How To Calculate Exactly How Much You Need For Retirement

How To Calculate Exactly How Much You Need To Retire Youtube The sooner you start planning for retirement, the more money you can invest for the long term. use our retirement calculator to help you understand where you are on the road to a secure retirement. Simply take your estimate for your retirement budget and divide it by your safe withdrawal rate. for example, if your retirement budget is $60,000 and your safe withdrawal rate is 4%, you'll need.

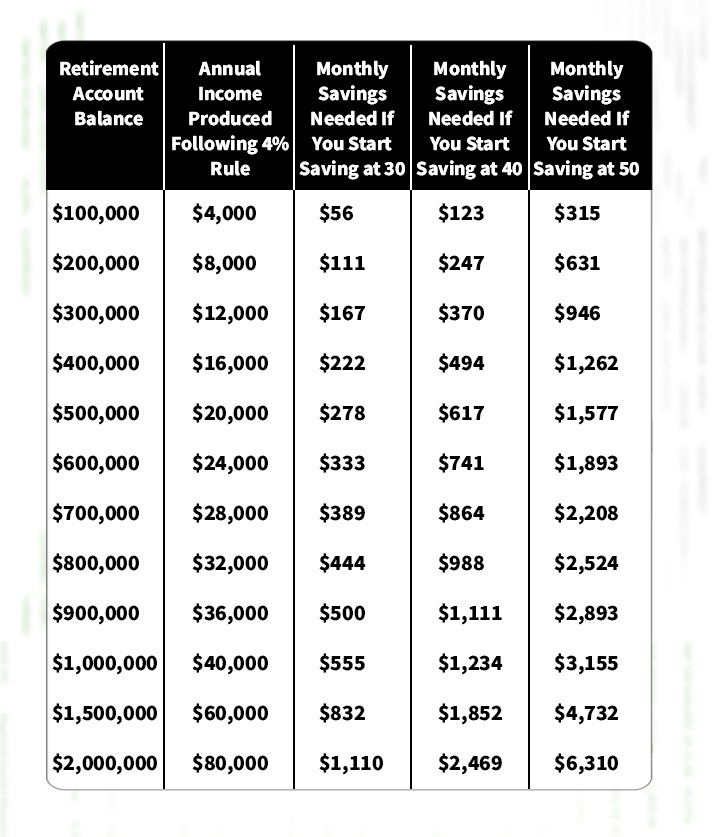

Retirement Calculator How Much You Need To Save Fox Business How this retirement calculator works. to estimate how much you'll save by retirement age ("what you'll have"), start with your current age and how much you've saved so far. add your income and. Step 1: estimate a budget. this is by far the hardest part in determining how much you'll need in retirement. the farther away you are from retirement, the more difficult this is going to be. but. Adding on to the 80% rule using the 4% rule. while the 80% rule focuses on how much someone should aim for annually, the 4% rule is used to estimate how much someone would need to save in total. It might also help you to know that generally speaking, retirees need about 70% to 80% of their former income to live comfortably. again, there are always exceptions. but as a starting point, know.

Use This Free Workbook To Calculate Exactly How Much You Should Have In Adding on to the 80% rule using the 4% rule. while the 80% rule focuses on how much someone should aim for annually, the 4% rule is used to estimate how much someone would need to save in total. It might also help you to know that generally speaking, retirees need about 70% to 80% of their former income to live comfortably. again, there are always exceptions. but as a starting point, know. Bad news: to pull all of that off, you’ll need to save $1,950 every month from now until you retire. that's about 23% of your monthly income. compare that to the 5% per month you've been saving up until now. if you stay on that course, you'll have a savings shortfall of $488,143 when you retire. If you have ever wondered how much to save for retirement every month or how many more years you need to work, this calculator is going to help you. if you want more detailed tools on retirement plans, check out the 401k calculator for retirement. if you are specifically interested in a 403b retirement plan, check our 403b calculator.

Use This Free Workbook To Calculate Exactly How Much You Should Have In Bad news: to pull all of that off, you’ll need to save $1,950 every month from now until you retire. that's about 23% of your monthly income. compare that to the 5% per month you've been saving up until now. if you stay on that course, you'll have a savings shortfall of $488,143 when you retire. If you have ever wondered how much to save for retirement every month or how many more years you need to work, this calculator is going to help you. if you want more detailed tools on retirement plans, check out the 401k calculator for retirement. if you are specifically interested in a 403b retirement plan, check our 403b calculator.

Comments are closed.