How Retirees Balance Spending And Income In Retirement

Retirement Planning Guide For Seniors Lexington Law Part of that requires spotting some common retirement spending myths Here are five that — if overlooked — could hurt your strategy 1 You need to spend less during the early But have you ever wondered how your level of retirement wealth stacks up? Here are four levels of wealth among older Americans — and how to get into one of the higher ones Retirees with a lower level

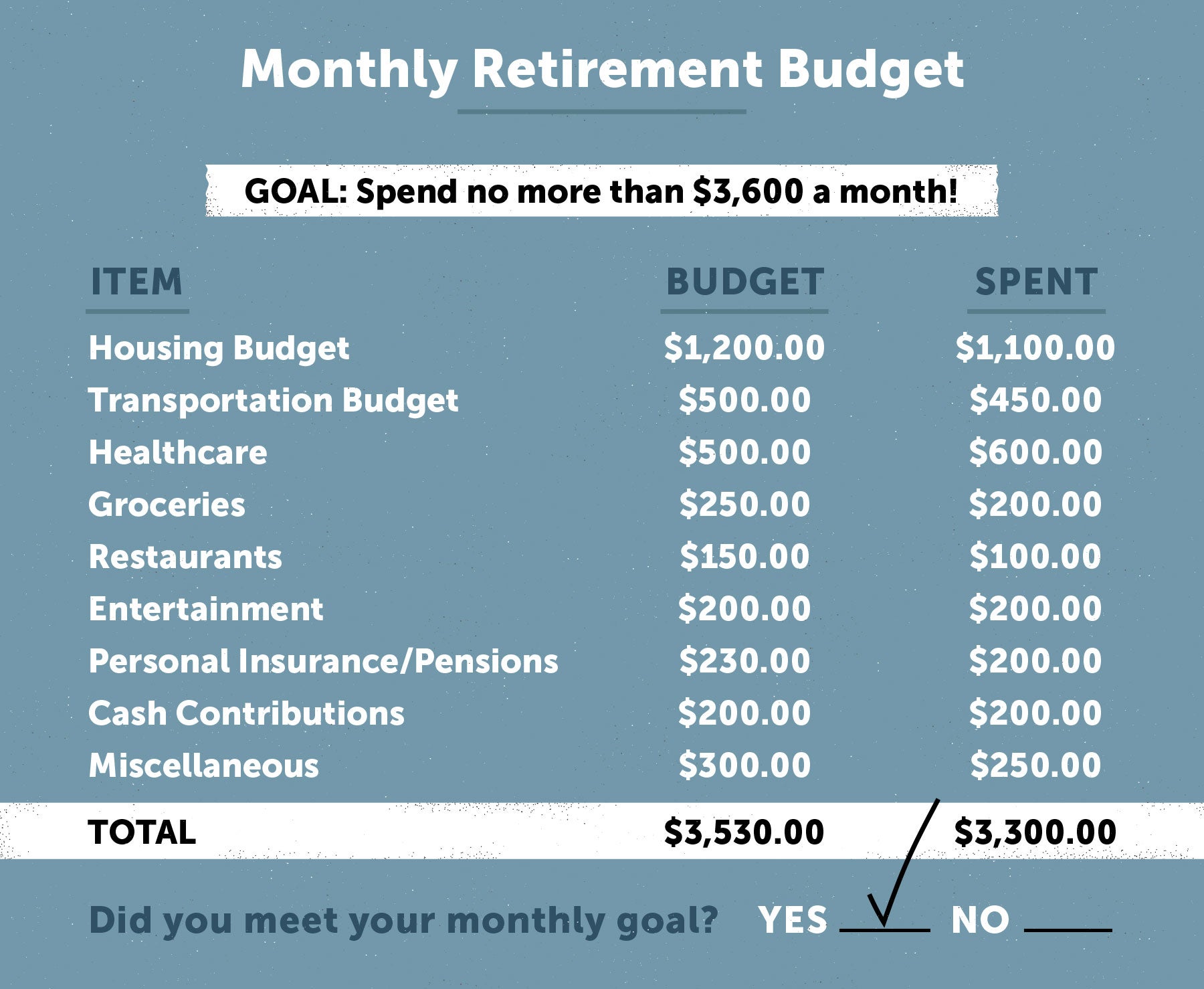

What Is The Average Retirement Savings By Age Everyone's situation is different, so retirement income strategies will vary Here are eight common strategies retirees use to Its purpose is to balance investment growth with easy access Average 401 (k) balances vary widely by age, which makes sense when you break it down Early in your career, you're likely earning less and juggling other financial priorities, so it's no surprise if When in retirement, there is a big difference between splurging on nice things occasionally and outright wasting your money on things you won’t use However, many retirees confuse the two and start It’s okay to spend on big experiences if you’ve laid the groundwork for financial security Retirement isn’t just about keeping money in the bank; it’s about using that money to live the lifestyle

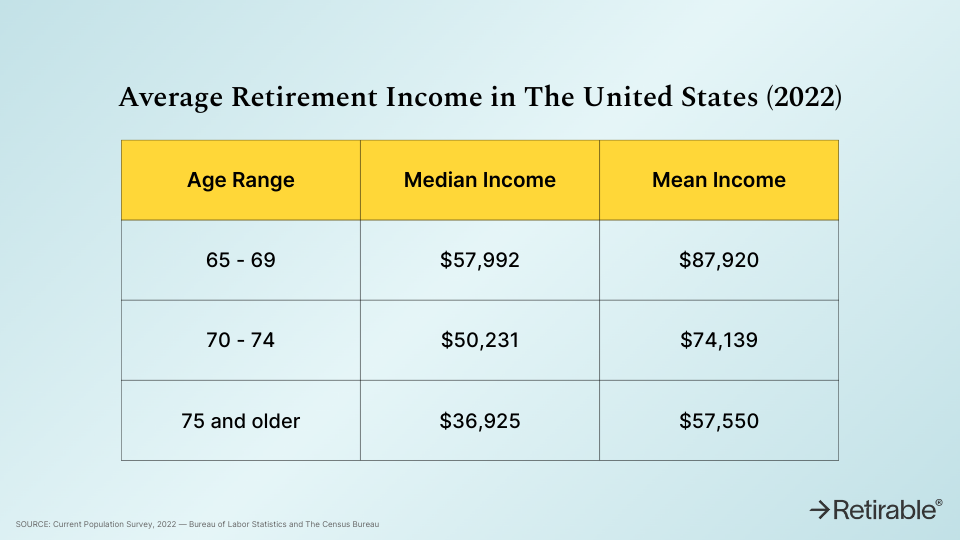

Average Retirement Income 2024 How Do You Compare When in retirement, there is a big difference between splurging on nice things occasionally and outright wasting your money on things you won’t use However, many retirees confuse the two and start It’s okay to spend on big experiences if you’ve laid the groundwork for financial security Retirement isn’t just about keeping money in the bank; it’s about using that money to live the lifestyle Retirement planning is filled with big questions For some retirees, whether or not to pay off their mortgage is one of them Are you getting close to retirement or saving up for a home down payment, for example? In that case, you might want to build out your portfolio’s stake in safe investments, while still holding stocks SoFi shares the nuances of different retirement plans, including tax benefits and drawbacks, to help people choose the right mix of plans to achieve their financial goals Retirement income planning is becoming an increasingly important topic as roughly 10,000 baby boomers turn 65 every day The reality is that over half of those facing retirement have never

Comments are closed.