How Much Money You Ll Need To Afford A Comfortable Retirement The

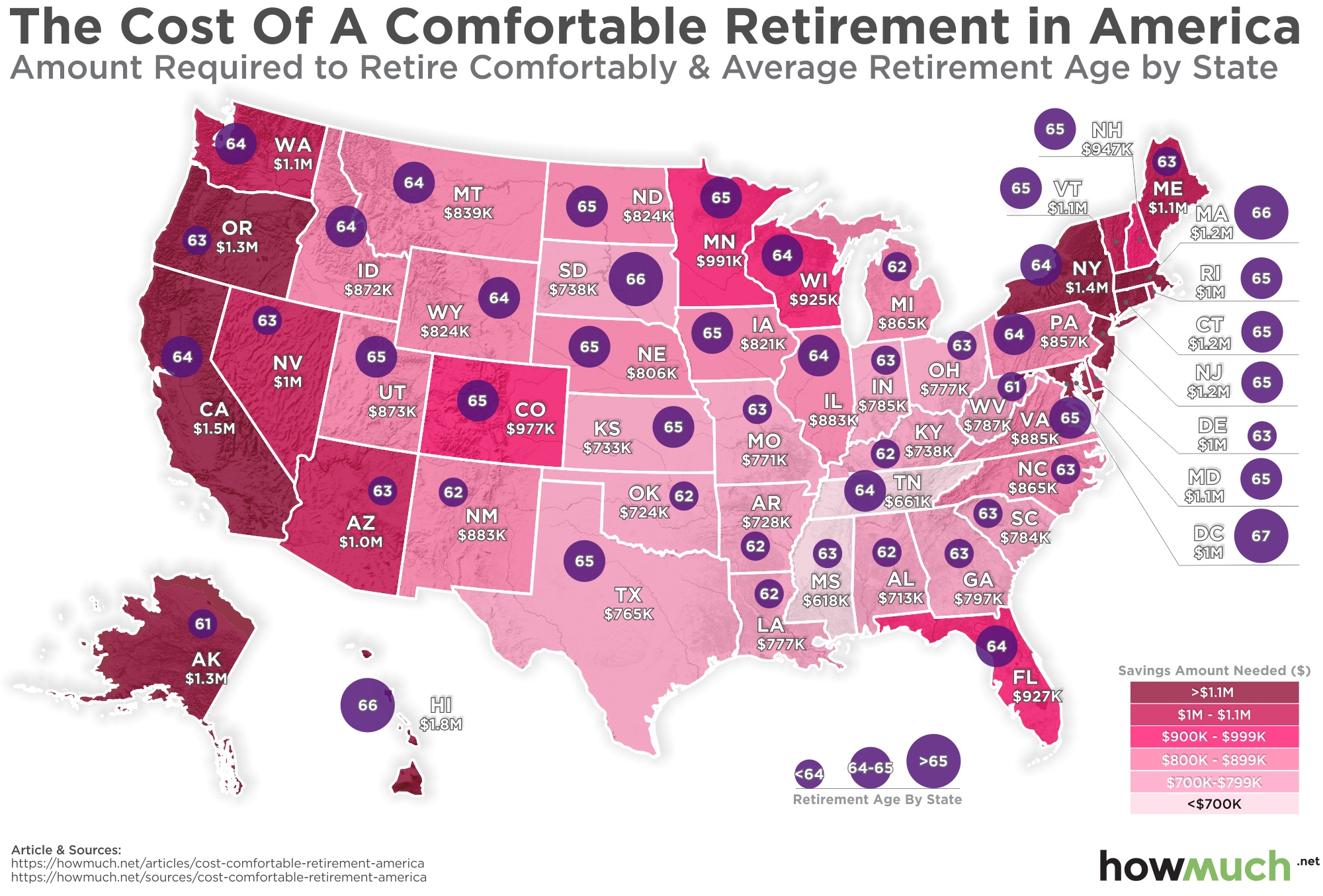

Mapped How Much Money Do You Need To Retire Comfortably In Each State Retirement age: enter the age you plan to retire. age 67 is considered full retirement age (when you get your full social security benefits) for people born in 1960 or later. life expectancy: this. Fidelity suggests that a person earning $50,000 a year could expect social security to replace about 35% of income, with the rest coming from savings. but this share is lower for high earners.

How To Calculate How Much Money You Need To Retire Business Insider We saw in the previous section that our couple would need $4,000 per month ($48,000 per year) from their savings. so, in this case, they should aim for $1.2 million in retirement savings accounts. Bad news: to pull all of that off, you’ll need to save $1,950 every month from now until you retire. that's about 23% of your monthly income. compare that to the 5% per month you've been saving up until now. if you stay on that course, you'll have a savings shortfall of $488,143 when you retire. Input your personal and financial information. for the retirement calculator, we define a comfortable retirement as living on 70% of your pre retirement income. however, the calculator is. To determine how much you’ll need to save for retirement, multiply how much you plan to spend annually by 25. for example, if you plan on spending $60,000 per year in retirement (not including social security), you’ll need to save $60,000 x 25 = $1,500,000 for retirement. remember: your annual spending amount will also need to include.

