How To Find Your Best Refinance Rate In 7 Steps 2023

How To Find Your Best Refinance Rate In 7 Steps 2023 Follow these seven steps to set yourself up for success when you shop for refinance rates and compare offers. 1. get your credit and debt in check. to get your best rate from any lender, you. To find the best refinance rates in 2024, we analyzed data on every loan from the 50 biggest refi lenders in 2023, which is the most recent data available. 1,2. the companies with the lowest 30.

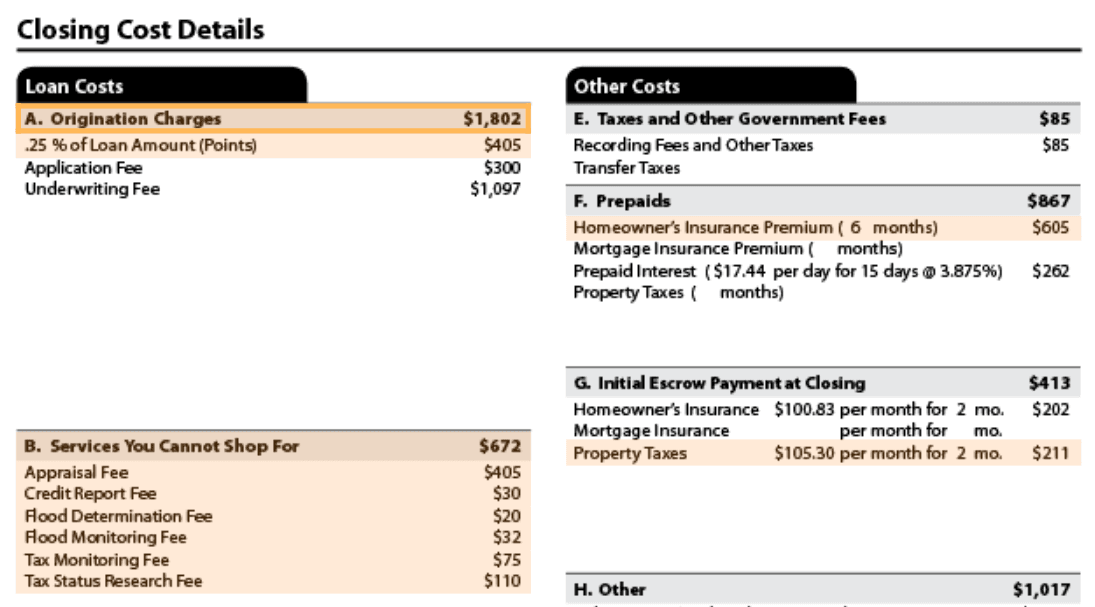

How To Find Your Best Refinance Rate In 7 Steps 2023 This time last week, the 30 year fixed apr was 7.35%. meanwhile, the average apr on a 15 year fixed refinance mortgage is 6.40%. this same time last week, the 15 year fixed rate mortgage apr was 6. Here are eight types of closing costs you can expect when you refinance your mortgage: application fee: $75 – $300. origination and or underwriting: 1% – 1.5% of loan principal. attorney. 6. consider the loan amount. the more you borrow for a mortgage, the higher your monthly payment will be. a homeowner who gets a mortgage on a $250,000 home with a 4 percent interest rate for 30. We have thousands of articles in addition to our guides. search all our content for answers to your questions. or, speak to a lender and get personalized help. learn how to refinance your home.

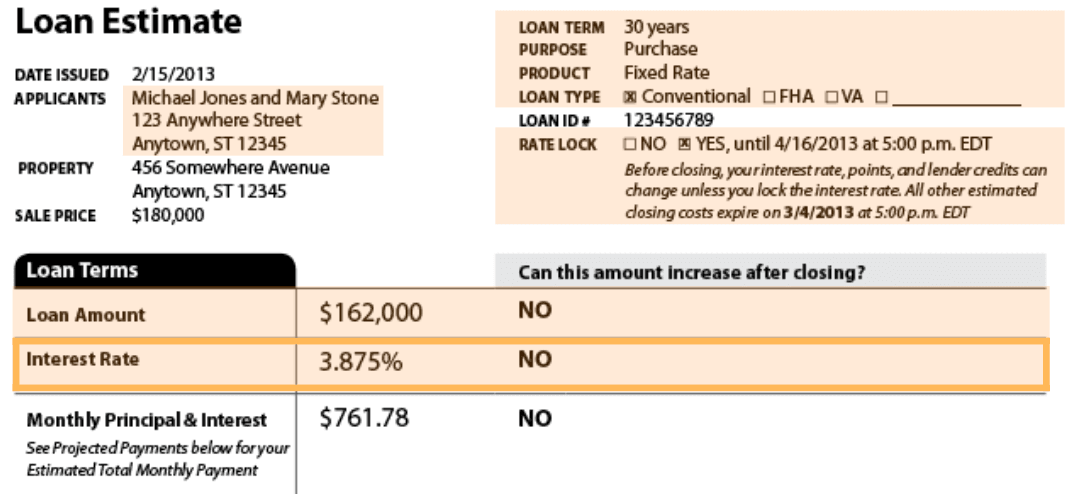

7 Steps To Refinance Your Mortgage Global Integrity Finance 6. consider the loan amount. the more you borrow for a mortgage, the higher your monthly payment will be. a homeowner who gets a mortgage on a $250,000 home with a 4 percent interest rate for 30. We have thousands of articles in addition to our guides. search all our content for answers to your questions. or, speak to a lender and get personalized help. learn how to refinance your home. Shop around for lenders. lastly, taking the time to shop around at different mortgage refinancing providers can help you get a better deal. "my top tip for securing the best mortgage refinance. Timing matters. mortgage refinance rates today may be lower or higher than the rates tomorrow, next week, or next month. in a rising interest rate environment, for example, you might get a mortgage refinancing quote for 7%, only for the rate to settle at 8% when it’s time to close. that’s why many borrowers choose to “lock in” their.

Which Bank Has The Best Refinance Rates In 2023 Home Shop around for lenders. lastly, taking the time to shop around at different mortgage refinancing providers can help you get a better deal. "my top tip for securing the best mortgage refinance. Timing matters. mortgage refinance rates today may be lower or higher than the rates tomorrow, next week, or next month. in a rising interest rate environment, for example, you might get a mortgage refinancing quote for 7%, only for the rate to settle at 8% when it’s time to close. that’s why many borrowers choose to “lock in” their.

Latest Rate Overview бђ Home Loan Refinancing Updated 2023

Comments are closed.