How To File Taxes If You Dont Have Your Original W2 Shorts

How To File Taxes Without W2 The Simple Guide The regular blank paper is acceptable for filing your return. the w 2 copies must be easily separable or already separated. perforations meet this requirement, as does cutting them yourself. the regulation is designed so that employees don't have to cut the w 2's themselves. if the forms are printed on different pieces of paper, or they are cut. If they don't receive the missing or corrected form from their employer or payer by the end of february, they may call the irs at 800 829 1040 for help. they'll need to provide their name, address, phone number, social security number and dates of employment. they'll also need to provide the employer's or payer's name, address and phone number.

How To File Taxes Without A W 2 Paystub Direct If you don't get a w 2 by end of february. if you contacted your employer and still don't have your w 2, call us at 800 829 1040. have your information ready so we can help you: we'll contact your employer and request the missing w 2. we'll also send you a copy of form 4852, substitute for form w 2, wage and tax statement. Level 15. if it's a photocopy of the original w 2 you can attach it to your tax return, as long as it's a clear readable copy. make sure you keep a copy for yourself. don't send the irs your only copy. sometimes they lose things. if you e file you don't have to send in a copy of your w 2 at all. june 4, 2019 7:40 pm. Step 4: file form 4852 with your tax return. if irs intervention still doesn't produce the form, you need and you want to file by the tax deadline, fill out form 4852. form 4852 is a substitute for form w 2 that taxpayers can complete if: they haven't received a w 2. their employer issued an incorrect w 2. What if your employer can’t give you your lost w 2 form? if your employer can’t give you your lost w 2 forms, you can get a copy of your form w 2 from the social security administration for a fee. you can also contact the irs by requesting a wage and income transcript directly from the irs (you will not get state and local information.

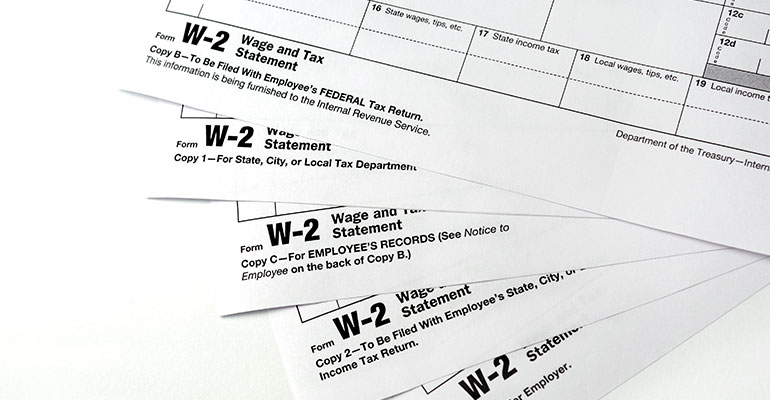

Can I Save A W2 For Next Year How To File Taxes When You Re Self Employed Step 4: file form 4852 with your tax return. if irs intervention still doesn't produce the form, you need and you want to file by the tax deadline, fill out form 4852. form 4852 is a substitute for form w 2 that taxpayers can complete if: they haven't received a w 2. their employer issued an incorrect w 2. What if your employer can’t give you your lost w 2 form? if your employer can’t give you your lost w 2 forms, you can get a copy of your form w 2 from the social security administration for a fee. you can also contact the irs by requesting a wage and income transcript directly from the irs (you will not get state and local information. For filing help, call 800 829 1040 or 800 829 4059 for tty tdd. if you need wage and income information to help prepare a past due return, complete form 4506 t, request for transcript of tax return, and check the box on line 8. you can also contact your employer or payer of income. if you need information from a prior year tax return, use get. W 2s include personal information like your social security number. if someone stole your w 2 or any of your other tax documents, they may try to use them to file a return and get a fraudulent refund. learn the signs of tax related identity theft and what to do if your personal information was compromised.

How To File Back Taxes Without Form W 2 Defense Tax Partners For filing help, call 800 829 1040 or 800 829 4059 for tty tdd. if you need wage and income information to help prepare a past due return, complete form 4506 t, request for transcript of tax return, and check the box on line 8. you can also contact your employer or payer of income. if you need information from a prior year tax return, use get. W 2s include personal information like your social security number. if someone stole your w 2 or any of your other tax documents, they may try to use them to file a return and get a fraudulent refund. learn the signs of tax related identity theft and what to do if your personal information was compromised.

How To File Taxes Without W2 The Simple Guide

Comments are closed.