How To Explain 1031 Exchange Rules To Your Clients

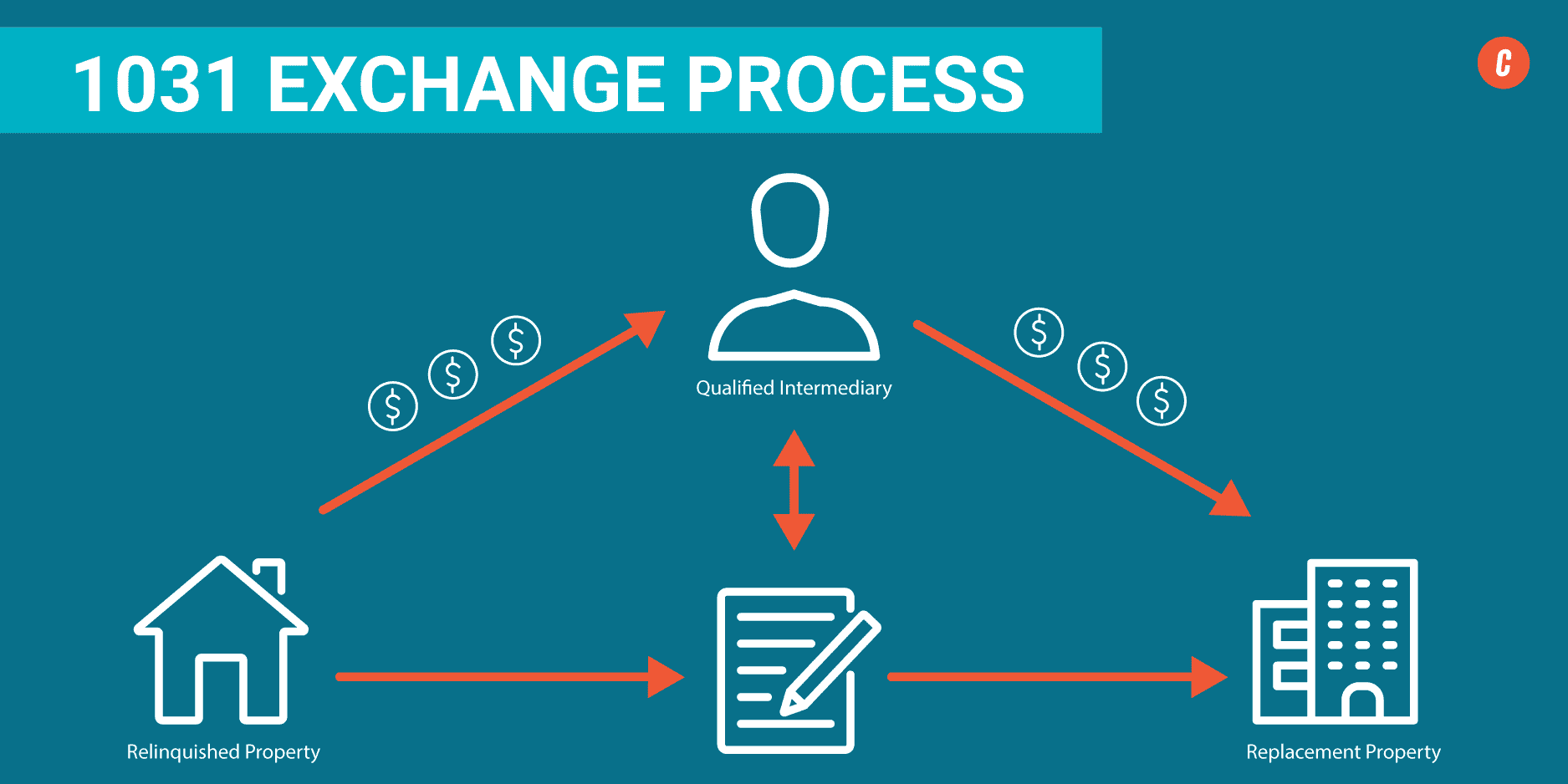

How To Explain 1031 Exchange Rules To Your Clients A 1031 exchange, named after section 1031 of the u.s. internal revenue code, is a strategic tool for deferring tax on capital gains. you can leverage it to sell an investment property and reinvest. A 1031 exchange has a tight schedule, so you must act precisely according to the rules provided by the irs to avoid paying the capital gains tax. how 1031 exchanges work examples a 1031 exchange is a multi step process with strict adherence to numerous irs guidelines to keep the tax deferred status.

