How To Fill Out A W 2 Form Everything Else Employers Need To Know

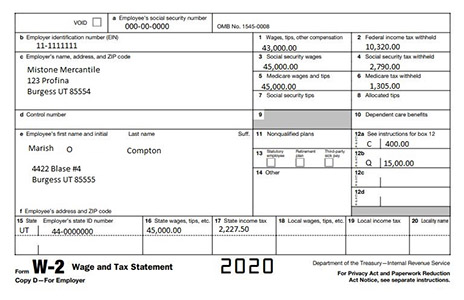

How To Fill Out A W2 Form If so, you’ll need a separate w 2 form. include your state id number (state ein) on box 15. for boxes 16 to 20, follow a similar process as boxes 1 to 4. some wages may be exempt from federal income tax, but not state income tax, so boxes 16 and 1 may differ. some new regulations in 2024 regarding form w 2 include:. Here’s how to fill out a form w 2: box a—employee’s social security number: here, you’ll enter your employee’s nine digit social security number using the xxx xx xxxx format. box b—employer identification number (ein): this box is for your nine digit ein, which should be in the xx xxxxxxx format. box c—employer’s name, address.

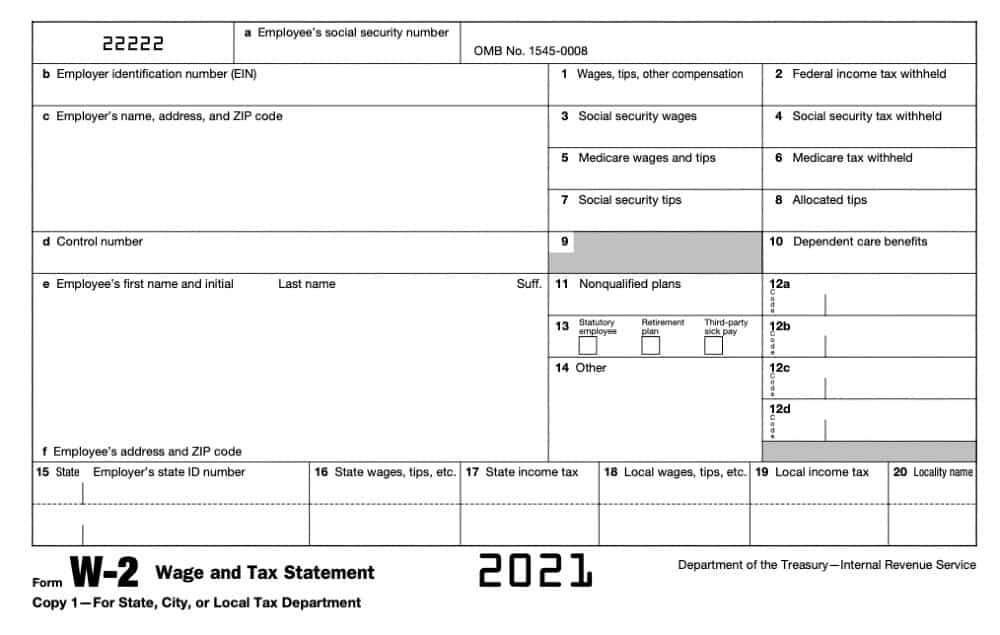

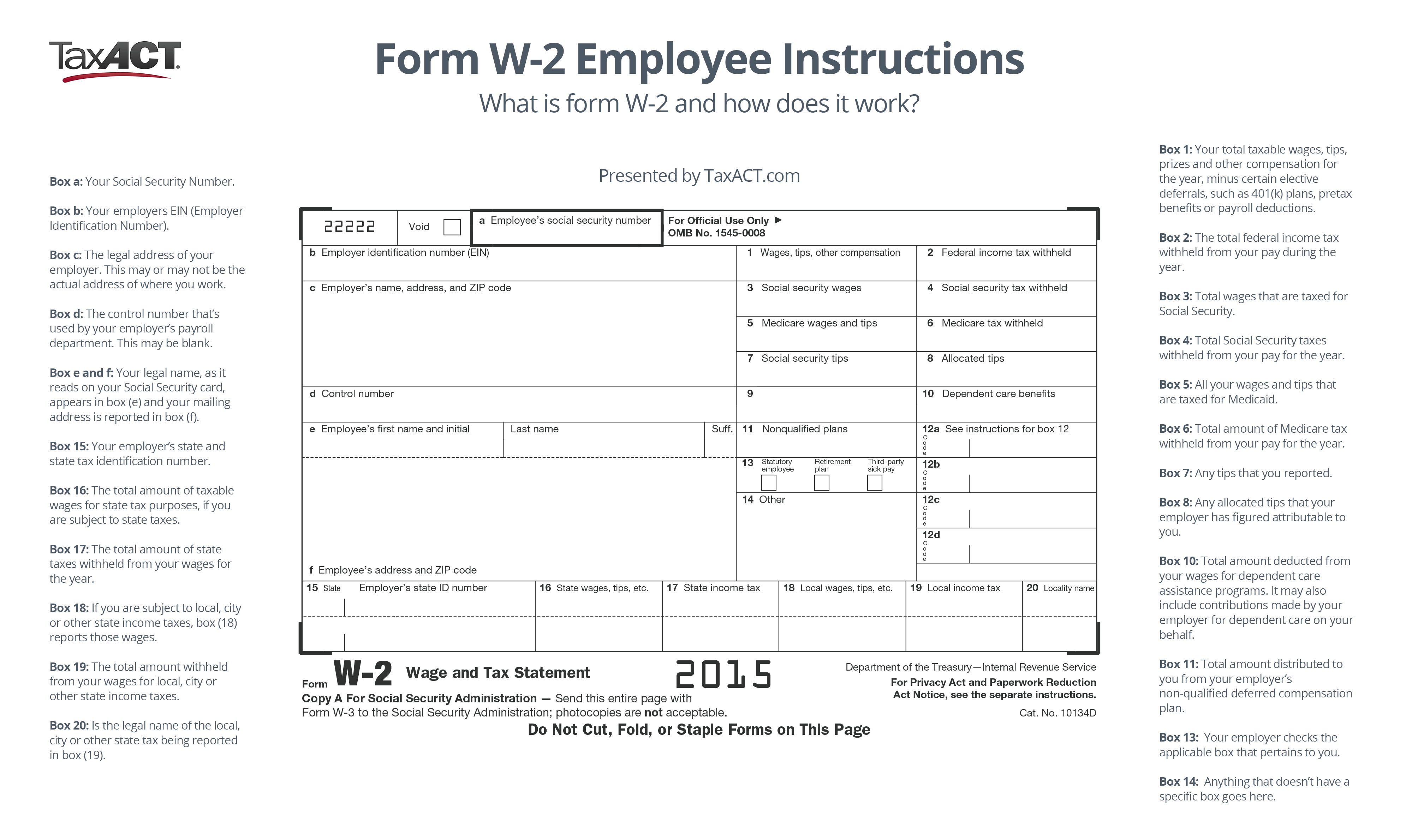

How To Fill Out A W 2 Form A Guide To The Irs Form W 2 Ageras There are several w 2 box 12 codes you may need to put on an employee’s form w 2. if applicable, add the codes and amounts in box 12. these codes and values may lower the employee’s taxable wages. let’s say an employee elected to contribute $1,000 to a 401 (k) retirement plan. you would write d | 1,000.00 in box 12. Also known as a “wage and tax statement,” form w 2 is a document that reports your annual wages and the amount of taxes withheld from your paycheck and sent to the irs. it also shows other. Copy a goes to the social security administration (ssa) along with a w 3 form that includes a summary of all of the w 2s for every worker on payroll. the ssa only accepts e filed forms, not photocopies. copy 1 of the w 2 form goes to the appropriate state, city or local tax department. employees keep copy c for themselves. Box 16 – state wages and tips. enter the amount of wages paid that are subject to state income tax. if your state allows an exemption for retirement contributions, this number will be the same as box 1. if not, it will be the same as boxes 3 and 5. again, if your state has no income tax, leave this blank.

