How Much Is Enough For A Comfortable Retirement The Exact Amount

How Much Do You Need For A Comfortable Retirement Bluesky American adults say on average they now need $1.46 million to retire, according to the northwestern northwestern 0.0% mutual 2024 planning & progress study. that’s 15% higher than a year earlier. Some people may be frugal and need only $50,000 each year to live comfortably. others may need $100,000 or $200,000. your annual income needs will determine how much you need to have saved. for.

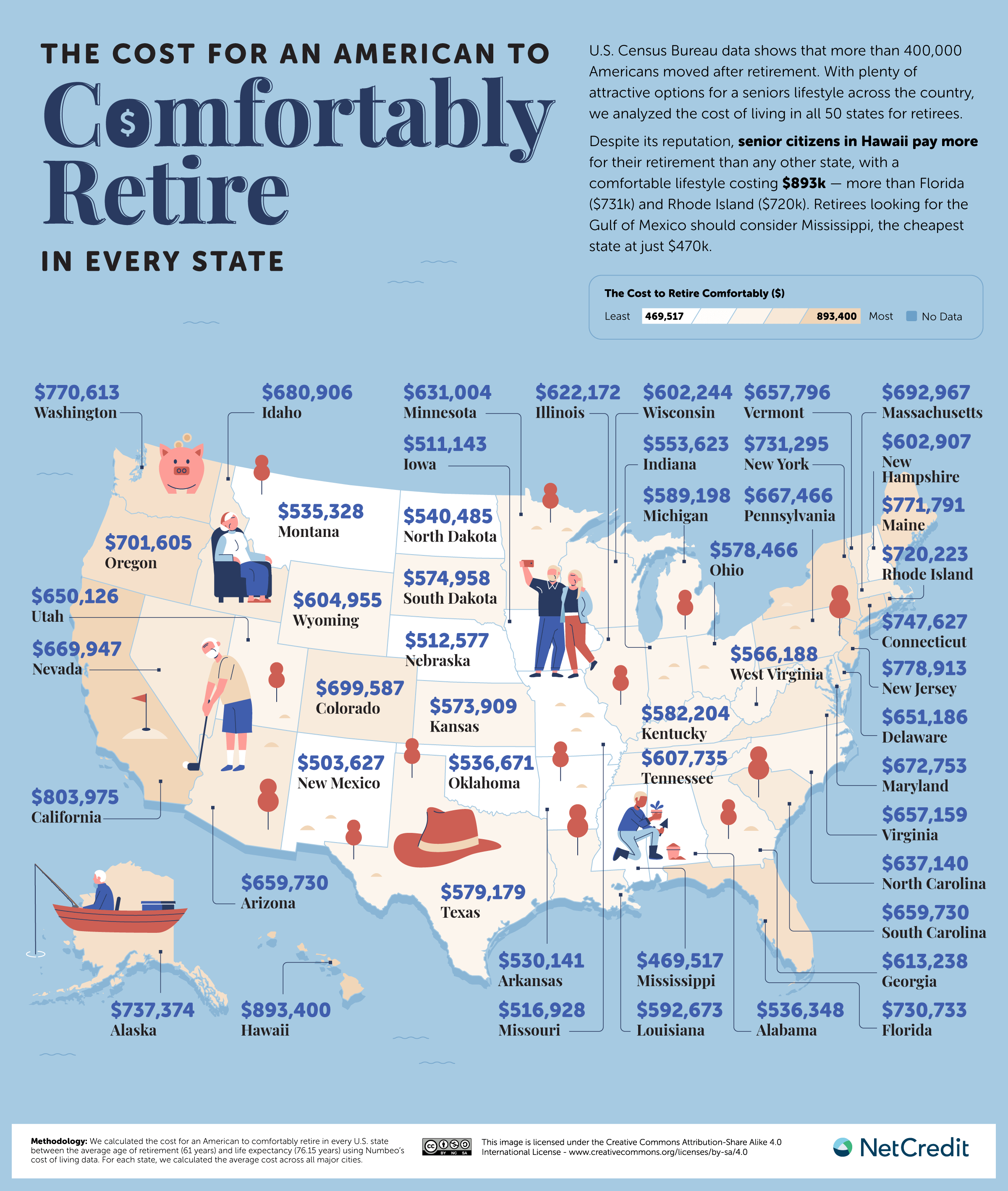

The Cost For An American To Comfortably Retire In Every State And We saw in the previous section that our couple would need $4,000 per month ($48,000 per year) from their savings. so, in this case, they should aim for $1.2 million in retirement savings accounts. The average amount adults have tucked away for their retirement increased 3% this year to $89,300 — up from $86,869 last year. at the same time, the expected price tag of a comfortable retirement is also increasing. in 2023, american say they will need $1.27 million to retire comfortably. last year, they said $1.25 million. 65 74 years: $63,187 per year or $5,266 per month. 75 and older: $47,928 per year or $3,994 per month. for some people, social security benefits might comprise a substantial portion of this income. The idea of a comfortable retirement just got a lot more expensive, and for some, it may be entirely out of reach. that $1.46 million is in sharp contrast to the average amount that u.s.

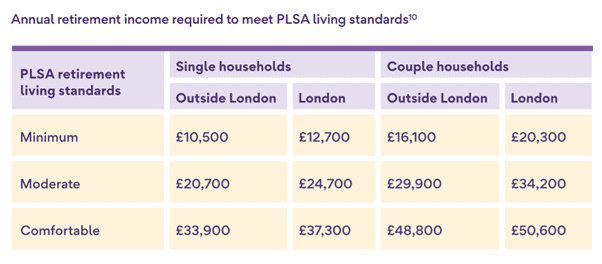

The Cost Of A Comfortable Retirement St James S Place Asia 65 74 years: $63,187 per year or $5,266 per month. 75 and older: $47,928 per year or $3,994 per month. for some people, social security benefits might comprise a substantial portion of this income. The idea of a comfortable retirement just got a lot more expensive, and for some, it may be entirely out of reach. that $1.46 million is in sharp contrast to the average amount that u.s. Fidelity suggests that a person earning $50,000 a year could expect social security to replace about 35% of income, with the rest coming from savings. but this share is lower for high earners. Those who haven’t retired yet estimated they will need $4,940 per month, on average, to retire comfortably. millennials anticipated needing a little more, $5,135 per month, and people closing in on retirement between the ages of 60 and 65 said they required a little less: $4,855. however, actual retirees surveyed by schroders reported earning.

How Much Is Enough For A Comfortable Retirement The Exact Amount Fidelity suggests that a person earning $50,000 a year could expect social security to replace about 35% of income, with the rest coming from savings. but this share is lower for high earners. Those who haven’t retired yet estimated they will need $4,940 per month, on average, to retire comfortably. millennials anticipated needing a little more, $5,135 per month, and people closing in on retirement between the ages of 60 and 65 said they required a little less: $4,855. however, actual retirees surveyed by schroders reported earning.

Comments are closed.