How To Qualify For Government Hvac Rebates Hvac Reviews Tips

How To Qualify For Government Hvac Rebates Hvac Reviews Tips Youtube The maximum credit you can claim each year is: $1,200 for energy efficient property costs and certain energy efficient home improvements, with limits on exterior doors ($250 per door and $500 total), exterior windows and skylights ($600) and home energy audits ($150) $2,000 per year for qualified heat pumps, water heaters, biomass stoves or. Over $1 billion awarded for home energy rebate programs. august 8, 2024. the u.s. department of energy’s (doe) home energy rebate programs has hit a major milestone: doe has now awarded over $1 billion to states to deliver rebate programs for energy efficient home upgrades to their eligible residents. learn more.

2024 Government Rebates For Heating Hvac Systems The hvac related tax credits in particular increased dramatically compared to previous years. for example, installing an eligible air source heat pump can qualify for a 30% tax credit worth up to $2,000 for systems installed from 2023 2032. credits decrease slightly after 2032 but still provide substantial savings. These devices are available as ducted and ductless versions (the latter are also called mini splits), and both types of heat pumps are eligible for eehic. for installing a qualifying energy efficient heat pump, you can claim 30% of the purchase and installation costs as tax credits, up to a maximum of $2,000 annually. Tax credit available: 30% of the total project cost, up to $600. eligibility requirements: natural gas boilers: afue > 95%. oil boilers: rated by the manufacturer for use with fuel blends containing at least 20% biodiesel, renewable diesel, or second generation biofuel. the total limit for an efficiency tax credit in one year is $3,200. The federal government offers tax credits for homeowners who install energy efficient hvac systems. under the energy efficient home improvement tax credit (extended and expanded through 2024): credit amount: up to 30% of the cost of the system, with a maximum of $600 for air conditioning units and $2,000 for heat pumps.

