How Long Will The Current Economic Expansion Last

How Long Will The Current Economic Expansion Last Dec. 5, 2023 by joseph brusuelas and tuan nguyen. solid consumer spending driven by real personal income gains and sustained private investment will underscore a steady pace of growth at or near the 1.8% long run rate in the united states in 2024. we expect that policy tailwinds from both the fiscal and monetary authorities will set the stage. The u.s. economy grew substantially faster in the final months of 2023 than forecasters had expected. for all of last year, the economy grew 3.1% — defying forecasts of a likely recession.

How Long Will The Current Economic Expansion Last Economic growth due to increases in jobs, incomes, and spending. today, the u.s. commerce department’s bureau of economic analysis (bea) reported fourth quarter real gross domestic product (gdp) increased at an annual rate of 3.3 percent in the fourth quarter of 2023 exceeding expectations. growth was in large part due to an increase in. The u.s. net international investment position, the difference between u.s. residents’ foreign financial assets and liabilities, was $22.52 trillion at the end of the second quarter of 2024, according to statistics released today by the u.s. bureau of economic analysis. assets totaled $36.00 trillion, and liabilities were $58.52 trillion. By the time its hikes ended in july last year, the central bank had raised its influential rate from near zero to roughly 5.4%, the highest level since 2001. as the fed’s rate hikes worked their way through the economy, year over year inflation slowed from 9.1% in june 2022, the fastest rate in four decades, to 3.4% as of last month. Consumer spending, the primary driver of the economy, grew last quarter at a 2.8% pace, down slightly from the 2.9% rate the government had previously estimated. business investment was also solid: it increased at a vigorous 8.3% annual pace last quarter, led by a 9.8% rise in investment in equipment.

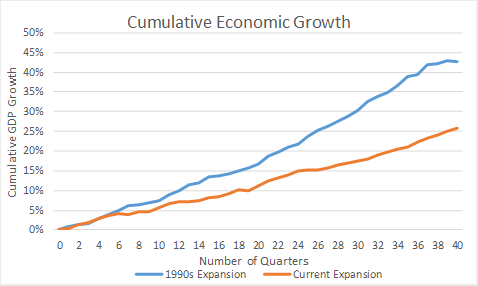

For How Long Can Today S Global Economic Expansion Last The By the time its hikes ended in july last year, the central bank had raised its influential rate from near zero to roughly 5.4%, the highest level since 2001. as the fed’s rate hikes worked their way through the economy, year over year inflation slowed from 9.1% in june 2022, the fastest rate in four decades, to 3.4% as of last month. Consumer spending, the primary driver of the economy, grew last quarter at a 2.8% pace, down slightly from the 2.9% rate the government had previously estimated. business investment was also solid: it increased at a vigorous 8.3% annual pace last quarter, led by a 9.8% rise in investment in equipment. New challenges to maintaining an ongoing economic expansion arose following the emergence of high inflation in 2021 and rapidly tightening monetary policy in 2022, but the economy ended 2023 with high employment and falling inflation. the chart book is arranged as follows: part i: economic growth and employment in recession and recovery. Yet the robust growth may prove to be a high water mark for the economy before a steady slowdown begins in the current october december quarter and extends into 2024. the breakneck pace is expected to ease as higher long term borrowing rates, on top of the federal reserve’s short term rate hikes, cool spending by businesses and consumers.

Economic Expansion Hits Record Seeking Alpha New challenges to maintaining an ongoing economic expansion arose following the emergence of high inflation in 2021 and rapidly tightening monetary policy in 2022, but the economy ended 2023 with high employment and falling inflation. the chart book is arranged as follows: part i: economic growth and employment in recession and recovery. Yet the robust growth may prove to be a high water mark for the economy before a steady slowdown begins in the current october december quarter and extends into 2024. the breakneck pace is expected to ease as higher long term borrowing rates, on top of the federal reserve’s short term rate hikes, cool spending by businesses and consumers.

Comments are closed.