How To Invest And Grow Your Retirement Savings

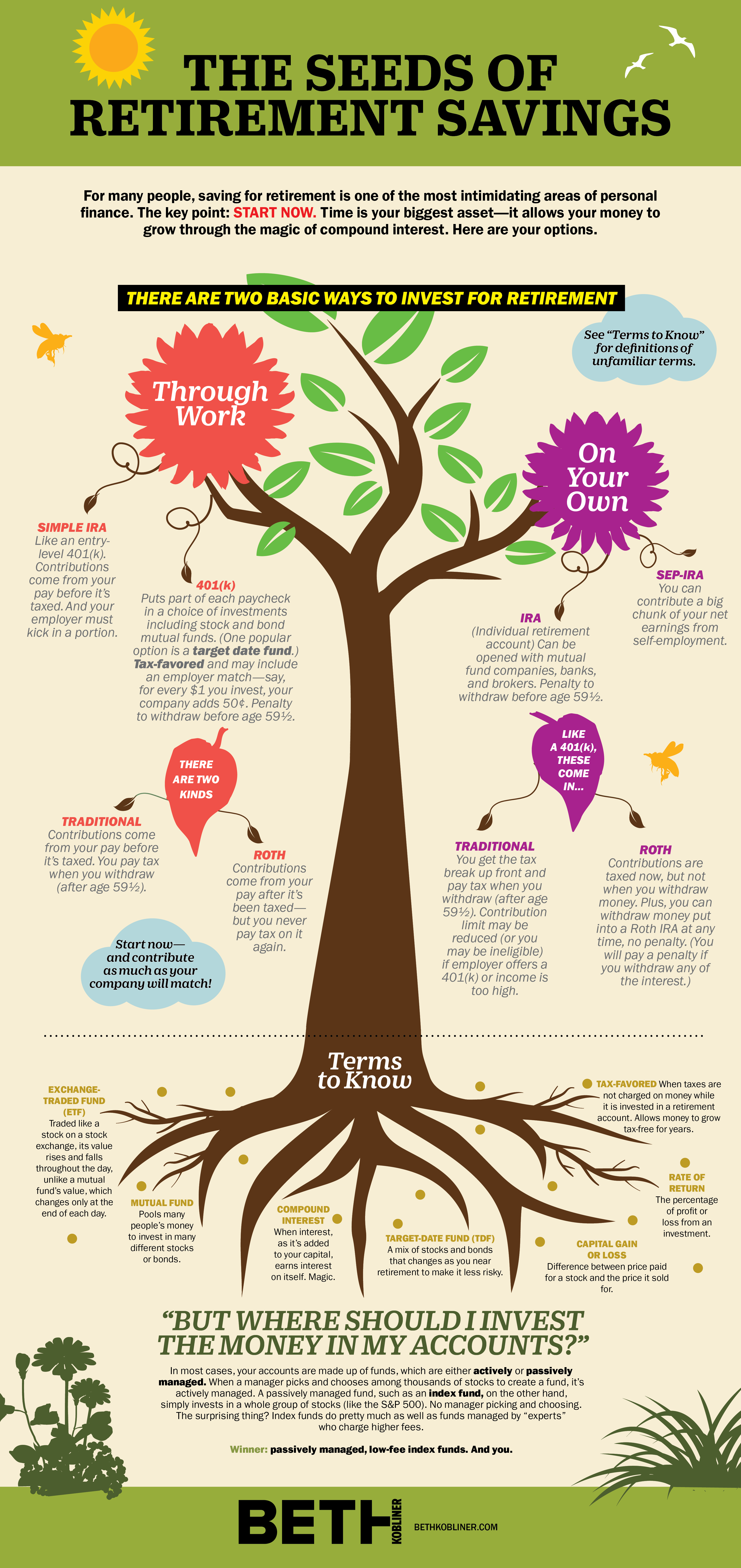

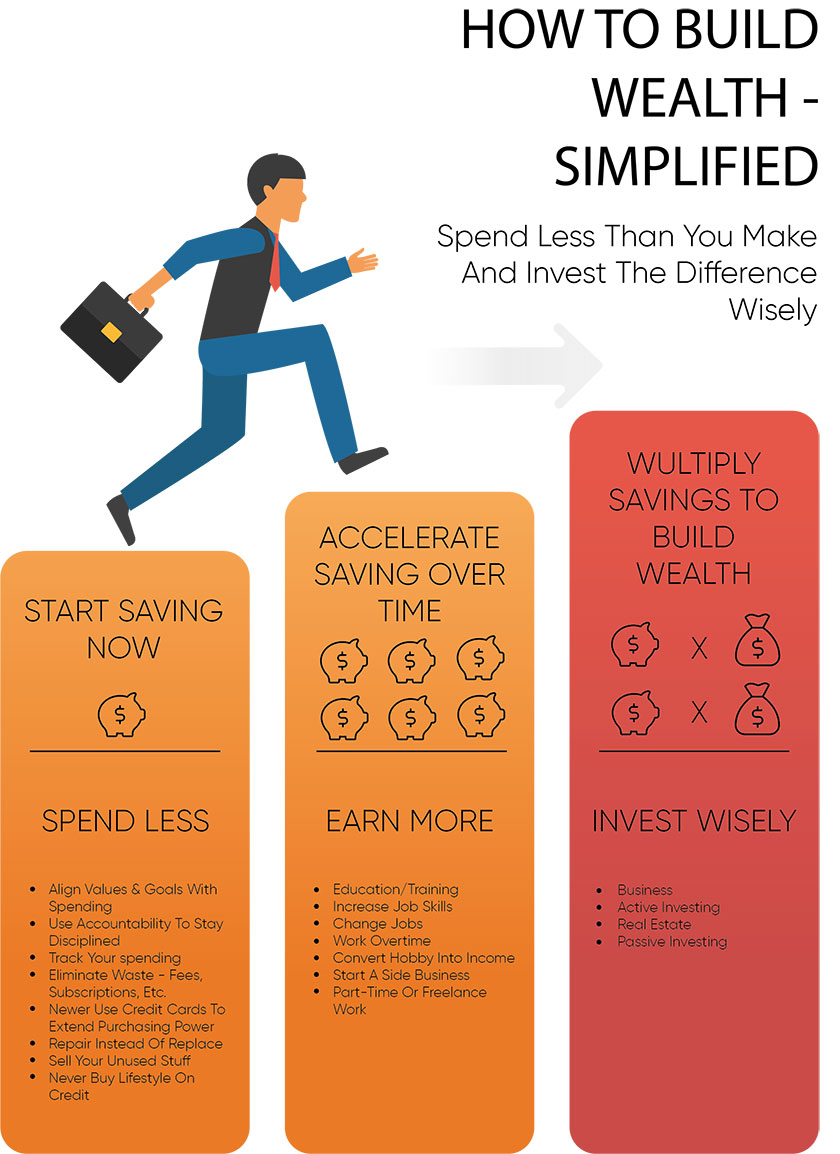

How To Invest And Grow Your Retirement Savings Some investors miss out on long term, positive returns because they abandon their investment strategies in times of turmoil. but j.p. morgan estimates that if an individual maintained her. I will find $100 of expenses to cut each month and use the savings to fund my roth ira. review your goals every year and celebrate every time you reach a goal. 5. get your company’s 401 (k.

How To Start Investing For Retirement Financing For Retirement 5. buy rental property to invest for retirement. like dividends, real estate is often thought of as a way to provide consistent income regardless of market performance. while you can also invest. Assuming a 6% rate of return and the $1.25 million figure from our earlier example, you would need to save about $218,000 over 30 years to reach this hypothetical retirement goal. that works out. 3. meet your employer's match. "if your employer offers to match your 401 (k) plan contributions, make sure you contribute at least enough to take full advantage of the match," vale says. for example, an employer may offer to match 50% of employee contributions up to 5% of your salary. that means if you earn $50,000 a year and contribute $2,500. Read viewpoints on fidelity : 5 ways hsas can help with your retirement. fidelity's guideline: save 15% of your income annually, including any match you get from your employer. this assumes you start saving at age 25 and plan to retire at age 67. 3. if 15% is too much, start where you can.

