How Much Is Enough For Retirement Growthrapidly Saving For

How Much Is Enough For Retirement Growthrapidly Saving For In other words, how much is enough for retirement depends on a myriad of personal factors. however, the conventional wisdom out there is that you should have $1 million to $1.5 million, or that your retirement savings should be 10 to 12 times your current income. even $1 million may not be enough to retire comfortably. This money is deducted before you have time to spend it. 2. you are not aggressive enough in saving for retirement. if you are in your 20’s, saving aggressively will help to fund a nice and comfortable retirement. as the saying goes, when it comes to investing, time is your biggest friend. the more money you save, the more money you will have.

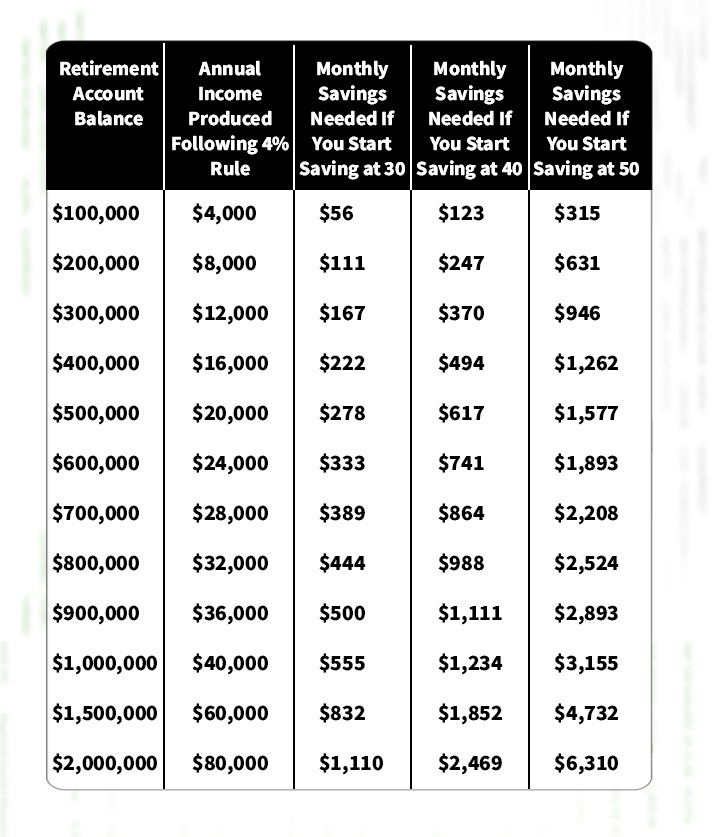

How Much Is Enough For Retirement Growthrapidly Saving For Monthly contribution: this is the amount you save for retirement each month. include contributions to your 401(k) (including your employer match), ira and any other retirement accounts. experts. We saw in the previous section that our couple would need $4,000 per month ($48,000 per year) from their savings. so, in this case, they should aim for $1.2 million in retirement savings accounts. To determine how much you’ll need to save for retirement, multiply how much you plan to spend annually by 25. for example, if you plan on spending $60,000 per year in retirement (not including social security), you’ll need to save $60,000 x 25 = $1,500,000 for retirement. remember: your annual spending amount will also need to include. 55 64. $537,560. 65 74. $609,230. 75 or older. $462,410. of course, averages can be skewed by those who have large nest eggs, and median numbers are significantly lower, according to the federal.

Retirement Calculator How Much You Need To Save Fox Business To determine how much you’ll need to save for retirement, multiply how much you plan to spend annually by 25. for example, if you plan on spending $60,000 per year in retirement (not including social security), you’ll need to save $60,000 x 25 = $1,500,000 for retirement. remember: your annual spending amount will also need to include. 55 64. $537,560. 65 74. $609,230. 75 or older. $462,410. of course, averages can be skewed by those who have large nest eggs, and median numbers are significantly lower, according to the federal. Fidelity suggests that a person earning $50,000 a year could expect social security to replace about 35% of income, with the rest coming from savings. but this share is lower for high earners. To better save for retirement, consider all of your options, such as contributing to a 401(k) or ira, or a 403(b) in 2024 and 2025. different accounts may have different fees that can eat into.

Am I Saving Enough Money For Retirement And How Much You Should Be Fidelity suggests that a person earning $50,000 a year could expect social security to replace about 35% of income, with the rest coming from savings. but this share is lower for high earners. To better save for retirement, consider all of your options, such as contributing to a 401(k) or ira, or a 403(b) in 2024 and 2025. different accounts may have different fees that can eat into.

Comments are closed.