How To Calculate The Present Value Of An Annuity

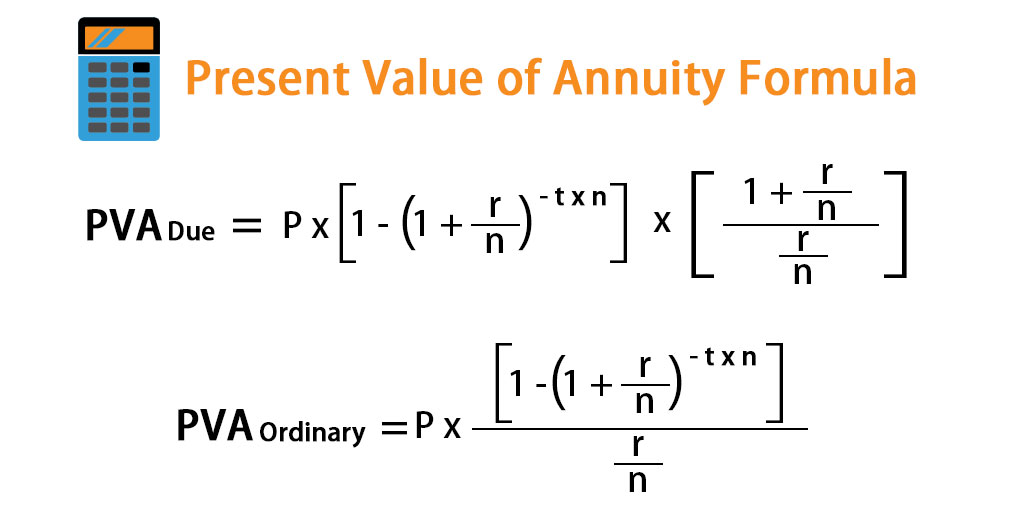

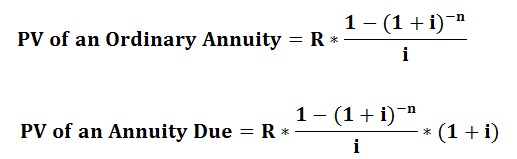

Present Value Of Annuity Formula Calculator With Excel Template By calculating the present value of an annuity, individuals can determine whether it is more beneficial for them to receive a lump sum payment or to receive an annuity spread out over a number of. Calculate the present value of an annuity due, ordinary annuity, growing annuities and annuities in perpetuity with optional compounding and payment frequency. annuity formulas and derivations for present value based on pv = (pmt i) [1 (1 (1 i)^n)](1 it) including continuous compounding.

How To Calculate Annuity Factor Ordinary annuities and annuities due differ in the timing of those recurring payments. the future value of an annuity is the total value of payments at a future point in time. the present value is. The present value of annuity calculator is a handy tool that helps you to find the value of a series of equal future cash flows over a given time. in other words, with this annuity calculator, you can compute the present value of a series of periodic payments to be received at some point in the future. This refers to whether the annuity is an ordinary annuity that pays at the end of a period, such as the last day of the month, or annuity due that pays at the outset of a period, such as the first. Multiply this result by (1 i): 5.53 x (1 0.05) ≈ 5.8019. therefore, the future value of your annuity due with $1,000 annual payments at a 5 percent interest rate for five years would be.

How To Calculate The Present Value Of An Annuity Youtube This refers to whether the annuity is an ordinary annuity that pays at the end of a period, such as the last day of the month, or annuity due that pays at the outset of a period, such as the first. Multiply this result by (1 i): 5.53 x (1 0.05) ≈ 5.8019. therefore, the future value of your annuity due with $1,000 annual payments at a 5 percent interest rate for five years would be. Multiply this result by (1 i): 5.53 x (1 0.05) ≈ 5.8019. therefore, the future value of your annuity due with $1,000 annual payments at a 5 percent interest rate for five years would be. Here’s the present value annuity formula: pmt x [ (1 – [1 (1 r)^n]) r] = the present value of the annuity. and here’s what each variable means: pmt: the amount the annuity pays you per period. r: the interest rate per period. n: the number of expected payment periods.

How To Calculate Present Value Of An Annuity Multiply this result by (1 i): 5.53 x (1 0.05) ≈ 5.8019. therefore, the future value of your annuity due with $1,000 annual payments at a 5 percent interest rate for five years would be. Here’s the present value annuity formula: pmt x [ (1 – [1 (1 r)^n]) r] = the present value of the annuity. and here’s what each variable means: pmt: the amount the annuity pays you per period. r: the interest rate per period. n: the number of expected payment periods.

Present Value Of An Annuity How To Calculate Examples

Comments are closed.