How Much Should I Save A Simple Retirement Plan For Your Savings By

How Much Should I Save A Simple Retirement Plan For Your Savings By How this retirement calculator works. to estimate how much you'll save by retirement age ("what you'll have"), start with your current age and how much you've saved so far. add your income and. Fidelity suggests that a person earning $50,000 a year could expect social security to replace about 35% of income, with the rest coming from savings. but this share is lower for high earners.

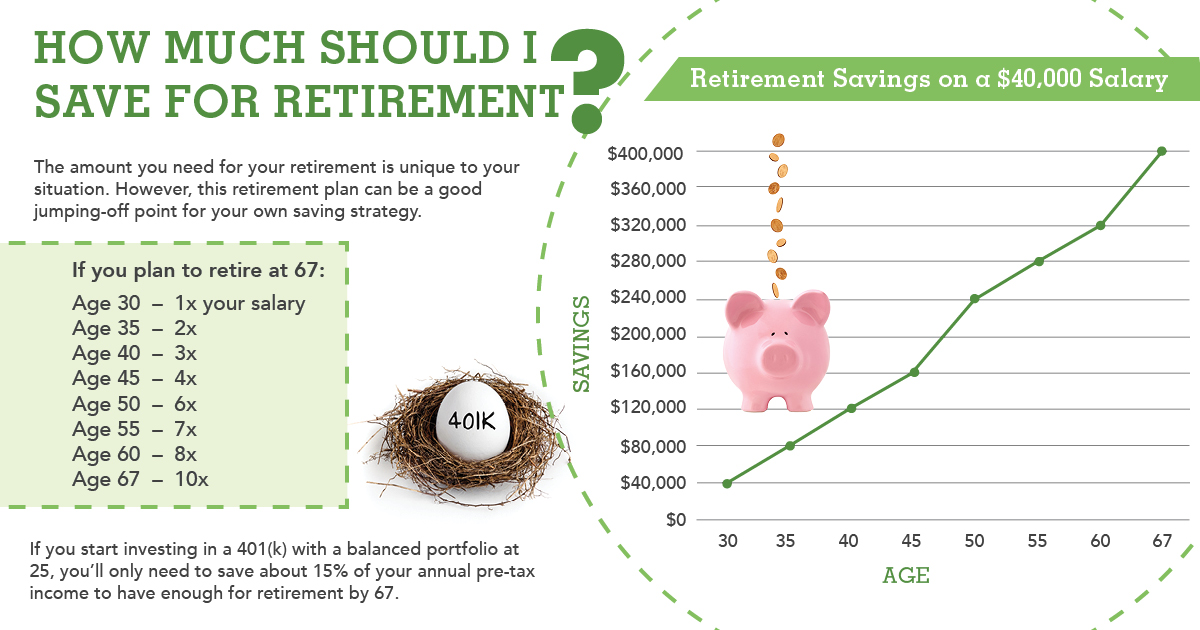

Recommended Retirement Savings By Age Are You Saving Enough Saving This calculator can help with planning the financial aspects of your retirement, such as providing an idea where you stand in terms of retirement savings, how much to save to reach your target, and what your retrievals will look like in retirement. your current age. your planned retirement age. It also assumes that you need an annual income in retirement equivalent to 55% to 80% of your pre retirement income to live comfortably. depending on your spending habits and medical expenses. Alan is 53 years old and has an income of $100,000. because alan is between ages in the table, he could average the multiplier ranges for age 50 (5–7x) and age 55 (6–9x) and use 5.5–8x to calculate his target savings, making his current estimated retirement portfolio around $550,000 to $800,000. if alan plans to splurge on travel in. If you have ever wondered how much to save for retirement every month or how many more years you need to work, this calculator is going to help you. if you want more detailed tools on retirement plans, check out the 401k calculator for retirement. if you are specifically interested in a 403b retirement plan, check our 403b calculator.

How Much Money Should I Save For Retirement Saving For Retirement Alan is 53 years old and has an income of $100,000. because alan is between ages in the table, he could average the multiplier ranges for age 50 (5–7x) and age 55 (6–9x) and use 5.5–8x to calculate his target savings, making his current estimated retirement portfolio around $550,000 to $800,000. if alan plans to splurge on travel in. If you have ever wondered how much to save for retirement every month or how many more years you need to work, this calculator is going to help you. if you want more detailed tools on retirement plans, check out the 401k calculator for retirement. if you are specifically interested in a 403b retirement plan, check our 403b calculator. To determine how much you’ll need to save for retirement, multiply how much you plan to spend annually by 25. for example, if you plan on spending $60,000 per year in retirement (not including social security), you’ll need to save $60,000 x 25 = $1,500,000 for retirement. remember: your annual spending amount will also need to include. This simple retirement calculator figures out how long until you reach your show more instructions. savings goal based on three factors: the amount of existing savings, the amount you add to your savings each month, and your expected annual interest rate. this calculator solves for time to reach your retirement savings goal, while leaving.

Comments are closed.