How To Fill Out Irs Form W 4 Single 2019 Updated Youtube

How To Fill Out Irs Form W 4 Single 2019 Updated Youtube In this video, i'm talking about how to fill out irs form w 4 for 2019 updated with the new tax estimator. if you're employer gave you the paper version of in this video, i'm talking about how. An animated look at the updated w 4 tax form and steps for withholding the right amount of income tax.the associated press is the essential global news netwo.

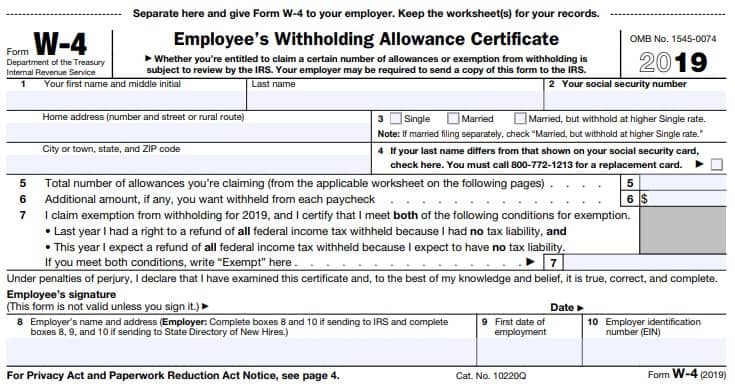

How To Fill Out Irs W4 Form Correctly And Maximize It For Your Benefit In this video, we'll provide a basic step by step guide on how to fill out a w4 form, the employee's withholding certificate, an important document for your. Page last reviewed or updated: 22 may 2024. information about form w 4, employee's withholding certificate, including recent updates, related forms and instructions on how to file. form w 4 is completed by employees and given to their employer so their employer can withhold the correct federal income tax from the employee's pay. As with the prior version of the form, the new w 4 allows you to claim exempt status if you meet certain requirements. in 2019 and years prior, form w 4 only required you to input: the number of allowances you were claiming. any additional amount you wanted to be withheld from your paycheck. to calculate the number of allowances, you could use. Your w 4 form tells your employer how much federal income tax to withhold from your wages every pay period. using the information you provided when filling out the form, your employer will determine how much tax to withhold from your paycheck. after filing your tax return, a smart financial move is to double check your form w 4.

How To Fill Out An Irs W 4 Form Money Instructor Youtube As with the prior version of the form, the new w 4 allows you to claim exempt status if you meet certain requirements. in 2019 and years prior, form w 4 only required you to input: the number of allowances you were claiming. any additional amount you wanted to be withheld from your paycheck. to calculate the number of allowances, you could use. Your w 4 form tells your employer how much federal income tax to withhold from your wages every pay period. using the information you provided when filling out the form, your employer will determine how much tax to withhold from your paycheck. after filing your tax return, a smart financial move is to double check your form w 4. How to fill out a w 4. step 1: enter your personal information. fill in your name, address, social security number and tax filing status. importantly, your tax filing status is the basis for which. The irs recommends completing step 3 on the w 4 form associated with the highest paying job; on your (or your spouse’s) other w 4 forms, leave it blank. step 3 is pretty straightforward.

How To Fill Out Irs Form W 4 As Single With Kids Youtube How to fill out a w 4. step 1: enter your personal information. fill in your name, address, social security number and tax filing status. importantly, your tax filing status is the basis for which. The irs recommends completing step 3 on the w 4 form associated with the highest paying job; on your (or your spouse’s) other w 4 forms, leave it blank. step 3 is pretty straightforward.

How To Fill Out A Form W 4 2019 Edition

Comments are closed.