Retirement Investing 101 Grow Your Savings From Small To Jumbo Rebalance 3. meet your employer's match. "if your employer offers to match your 401 (k) plan contributions, make sure you contribute at least enough to take full advantage of the match," vale says. for example, an employer may offer to match 50% of employee contributions up to 5% of your salary. that means if you earn $50,000 a year and contribute $2,500. Read viewpoints on fidelity : 5 ways hsas can help with your retirement. fidelity's guideline: save 15% of your income annually, including any match you get from your employer. this assumes you start saving at age 25 and plan to retire at age 67. 3. if 15% is too much, start where you can. The maximum you can contribute to your 401 (k) plan is $23,000 in 2024 and $23,500 in 2025. (in 2024 and 2025, people aged 50 and older can contribute an extra $7,500 as a catch up contribution. If your debt balance is compounding at those high rates, the best investment you can make is to pay down the balance as soon as possible. if you can, try to pay off any mortgages before you reach.

Investing To Grow Your Retirement Savings The maximum you can contribute to your 401 (k) plan is $23,000 in 2024 and $23,500 in 2025. (in 2024 and 2025, people aged 50 and older can contribute an extra $7,500 as a catch up contribution. If your debt balance is compounding at those high rates, the best investment you can make is to pay down the balance as soon as possible. if you can, try to pay off any mortgages before you reach.

Retirement Calculator How Much Do I Need To Retire Kiplinger

Comments are closed.