How Much Should You Save For Retirement How Much Guide

Retirement Calculator How Much You Need To Save Fox Business Monthly contribution: this is the amount you save for retirement each month. include contributions to your 401(k) (including your employer match), ira and any other retirement accounts. experts. It also assumes that you need an annual income in retirement equivalent to 55% to 80% of your pre retirement income to live comfortably. depending on your spending habits and medical expenses.

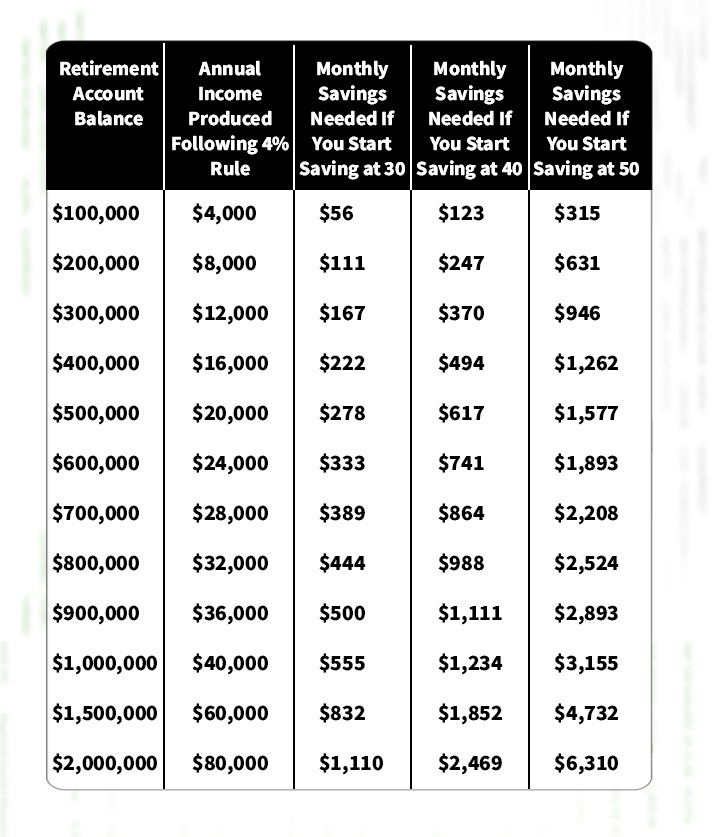

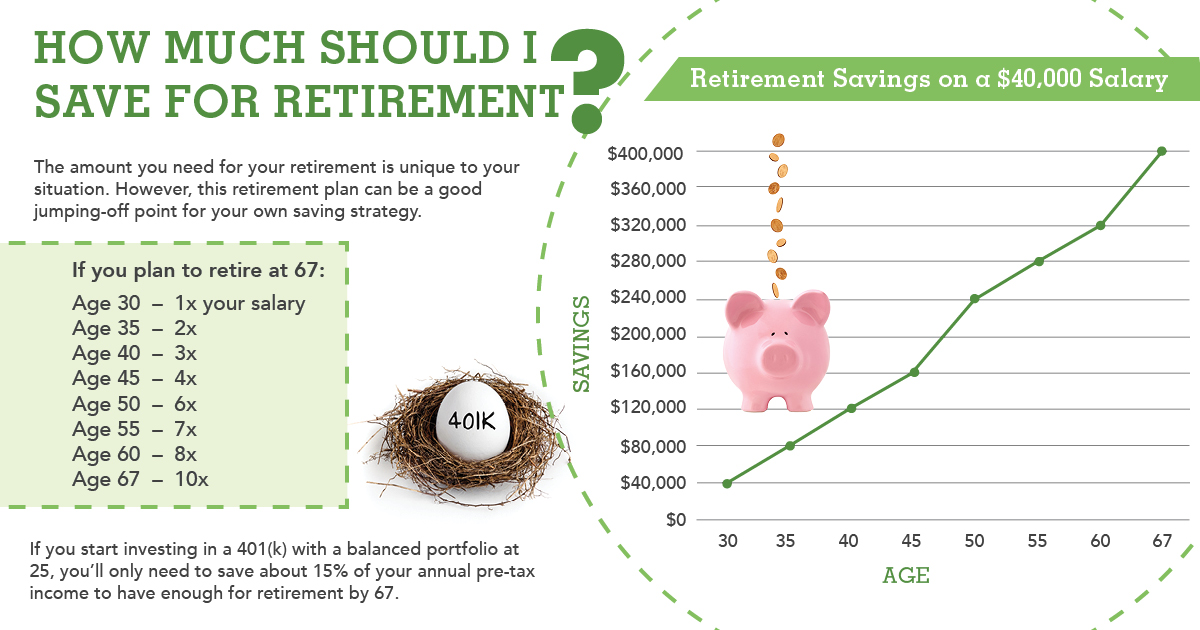

How Much Should I Save A Simple Retirement Plan For Your Savings By Savings by age 30: the equivalent of your annual salary saved; if you earn $55,000 per year, by your 30th birthday you should have $55,000 saved. savings by age 40: three times your income. We noted one general rule above about how much to save. as far as how much income to replace, the rule used most often is the 80% rule, which says you should aim to replace 80% of your. Financial services giant fidelity suggests you should be saving at least 15% of your pre tax salary for retirement. many financial advisors recommend a similar rate for retirement planning. How much should you have saved for retirement by your 30s? a good rule of thumb is to have one year's salary invested in a retirement account by the time you reach your 30s. at this age, you may wonder if you need to start saving at all at this point. as a 30 something, time is on your side, and you have ample opportunity to save and get ahead.