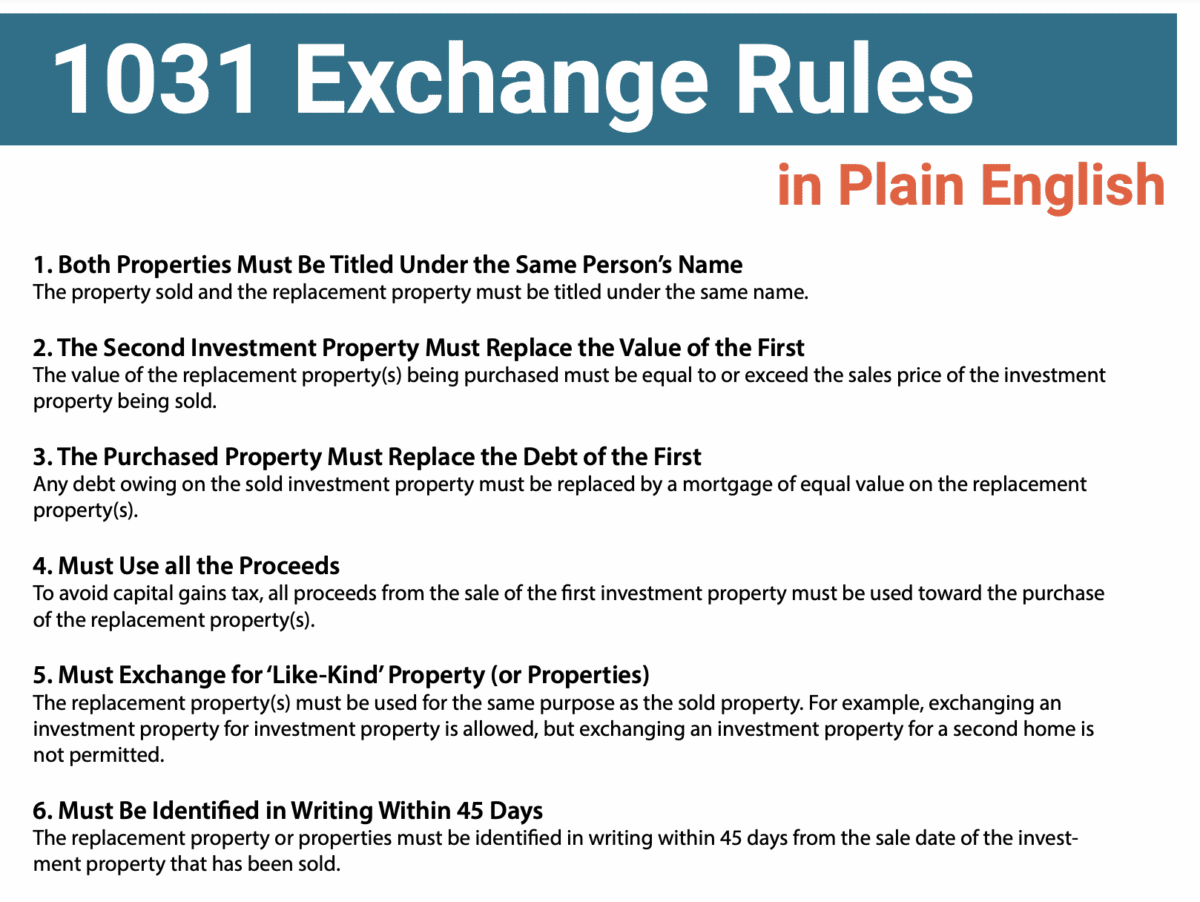

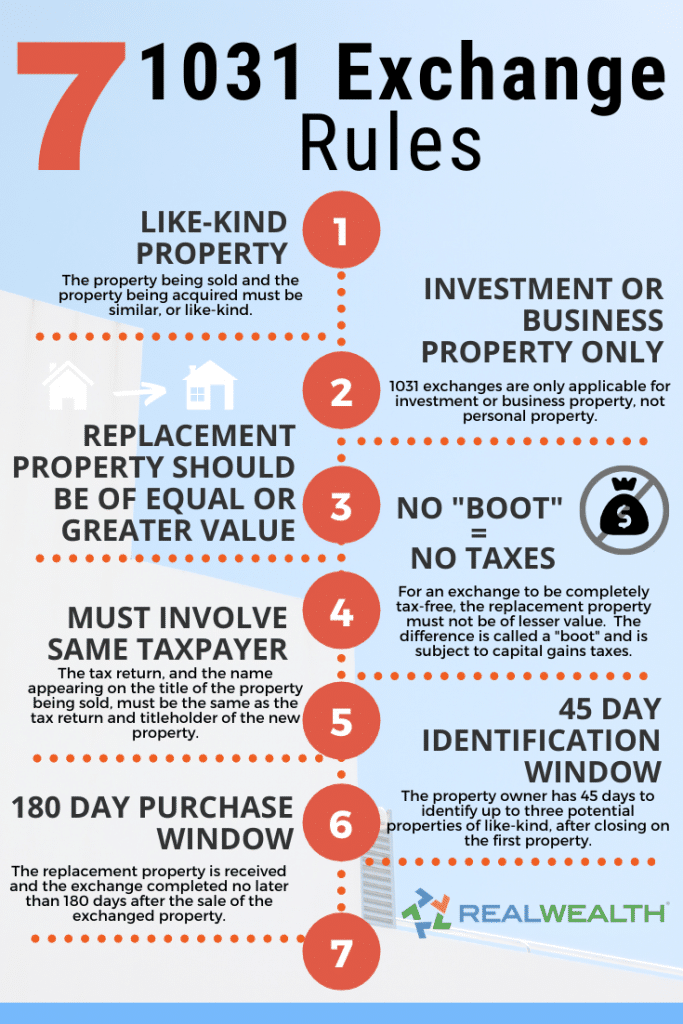

How To Explain 1031 Exchange Rules To Your Clients Explaining all of these important 1031 exchange rules to your clients will help create urgency. 1031 exchange rules: how to quality. here are a few of the 1031 exchange rules. for a full list of rules, see the graphic below, and feel free to share with your clients! your property must be used for business purposes. Step 5: filing irs form 8824. the final step in the 1031 exchange process is filing irs form 8824 with your tax return for the year in which the exchange was completed. this form details the exchange and helps the irs determine whether the transaction qualifies for tax deferral. 1. 1031 exchanges are also known as 'like kind' exchanges, and that matters. section 1031 of the irc defines a 1031 exchange as when you exchange real property used for business or held as an. What is a 1031 exchange? a 1031 exchange, named after section 1031 of the u.s. internal revenue code, is a way to postpone capital gains tax on the sale of a business or investment property by.

1031 Exchange Rules Success Stories For Real Estate Investors 2021 1. 1031 exchanges are also known as 'like kind' exchanges, and that matters. section 1031 of the irc defines a 1031 exchange as when you exchange real property used for business or held as an. What is a 1031 exchange? a 1031 exchange, named after section 1031 of the u.s. internal revenue code, is a way to postpone capital gains tax on the sale of a business or investment property by. 5. identify the property you want to buy. the next step in the 1031 exchange process is identifying the property you want to buy as a replacement. consider your investment objectives, such as location, property type, and growth potential. conduct market research to analyze trends and opportunities. Use the same buyer & seller. this requirement seems pretty straightforward, but it’s important to mention. both the official buyer and the official seller within a 1031 exchange must be the same person. you can’t do something like list your wife as the seller of one property and yourself as the buyer of the other property in the exchange.

1031 Exchange Locations 5. identify the property you want to buy. the next step in the 1031 exchange process is identifying the property you want to buy as a replacement. consider your investment objectives, such as location, property type, and growth potential. conduct market research to analyze trends and opportunities. Use the same buyer & seller. this requirement seems pretty straightforward, but it’s important to mention. both the official buyer and the official seller within a 1031 exchange must be the same person. you can’t do something like list your wife as the seller of one property and yourself as the buyer of the other property in the exchange.

New 1031 Exchange Rules 2024 Nanci Analiese

Comments are closed.