How To Fill Out A W 2 Form Copy a goes to the social security administration (ssa) along with a w 3 form that includes a summary of all of the w 2s for every worker on payroll. the ssa only accepts e filed forms, not photocopies. copy 1 of the w 2 form goes to the appropriate state, city or local tax department. employees keep copy c for themselves. Box 16 – state wages and tips. enter the amount of wages paid that are subject to state income tax. if your state allows an exemption for retirement contributions, this number will be the same as box 1. if not, it will be the same as boxes 3 and 5. again, if your state has no income tax, leave this blank. The w 2 form is how you report total annual wages to your employees and the irs. it is the employer’s responsibility to fill out the form correctly and file it on time. this tool will explain each of the fields in a standard w 2 form. click on a box below for more information. the ssa lets you verify employee names and ssns online or by phone. W 2s allow the irs to track your employees’ income, taxes withheld, social security wages, taxable benefits, and more to help determine income taxes payable. the deadline for form w 2 is january 31 st, but you can apply for an extension for 30 days. if you have over 10 employees, you must file their w 2s online unless your application for a.

How To Fill Out Form W 2 Detailed Guide For Employers The w 2 form is how you report total annual wages to your employees and the irs. it is the employer’s responsibility to fill out the form correctly and file it on time. this tool will explain each of the fields in a standard w 2 form. click on a box below for more information. the ssa lets you verify employee names and ssns online or by phone. W 2s allow the irs to track your employees’ income, taxes withheld, social security wages, taxable benefits, and more to help determine income taxes payable. the deadline for form w 2 is january 31 st, but you can apply for an extension for 30 days. if you have over 10 employees, you must file their w 2s online unless your application for a.

What Is Form W 2 And How Does It Work Taxact Blog

How To Fill Out Form W 2 Detailed Guide For Employers

Comments are closed.