How To Pay Off A Debt In Collection

/tactics-for-paying-off-debt-collections-960596-final-dd5c75985b904e46b8d1bd8e0a9f4d77.jpg)

How To Pay Off A Debt In Collection By brianna mcgurran. quick answer. you can pay off debt in collections by following these steps: confirm the debt is yours. know your rights. calculate how much you can pay. contact the debt collector. pay the debt. once your debt is sent to collections, it's important to address it rather than ignoring it. You might also be interested in how to set up a debt payoff plan and stick to it. 8. make your payment (s) as agreed. once you’ve agreed on a payment plan with the debt collector, make sure you.

How To Pay Off Debt In Collections Online Credello 1. create a payment plan. creating a payment plan lets you set a payment schedule and amount that works for your budget. comb through your finances to see how much you can afford to pay each week. Tell the collectors not to contact you. make a plan to pay off the debt. contact the collection agency and make payments. that’s all there is to it. and it sounds pretty simple. but here’s the truth about paying off collections debt (or any other debt): getting out of it is only 20% head knowledge and 80% behavior. 6 steps for dealing with a debt collector. 1. don't give in to pressure to pay on first contact. just as you wouldn’t jump into a contract without understanding its terms, don’t rush to make a. 4. rebuild your credit. when you have a debt in collections, it can hurt your credit score. lenders will see you as unlikely to pay your debts, and thus your chances of getting a mortgage, a good credit card or another financial product will suffer. that’s why it’s important to pay off your debts if you can.

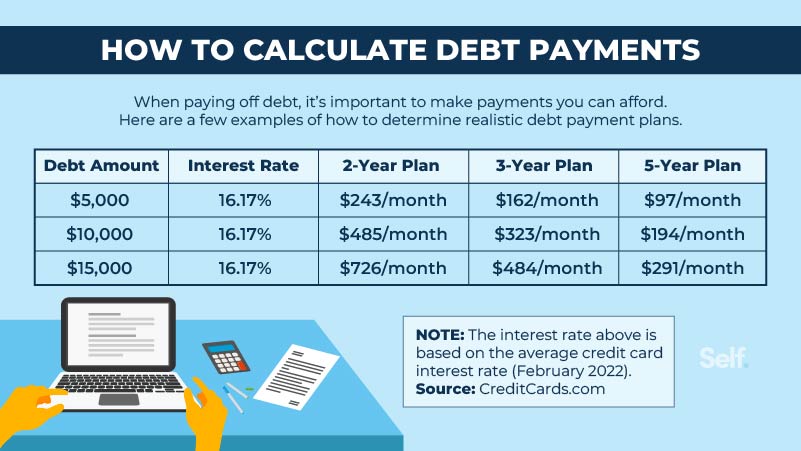

How To Pay Off Debt In Collections Self Credit Builder 6 steps for dealing with a debt collector. 1. don't give in to pressure to pay on first contact. just as you wouldn’t jump into a contract without understanding its terms, don’t rush to make a. 4. rebuild your credit. when you have a debt in collections, it can hurt your credit score. lenders will see you as unlikely to pay your debts, and thus your chances of getting a mortgage, a good credit card or another financial product will suffer. that’s why it’s important to pay off your debts if you can. To pay off $10,000 in credit card debt within 36 months, you will need to pay $362 per month, assuming an apr of 18%. you would incur $3,039 in interest charges during that time, but you could avoid much of this extra cost and pay off your debt faster by using a 0% apr balance transfer credit card. In a nutshell. here's how to pay off a debt in collections: step 1: know your rights step 2: respond to the debt collector or collection agency step 3: verify the debt step 4: check the statute of limitations in your state step 5: review your budget & make a payment strategy step 6: get your agreement in writing step 7: check your credit report.

Comments are closed.