How To Calculate Commission And Tip

How To Calculate Commission And Tip Youtube Under the flsa, tipped employees must be compensated at least $2.13 per hour in direct cash wages, and up to $5.12 in tips per hour can be applied toward meeting the minimum wage (known as the "tip credit"). employers must provide certain information to employees before they can use the tip credit and may count only tips actually received by. Generally, the tip percentage will fall between 15% and 20%, although it may vary depending on factors such as the quality of service and the establishment’s location. tip amount: to calculate the tip amount, multiply the total sales by the tip percentage. for example, if the total sales are $200 and the tip percentage is 18%, the tip amount.

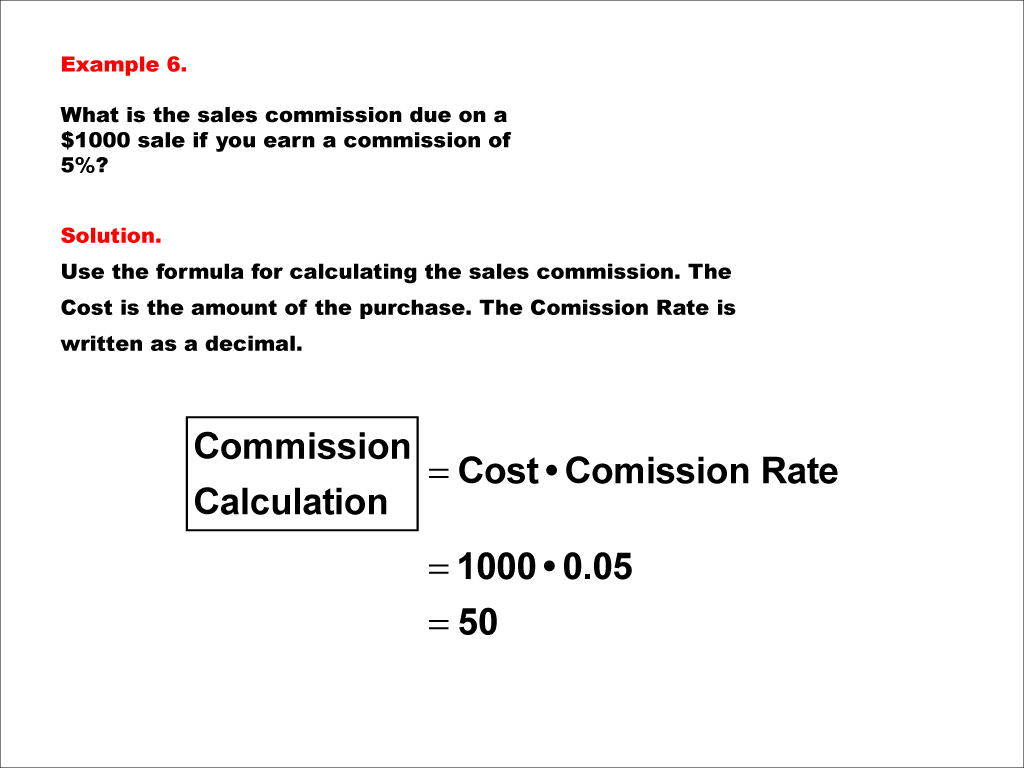

Student Tutorial Calculating Commissions And Tips Media4math Example: you and two other people are involved in march sales amounting to a $30,000 base. the rate is 6%. to calculate the total commission, you'd multiply $30,000 by 0.06, which equals $1,800. you'd then divide equally among the three of you, as follows: $1,800 3 the commission payment for each of you is $600. 9. Tips are paid at the customer’s discretion and do not obligate the employer to calculate a higher regular rate of pay for the employee. note: if the employer pays an additional bonus or commission for additional product sold or for high customer reviews, then that outcome based incentive should be added into the employee’s regular rate of pay. Add your tips to your base pay. you can determine your total earnings for that shift or pay period by adding your base pay to your tips. using our example, $210 (base pay) $75 (tips) equals $285. in other words, if you worked 21 hours at $10 per hour and earned $500 in sales with a 15% tip rate, you would make $285 weekly. If calculating withholding taxes on tips sounds complicated to you, don’t worry: we’ve designed a calculator specifically to tackle tip tax. all you have to do is enter into the calculator your employees’ gross wages, their w 4 withholding information below and the cash and credit card tips they’ve earned. the resulting calculation will.

Mathematics How To Calculate Commission Examples Youtube Add your tips to your base pay. you can determine your total earnings for that shift or pay period by adding your base pay to your tips. using our example, $210 (base pay) $75 (tips) equals $285. in other words, if you worked 21 hours at $10 per hour and earned $500 in sales with a 15% tip rate, you would make $285 weekly. If calculating withholding taxes on tips sounds complicated to you, don’t worry: we’ve designed a calculator specifically to tackle tip tax. all you have to do is enter into the calculator your employees’ gross wages, their w 4 withholding information below and the cash and credit card tips they’ve earned. the resulting calculation will. If their commission rate is 10%, then you’ll multiply it with their commission base. 5,000 x 0.10 = $500. if you’re doing a fixed rate commission, then you will have to determine how many units your employee sold and then multiply that by their fixed commission rate. 100 units x $50 fixed rate = $500. 4. For a regular hourly employee, the calculation is simple: $15 x 45 hours worked = $675 base pay. $7.50 x 5 hours = overtime pay at half rate (to create time and one half) = $37.50 overtime pay. $712.50 total pay owed. another way some people calculate it, which is the same in the end, is this: $15 x 40 base hours = $600 for regular pay for the.

Comments are closed.