How To Maximize Tax Benefits Using Tax Advantage Investment Vehicles To Invest In Real Estate

How To Maximize Tax Benefits Using Tax Advantage Investment Vehicles To Very simply, tax smart investing targets leveraging various investment strategies and vehicles in order to potentially optimize returns while also minimizing tax liabilities. when it comes to real. Defer paying capital gains until 2026 (or until you sell your stake in the fund). grow your capital gains by 10% if you hold the fund for 5 years; 15% for 7 years. avoid paying capital gains entirely if you remain invested in the fund for 10 years. 6. be self employed without the fica tax.

How To Maximize Your Real Estate Tax Benefits Theadvisermagazine This is unique to syndication, unlike other forms of real estate investing like reits. the following are the core ways in which a real estate syndication provides significant tax benefits for passive investors: depreciation. carrying over passive losses. cash out refinance. lower capital gains tax rate. Yes, earning tax deductions is a primary and powerful benefit of real estate investment. for rental properties, these deductions can include (but are not limited to): • mortgage interest. 8. take advantage of the 20% pass through deduction. the tax cuts and jobs act of 2017 included an intriguing tax perk for small business owners, including real estate investors. on the simplest level, it allows small business owners to deduct an extra 20% of their net business income. A real estate investment trust is a company that owns and operates income producing commercial real estate. they invest in, manage, and collect rent on apartment buildings, cell towers, data centers, warehouses, hotels, hospitals, offices, malls, and more. they must comply with certain strict irs regulations, and they’re publicly traded in.

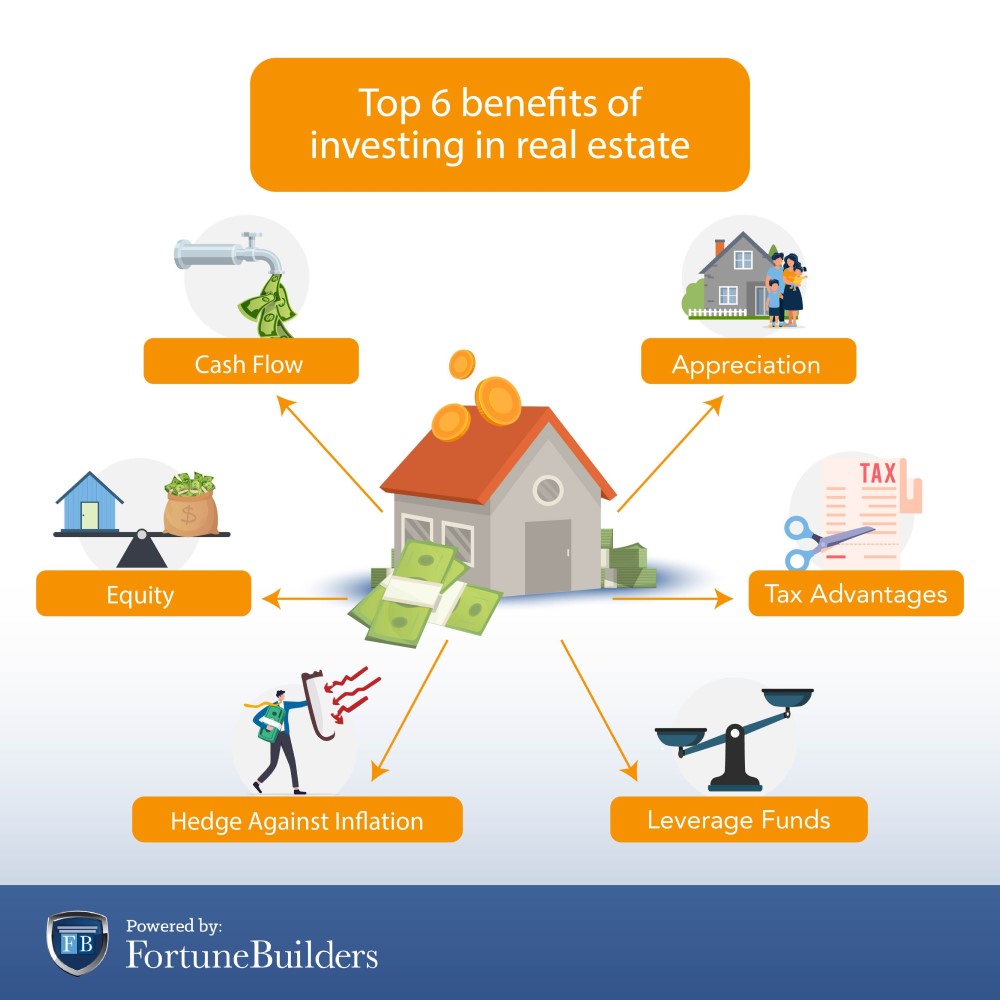

Benefits Of Investing In Real Estate Fortunebuilders 8. take advantage of the 20% pass through deduction. the tax cuts and jobs act of 2017 included an intriguing tax perk for small business owners, including real estate investors. on the simplest level, it allows small business owners to deduct an extra 20% of their net business income. A real estate investment trust is a company that owns and operates income producing commercial real estate. they invest in, manage, and collect rent on apartment buildings, cell towers, data centers, warehouses, hotels, hospitals, offices, malls, and more. they must comply with certain strict irs regulations, and they’re publicly traded in. Real estate investors can qualify for tax write offs, pass through deductions, incentive programs and other tax benefits. Investments held for longer than a year trigger long term capital gains tax, which are 0%, 15% or 20% depending on your filing status and income level. if you can wait to get past that one year.

Are You Taking Advantage Of The Top 5 Tax Benefits Of Investing In Real Real estate investors can qualify for tax write offs, pass through deductions, incentive programs and other tax benefits. Investments held for longer than a year trigger long term capital gains tax, which are 0%, 15% or 20% depending on your filing status and income level. if you can wait to get past that one year.

Are You Taking Advantage Of The Top 5 Tax Benefits Of Investing In Real

Comments are closed.