Fidelity S Retirement Savings Guidelines Here S How Much You Need To Financial services giant fidelity suggests you should be saving at least 15% of your pre tax salary for retirement. many financial advisors recommend a similar rate for retirement planning. How much should you have saved for retirement by your 30s? a good rule of thumb is to have one year's salary invested in a retirement account by the time you reach your 30s. at this age, you may wonder if you need to start saving at all at this point. as a 30 something, time is on your side, and you have ample opportunity to save and get ahead. Fidelity brokerage services llc, member nyse, sipc, 900 salem street, smithfield, ri 02917. 738991.16.0. here's a simple rule for calculating how much money you need to retire: at least 1x your salary at 30, 3x at 40, 6x at 50, 8x at 60, and 10x at 67. In developing the series of salary multipliers corresponding to age, fidelity assumed age based asset allocations consistent with the equity glide path of a typical target date retirement fund, a 15% savings rate, a 1.5% constant real wage growth, a retirement age of 67 and a planning age through 93. the replacement annual income target is.

How Much Should You Save For Retirement Fidelity brokerage services llc, member nyse, sipc, 900 salem street, smithfield, ri 02917. 738991.16.0. here's a simple rule for calculating how much money you need to retire: at least 1x your salary at 30, 3x at 40, 6x at 50, 8x at 60, and 10x at 67. In developing the series of salary multipliers corresponding to age, fidelity assumed age based asset allocations consistent with the equity glide path of a typical target date retirement fund, a 15% savings rate, a 1.5% constant real wage growth, a retirement age of 67 and a planning age through 93. the replacement annual income target is.

How Much Should You Save For Retirement How Much Guide

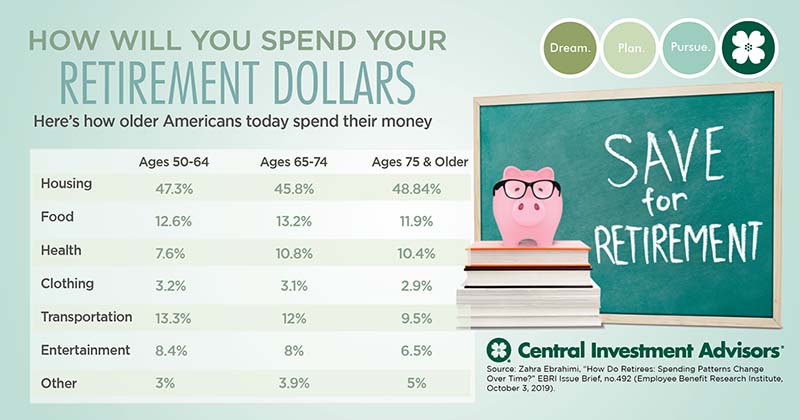

How Much Should You Save For Retirement Central Investment Advisors

Comments are closed.