How Much Do I Need To Retire Fidelity

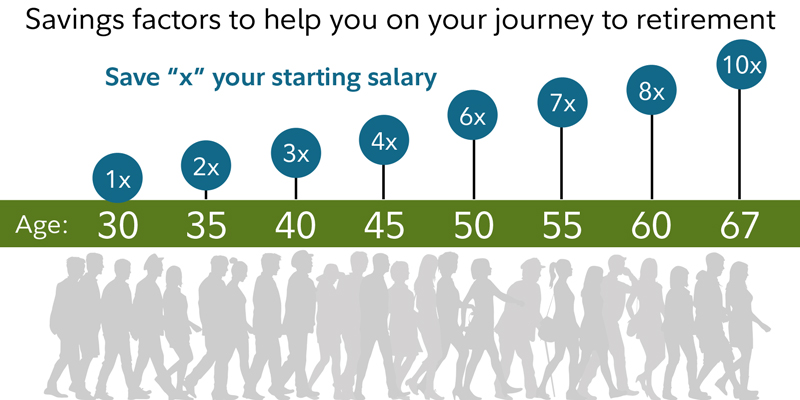

Fidelity S Retirement Savings Guidelines Here S How Much You Need To Fidelity brokerage services llc, member nyse, sipc, 900 salem street, smithfield, ri 02917. 738991.16.0. here's a simple rule for calculating how much money you need to retire: at least 1x your salary at 30, 3x at 40, 6x at 50, 8x at 60, and 10x at 67. All these guidelines depend on a number of factors, especially the age at which you retire. the average retirement age in america is about 65 for men and 63 for women. 5 at 62, you can start claiming social security benefits. but postponing claiming can increase your monthly benefit by 8% every year you delay between age 62 and 70.

Solution How Much Do I Need To Retire Fidelity Studypool The change in the rmds age requirement from 72 to 73 applies only to individuals who turn 72 on or after january 1, 2023. after you reach age 73, the irs generally requires you to withdraw an rmd annually from your tax advantaged retirement accounts (excluding roth iras, and roth accounts in employer retirement plan accounts starting in 2024). Fidelity suggests that a person earning $50,000 a year could expect social security to replace about 35% of income, with the rest coming from savings. how much do i need to retire? how much. Fidelity offers four guidelines on how much to save for retirement and how much to withdraw during retirement. We saw in the previous section that our couple would need $4,000 per month ($48,000 per year) from their savings. so, in this case, they should aim for $1.2 million in retirement savings accounts.

How Much Do I Need To Retire Fidelity Fidelity offers four guidelines on how much to save for retirement and how much to withdraw during retirement. We saw in the previous section that our couple would need $4,000 per month ($48,000 per year) from their savings. so, in this case, they should aim for $1.2 million in retirement savings accounts. Savings by age 30: the equivalent of your annual salary saved; if you earn $55,000 per year, by your 30th birthday you should have $55,000 saved. savings by age 40: three times your income. That means the average retirement account at age 67 should be $645,700, based on fidelity’s guidelines. read: if you want to retire in 2025, here's what you need to prep now.

Comments are closed.