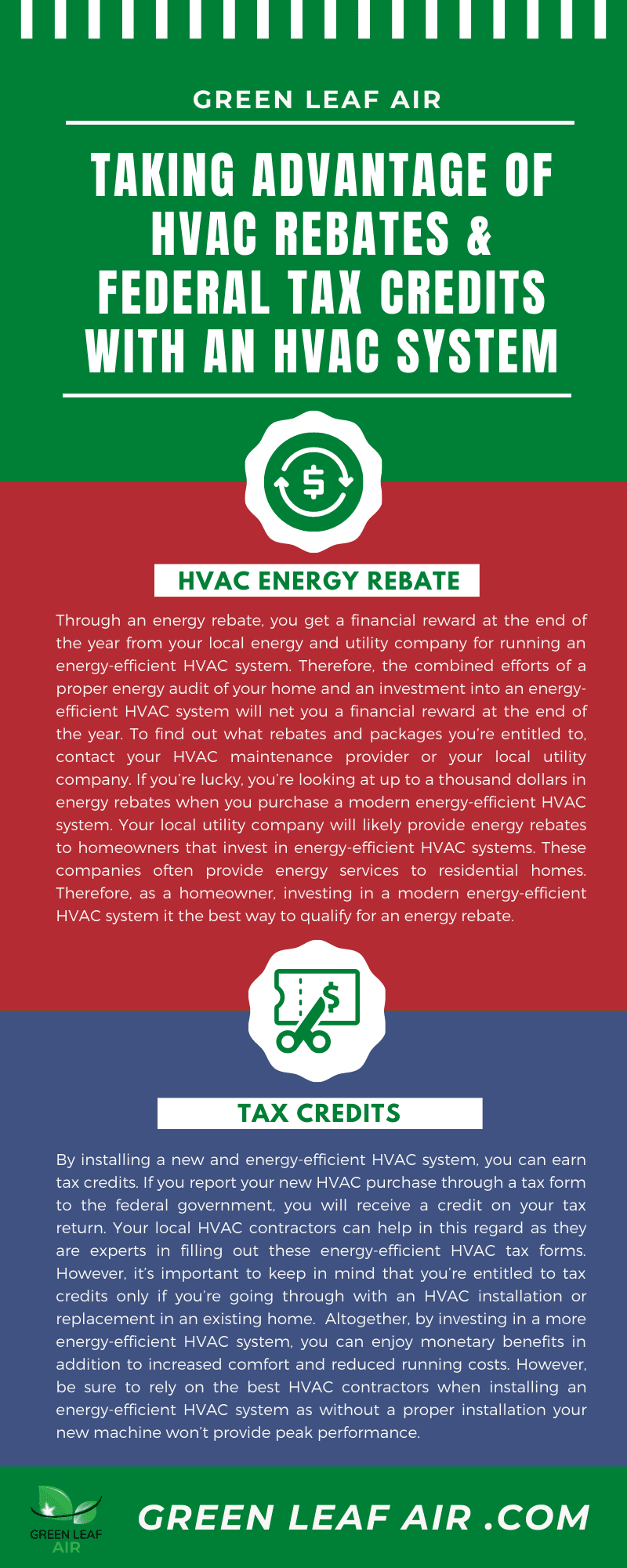

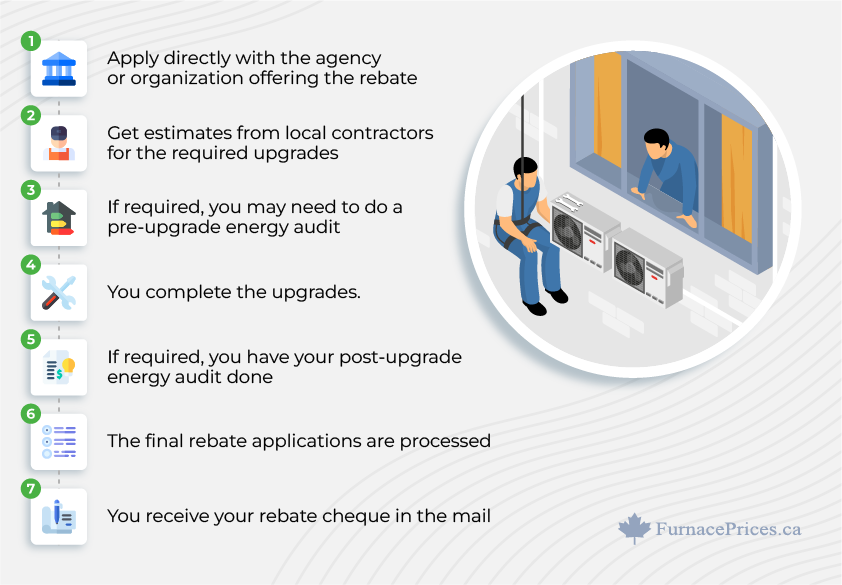

Taking Advantage Of Hvac Rebates Federal Tax Credits With An Hvac Tax credit available: 30% of the total project cost, up to $600. eligibility requirements: natural gas boilers: afue > 95%. oil boilers: rated by the manufacturer for use with fuel blends containing at least 20% biodiesel, renewable diesel, or second generation biofuel. the total limit for an efficiency tax credit in one year is $3,200. The federal government offers tax credits for homeowners who install energy efficient hvac systems. under the energy efficient home improvement tax credit (extended and expanded through 2024): credit amount: up to 30% of the cost of the system, with a maximum of $600 for air conditioning units and $2,000 for heat pumps. Power your home — and save money — with home energy rebates. through the home energy rebates, you may be eligible for cash back on appliances and other home improvements that can lower your energy bills. the map below shows your state’s progress toward launching its rebates. nh vt ri nj de md dc ma ct hi ak fl me ny pa va wv oh in il wi. Networx estimate. networx is one of trusted companies which offers local quotes for hvac and other home improvement projects. they will call you after matching suitable local contractors, then you can ask for suitable tax credits or local rebates based on your own condition. 3. energy.gov.

2024 Government Rebates For Heating Hvac Systems Power your home — and save money — with home energy rebates. through the home energy rebates, you may be eligible for cash back on appliances and other home improvements that can lower your energy bills. the map below shows your state’s progress toward launching its rebates. nh vt ri nj de md dc ma ct hi ak fl me ny pa va wv oh in il wi. Networx estimate. networx is one of trusted companies which offers local quotes for hvac and other home improvement projects. they will call you after matching suitable local contractors, then you can ask for suitable tax credits or local rebates based on your own condition. 3. energy.gov.

2020 Hvac Rebates Federal Tax Credits Dtc Air Conditioning Heating

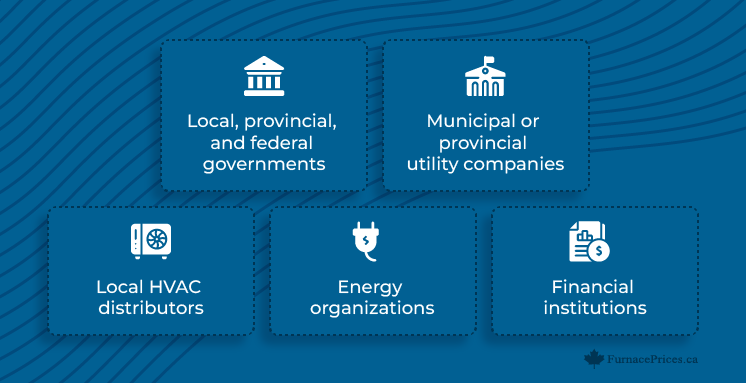

Unlocking Savings Understanding Hvac Rebates Incentive Programs

Comments are closed.