How To Fill Out The W 4 Form 2024

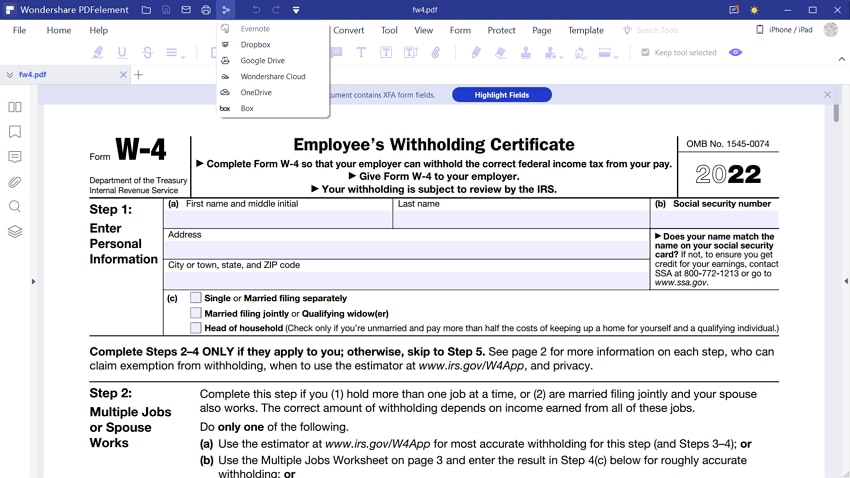

How To Fill In 2024 W 4 Form Step By Step Instructions Step 4: refine your withholdings. if you want extra tax withheld, or expect to claim deductions other than the standard deduction when you do your taxes, you can note that. step 5: sign and date. 2024 form w 4. form. w 4. department of the treasury internal revenue service. employee’s withholding certificate. complete form w 4 so that your employer can withhold the correct federal income tax from your pay. give form w 4 to your employer. your withholding is subject to review by the irs. omb no. 1545 0074.

W4 Form 2024 For Employee To Fill Out And Print Reeta Celestia Page last reviewed or updated: 22 may 2024. information about form w 4, employee's withholding certificate, including recent updates, related forms and instructions on how to file. form w 4 is completed by employees and given to their employer so their employer can withhold the correct federal income tax from the employee's pay. How to fill out the w 4 form (2024) the redesigned w 4 form no longer has allowances. we explain the five steps to filling it out and answer other faq about the form. Step 3: claim dependents and children. if you earn less than $200,000 per year as a single filer or less than $400,000 per year if married filing jointly, you can follow the steps on your w 4 form to include the $2,000 in credit for each dependent under 17 years of age and $500 for other dependents. Step 2: account for all jobs you and your spouse have. unlike when you filled out w 4 forms in the past, you’ll have to fill out your w 4 with your combined income in mind, including self employment. otherwise, you may set up your withholding at too low a rate. to fill out this part correctly, you have three choices.

W4 2024 Fillable Dora Nancee Step 3: claim dependents and children. if you earn less than $200,000 per year as a single filer or less than $400,000 per year if married filing jointly, you can follow the steps on your w 4 form to include the $2,000 in credit for each dependent under 17 years of age and $500 for other dependents. Step 2: account for all jobs you and your spouse have. unlike when you filled out w 4 forms in the past, you’ll have to fill out your w 4 with your combined income in mind, including self employment. otherwise, you may set up your withholding at too low a rate. to fill out this part correctly, you have three choices. Step 5: sign and date form w 4. the form isn't valid until you sign it. remember, you only have to fill out the new w 4 form if you start a new job or if you want to make changes to the amount. The most notable change in the 2024 w 4 form occurs in step 2, which deals with considerations for those who have multiple jobs or are filing jointly with a working spouse. the irs has updated this section to replace the previous "reserved for future use" with a direct prompt to utilize the irs’ w 4 tax withholding estimator tool.

Comments are closed.