How To Fill Out A W2 Form

How To Fill Out A W 2 Form A Guide To The Irs Form W 2 Ageras Learn how to file form w 2 for employees who received $600 or more in wages, tips, or other compensation in 2023. find the latest updates, instructions, and electronic filing requirements for form w 2 and related forms. The entries on form w 2 must be based on wages paid during the calendar year. use form w 2 for the correct tax year. for example, if the employee worked from december 15, 2024, through december 28, 2024, and the wages for that period were paid on january 3, 2025, include those wages on the 2025 form w 2.

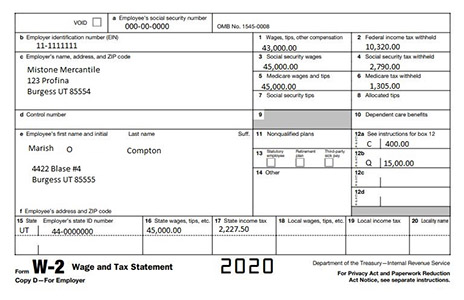

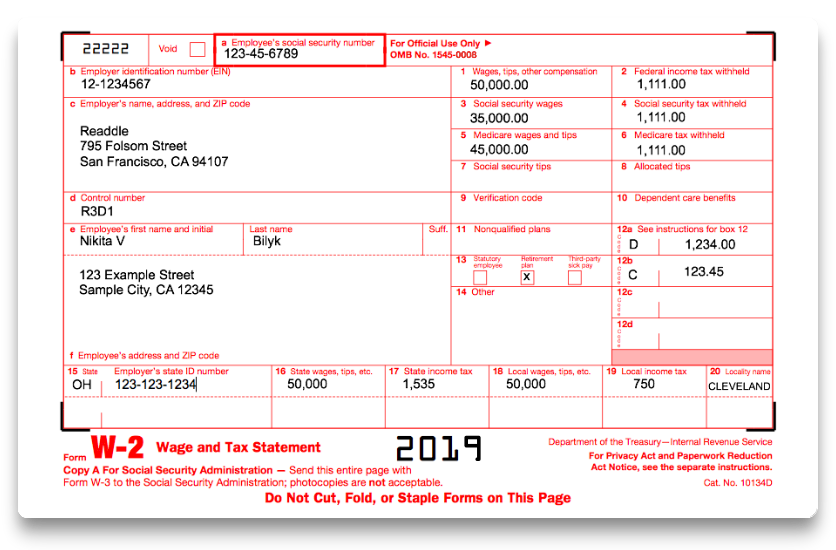

How To Fill Out A W2 Form Copy a goes to the social security administration (ssa) along with a w 3 form that includes a summary of all of the w 2s for every worker on payroll. the ssa only accepts e filed forms, not photocopies. copy 1 of the w 2 form goes to the appropriate state, city or local tax department. employees keep copy c for themselves. How to fill out form w 2. you might have your form w 2 responsibilities down to a science. input employee information; send copies to employees; file the form with the ssa and state, city, or local tax department; and repeat the following year. or, you just might spend hours gathering employee information and trying to decode the wage and tax. Here’s how to fill out a form w 2: box a—employee’s social security number: here, you’ll enter your employee’s nine digit social security number using the xxx xx xxxx format. box b—employer identification number (ein): this box is for your nine digit ein, which should be in the xx xxxxxxx format. box c—employer’s name, address. Boxes e and f — employee name and address. enter employee names as shown on your forms 941, 943, 944, ct 1, or schedule h (form 1040). if the name of an employee is too long, put the initials of their first and middle name. it’s more important to have the full last name of your employee on irs form w 2.

How To Fill Out Irs Form W 2 2019 2020 Pdf Expert Here’s how to fill out a form w 2: box a—employee’s social security number: here, you’ll enter your employee’s nine digit social security number using the xxx xx xxxx format. box b—employer identification number (ein): this box is for your nine digit ein, which should be in the xx xxxxxxx format. box c—employer’s name, address. Boxes e and f — employee name and address. enter employee names as shown on your forms 941, 943, 944, ct 1, or schedule h (form 1040). if the name of an employee is too long, put the initials of their first and middle name. it’s more important to have the full last name of your employee on irs form w 2. Irs form w 2, also known as a “wage and tax statement,” reports an employee’s income from the prior year and how much tax the employer withheld. employers send out w 2s to employees in. Box 16 – state wages and tips. enter the amount of wages paid that are subject to state income tax. if your state allows an exemption for retirement contributions, this number will be the same as box 1. if not, it will be the same as boxes 3 and 5. again, if your state has no income tax, leave this blank.

Comments are closed.