How Much Money Can Health Insurance Agents Make Aca Medicare

How Much Money Can Health Insurance Agents Make Aca Medicare Youtube Generally, agents brokers receive an initial payment in the first year of the policy (or when there is an “unlike plan type” enrollment change) and half as much for years two (2) and beyond if the member remains enrolled in the plan or make a “like plan type” enrollment change. agents brokers must be licensed in the state in which they. Prescription drug plans. independent agents can also sell standalone prescription drug plans, also known as medicare part d, to those looking to only add prescription drug coverage to their original medicare plan. commissions for medicare part d plans in 2022 are capped at $87 for initial plan enrollment and $44 for each renewal year.

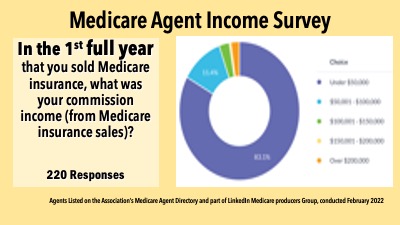

How Much Do Medicare Agents Make Survey Of Real Reported Income Cms set the broker commissions for medicare advantage and medicare part d annually, based on the fair market value. for 2025, the national maximum broker compensation rate for ma sales will be $626 for initial sales and $313 for renewals. the 2025 pdp national maximum broker compensation will be $109 for initial sales and $55 for renewals. Cms has released updated 2025 agent commission rates for medicare advantage and medicare part d. find out how much you can make in sales with the recent medicare commissions court cases in mind. 2025 maximum broker commissions for medicare advantage & medicare part d | ritter insurance marketing. The individual health insurance market , ultimately increasing health of the risk pooland creating a more stable individual market. shopping for and enrolling in health insurance can be a confusing process. consumers often need help understanding the different metal levels, deductibles, copays and subsidy eligibility factors. 1. Selling medicare policies can be highly lucrative. one insurance agency is advertising an upcoming “six figure medicare agent summit” in salt lake city, charging $200 to $5,000 to “help.

How Much Do Health Insurance Agents Make On Average Insurance The individual health insurance market , ultimately increasing health of the risk pooland creating a more stable individual market. shopping for and enrolling in health insurance can be a confusing process. consumers often need help understanding the different metal levels, deductibles, copays and subsidy eligibility factors. 1. Selling medicare policies can be highly lucrative. one insurance agency is advertising an upcoming “six figure medicare agent summit” in salt lake city, charging $200 to $5,000 to “help. Note: insurance providers are not required to pay the maximum medicare commission rate. we’ll let you know when insurance companies release their 2024 filings. medicare part d maximum broker commissions. initial commissions increased from $92 member year to $100 member year, a 8.7% increase yoy. The commission for subsequent years (i.e., the renewal commission) is set at 10 percent of the premium. based on our analysis, the average premium in 2020 for medigap was $1,660, meaning an agent would be paid $322 for the first year and $166 as a renewal commission. because premiums and rate adjustments for policies can vary, commissions may.

Comments are closed.