How To File Your Taxes For Free In 2022 Tcc

File Your Taxes For Free In 2022 Tutorial Irs File For Free Online E file through the iris taxpayer portal. this free, web based filing system lets you: e file up to 100 returns at a time. enter manually or by .csv upload. download payee copies to distribute. keep a record of completed, filed and distributed forms. save and manage issuer information. Looking for a video to tell you how to file your taxes for free in 2022? well, then look no further! in this video jared will break down 5 ways that one ca.

How To File An Amended Tax Return In 2022 Form 1040x Tcc Youtube To e file information returns with an irs system, you need to apply for a tcc. this five character, alphanumeric code identifies your firm or entity when you e file. don't delay in completing your tcc application. it may take to up 45 days for processing. apply for a tcc to e file with an irs system: the responsible official listed on your. After august 1, 2023, any fire tcc without a completed application will not be available for e file. ir application for tcc. the ir application for tcc is an online tool that allows small, mid size and large businesses, fiduciaries and state and federal agencies to request a tcc to electronically file information returns through the fire system. Executive summary: new fire tcc code applications required for 2022 information returns. taxpayers planning to file information returns electronically next year who were assigned a transmitter control code (tcc) before sept. 26, 2021 now have until aug. 1, 2023 to submit a new information returns application for transmitter control code (ir tcc) or they will not have access to the irs. A fire transmitter control code (tcc) is required to e file 1099’s (and certain other information returns) to the irs. you must electronically apply for a fire tcc through the ir application described in this article. this article is about the fire system. cfs also supports csv file uploads to the new iris system, but continues to recommend.

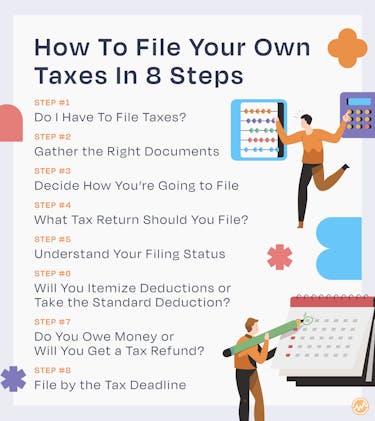

How To File Your Own Taxes In 2022 Wealthfit Executive summary: new fire tcc code applications required for 2022 information returns. taxpayers planning to file information returns electronically next year who were assigned a transmitter control code (tcc) before sept. 26, 2021 now have until aug. 1, 2023 to submit a new information returns application for transmitter control code (ir tcc) or they will not have access to the irs. A fire transmitter control code (tcc) is required to e file 1099’s (and certain other information returns) to the irs. you must electronically apply for a fire tcc through the ir application described in this article. this article is about the fire system. cfs also supports csv file uploads to the new iris system, but continues to recommend. Starting tax year 2023, if you have 10 or more information returns, you must file them electronically. find details on final e file regulations on irs.gov. to complete an ir application for tcc. go to the ir application for tcc page. validate your identity – sign in to your existing id.me account or create your new id.me account. Irs free file: guided tax software. do your taxes online for free with an irs free file trusted partner. if your adjusted gross income (agi) was $79,000 or less, review each trusted partner’s offer to make sure you qualify. some offers include a free state tax return. use the find your trusted partner (s) to narrow your list of trusted.

Comments are closed.