Calculating How Much Money I Need To Retire Homeequity Bank Input your personal and financial information. for the retirement calculator, we define a comfortable retirement as living on 70% of your pre retirement income. however, the calculator is. To determine how much you’ll need to save for retirement, multiply how much you plan to spend annually by 25. for example, if you plan on spending $60,000 per year in retirement (not including social security), you’ll need to save $60,000 x 25 = $1,500,000 for retirement. remember: your annual spending amount will also need to include. Some people may be frugal and need only $50,000 each year to live comfortably. others may need $100,000 or $200,000. your annual income needs will determine how much you need to have saved. for. This calculator tells you how much money you need to retire comfortably, based on age and income. the idea of becoming a millionaire may seem daunting, but getting there could be easier than you.

How Much Money You Ll Need To Afford A Comfortable Retirement The Some people may be frugal and need only $50,000 each year to live comfortably. others may need $100,000 or $200,000. your annual income needs will determine how much you need to have saved. for. This calculator tells you how much money you need to retire comfortably, based on age and income. the idea of becoming a millionaire may seem daunting, but getting there could be easier than you.

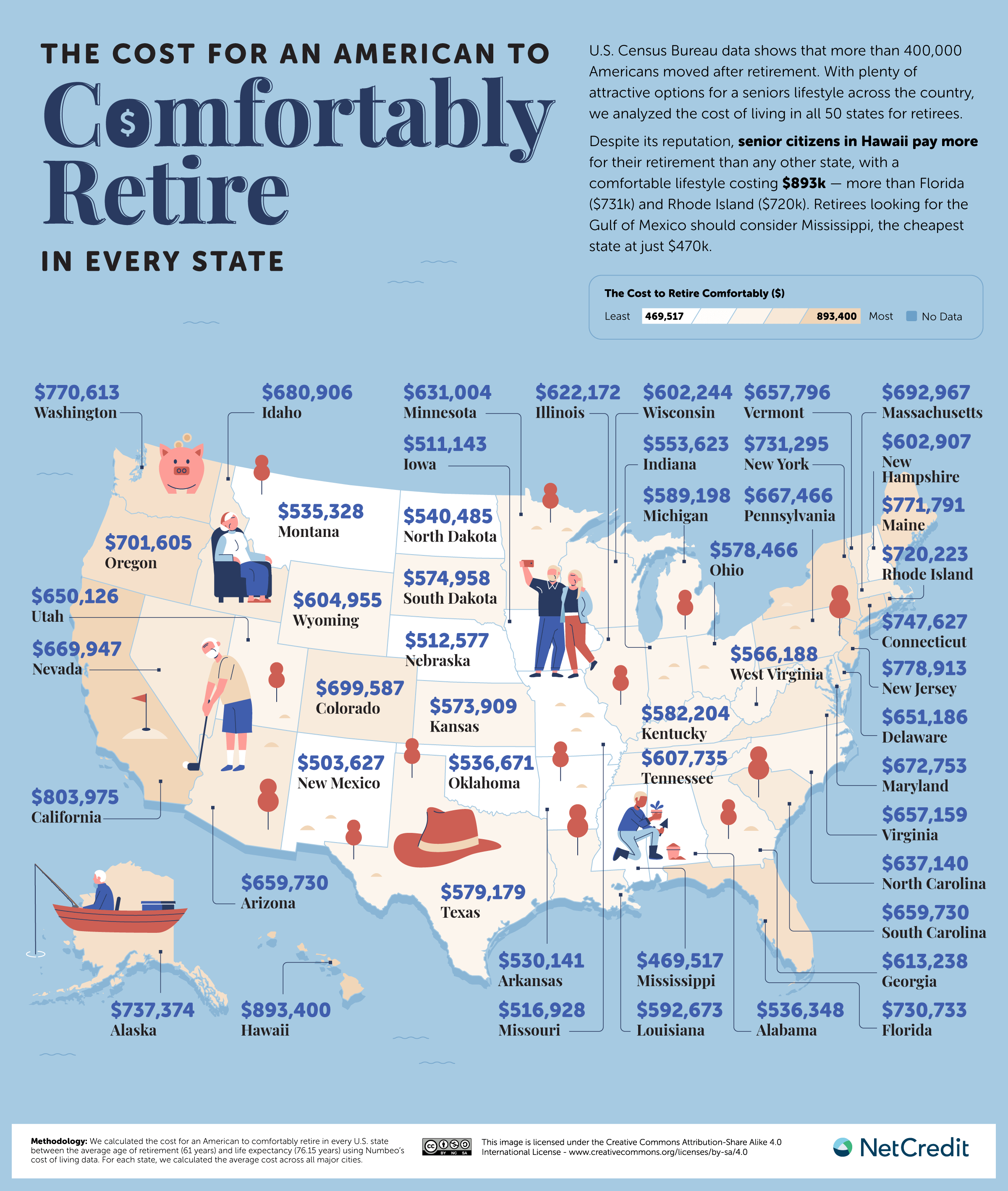

The Cost For An American To Comfortably Retire In Every State And

Comments are closed.