points on a chart and dividing the vertical distance by the key fibonacci ratios of 23.6%, 38.2%, 50 %, 61.8%, and 78.6% (derived from mathematical relationships found in the fibonacci sequence). keep reading to learn how to apply the fibonacci retracement to your trading strategy. In the above chart, the anticipated resistance levels for stellar lumens (xlm btc) were calculated using the fibonacci tool by connecting the swing high of 0.00006335 btc to the swing low of 0. For example, if you divide 21 by 34, you’ll get 0.6176. and if you divide a number by the number found two places to the right, you’ll get a ratio close to 0.382. for instance, if you divide 21 by 55, you’ll get 0.3818. all the ratios (except 50%) in the fibonacci retracement tool are based on some calculations involving this method. The 78.6% fibonacci retracement level is calculated using the formula retracement level = swing low (vertical distance × 0.786). for instance, a fibonacci retracement trader calculates the retracement levels on a eur usd price chart by identifying the swing low (say 1.1000) and swing high (say 1.2000).

Trading Tip 6 How To Use The Fibonacci Retracement Tool Youtube For example, if you divide 21 by 34, you’ll get 0.6176. and if you divide a number by the number found two places to the right, you’ll get a ratio close to 0.382. for instance, if you divide 21 by 55, you’ll get 0.3818. all the ratios (except 50%) in the fibonacci retracement tool are based on some calculations involving this method. The 78.6% fibonacci retracement level is calculated using the formula retracement level = swing low (vertical distance × 0.786). for instance, a fibonacci retracement trader calculates the retracement levels on a eur usd price chart by identifying the swing low (say 1.1000) and swing high (say 1.2000). Step 2: determine the retracement level and entry point. wait for the price to retrace to one of the key fibonacci levels (like 38.2%, 50%, or 61.8%). enter the trade when you have additional confirmation from other indicators. you want multiple signals pointing in the same direction before you pull the trigger. In fibonacci retracements, potential reversal points or price levels get determined by the key fibonacci ratios, namely 23.6%, 38.2%, 50%, 61.8%, and 78.6%. upon spotting a trend, traders often pull the fibonacci retracement tool from the low to the high if it’s an uptrend, or high to low if it’s a downtrend. fibonacci levels are then.

How To Use Fibonacci Retracement Indicator To Trade Step 2: determine the retracement level and entry point. wait for the price to retrace to one of the key fibonacci levels (like 38.2%, 50%, or 61.8%). enter the trade when you have additional confirmation from other indicators. you want multiple signals pointing in the same direction before you pull the trigger. In fibonacci retracements, potential reversal points or price levels get determined by the key fibonacci ratios, namely 23.6%, 38.2%, 50%, 61.8%, and 78.6%. upon spotting a trend, traders often pull the fibonacci retracement tool from the low to the high if it’s an uptrend, or high to low if it’s a downtrend. fibonacci levels are then.

How To Use Fibonacci Retracement In Forex Trading

Comments are closed.