How Much Do I Need To Retire In Canada Canadian Lic

How Much Do I Need To Retire In Canada Canadian Lic In canada, the rule can be adapted as follows: by age 30: target savings equivalent to about 1 times your annual income. for example, if your annual income is $50,000, aim to have saved around $50,000 for retirement. by age 40: strive to have savings of about 3 times your annual income. The calculator takes into account your registered and non registered savings, annual returns, investment fees, income tax, and inflation to compute these estimates. here are some market assumptions baked into our calculations. inflation rate of 2%. yearly salary increase of 2% per year up to the age of 45 and none thereafter.

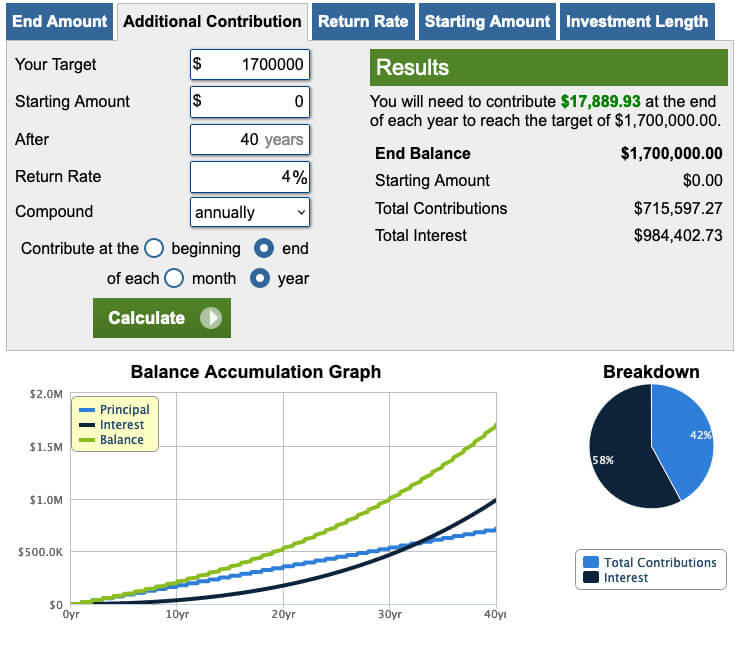

How Much Do I Need To Retire In Canada Canadian Lic If you’re just starting out on the long road to saving for retirement, you may have heard about bmo’s recent poll, which found that canadians say they will need $1.7 million to retire. because. Here’s an overview of the steps to take to retire in canada. decide which part of canada is right for you. research residence permits. make your finances accessible from anywhere. understand. According to this rule, you’ll need 70% of your pre retirement household income each year in retirement for 25 years. for example, if your household brings in $150,000 in the year before you. Using the 70% rule, you will need approximately $70,000 ($100,000 x 70%) in annual income to maintain your lifestyle in retirement. going back to rule 2, it implies you need: ⇒ $70,000 x 25 ⇒ $1.75 million in retirement. i think the 70% rule is a reasonably liberal estimate of retirement income needs (barring exceptional circumstances).

How Much Do I Need To Retire In Canada Canadian Lic According to this rule, you’ll need 70% of your pre retirement household income each year in retirement for 25 years. for example, if your household brings in $150,000 in the year before you. Using the 70% rule, you will need approximately $70,000 ($100,000 x 70%) in annual income to maintain your lifestyle in retirement. going back to rule 2, it implies you need: ⇒ $70,000 x 25 ⇒ $1.75 million in retirement. i think the 70% rule is a reasonably liberal estimate of retirement income needs (barring exceptional circumstances). For example, assume you earn $100,000 per year before retiring. using the 70% rule, you will need approximately $70,000 ($100,000 x 70%) in annual income to maintain your lifestyle in retirement. going back to rule 2, this implies you will need: ⇒ $70,000 x 25 ⇒ $1.75 million in retirement. According to this rule, you’ll need 70% of your pre retirement household income each year in retirement for 25 years. if your household brings in $150,000 in the year before you retire, for instance, then you’ll need $105,000 annually. multiply that by 25 years and your retirement savings should equal $2,625,000.

How Much Money Do You Need To Retire In Canada Is It Really 1 7 For example, assume you earn $100,000 per year before retiring. using the 70% rule, you will need approximately $70,000 ($100,000 x 70%) in annual income to maintain your lifestyle in retirement. going back to rule 2, this implies you will need: ⇒ $70,000 x 25 ⇒ $1.75 million in retirement. According to this rule, you’ll need 70% of your pre retirement household income each year in retirement for 25 years. if your household brings in $150,000 in the year before you retire, for instance, then you’ll need $105,000 annually. multiply that by 25 years and your retirement savings should equal $2,625,000.

Comments are closed.