How To Fill Out A W 2 Form Chime

How To Fill Out A W 2 Form Chime Whether you file online or on paper, all you need to do is enter your chime checking account number and routing number where prompted. you can find your checking account number and routing number in the chime app! just go to settings > account information! a w 2 tax form is used to file your federal and state taxes. Box 2: federal income tax withheld. when you started your job, you filled out form w 4 to indicate how much tax your employer should withhold.³. box 3: social security wages. this is the amount of wages you earned that are subject to social security tax. box 4: social security tax withheld.

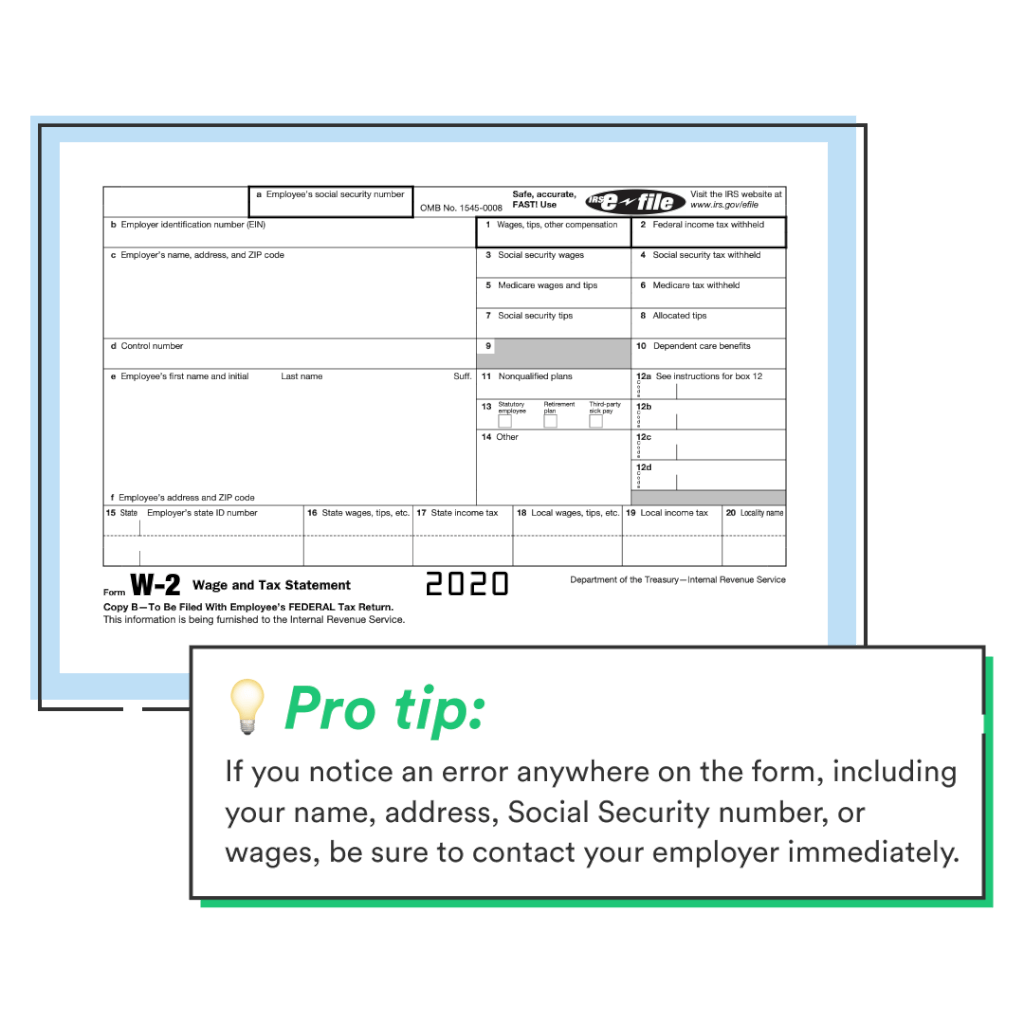

How To Fill Out A W 2 Form Chime A form w 2 is an official tax statement that employers fill out reporting wages paid to employees and the taxes that were withheld from them. an employer mails the w 2 to an employee at least eight weeks before the irs tax deadline. the w 4 is a form filled out by the employee, not the employer. Copy a goes to the social security administration (ssa) along with a w 3 form that includes a summary of all of the w 2s for every worker on payroll. the ssa only accepts e filed forms, not photocopies. copy 1 of the w 2 form goes to the appropriate state, city or local tax department. employees keep copy c for themselves. Boxes e and f — employee name and address. enter employee names as shown on your forms 941, 943, 944, ct 1, or schedule h (form 1040). if the name of an employee is too long, put the initials of their first and middle name. it’s more important to have the full last name of your employee on irs form w 2. There are several w 2 box 12 codes you may need to put on an employee’s form w 2. if applicable, add the codes and amounts in box 12. these codes and values may lower the employee’s taxable wages. let’s say an employee elected to contribute $1,000 to a 401 (k) retirement plan. you would write d | 1,000.00 in box 12.

How To Fill Out And Print W2 Forms Boxes e and f — employee name and address. enter employee names as shown on your forms 941, 943, 944, ct 1, or schedule h (form 1040). if the name of an employee is too long, put the initials of their first and middle name. it’s more important to have the full last name of your employee on irs form w 2. There are several w 2 box 12 codes you may need to put on an employee’s form w 2. if applicable, add the codes and amounts in box 12. these codes and values may lower the employee’s taxable wages. let’s say an employee elected to contribute $1,000 to a 401 (k) retirement plan. you would write d | 1,000.00 in box 12. Check that you include decimal points and do not use dollar signs. a: enter the employee’s social security number. you may truncate this on employee copies b, c, and 2, but you must use the full ssn on copy a. there are six copies of the w 2, that are each required to be submitted to a different recipient. Box 16 – state wages and tips. enter the amount of wages paid that are subject to state income tax. if your state allows an exemption for retirement contributions, this number will be the same as box 1. if not, it will be the same as boxes 3 and 5. again, if your state has no income tax, leave this blank.

Comments are closed.