How Is Open Banking Transforming The World Of Payments

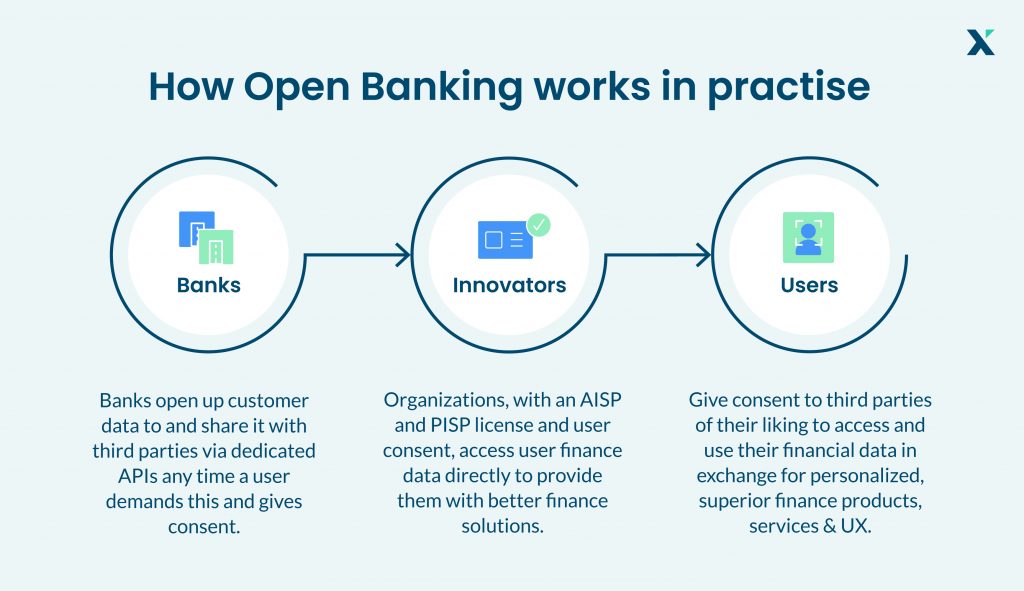

Open Banking Apis In 2024 Definition Benefits Applications Ser aware ness of new products and services. doing this will keep cus tomers informed about the benefits and risks of using open banking and fast payment services—particularly i. markets with a strong preference for cards. in this context, businesses can benefit from operational and transa. How open banking for payments is transforming online payments. the concept of ‘open banking’ aims to open up that data and therefore redefine the way consumers, businesses and banks work together through application programming interfaces (apis) so that third parties can offer new financial services – provided the customer consents of course.

How Open Banking Is Transforming The Global Payment Landscape There are many open banking initiatives at various stages of maturity across the world (see figure 1), but the shift in the uk has come through the competition and markets authority (cma) mandating that the uk’s major banks adopt the open banking standard, and in europe through the eu second payment services directive (psd2). the psd2. The open banking sector rose from $11.79 billion in 2020 to $15.13 billion in 2021. the reversal in growth trajectory is mostly due to enterprises stabilizing their output following the epidemic in 2020, when demand rose rapidly. at a cagr of 25.7%, it is predicted that the market will reach $37.77 billion by 2025. According to a 2021 report by the financial brand, more than 2,500 european firms had registered as third party providers under psd2, and the global open banking market was expected to reach $43. Here are some of the ways open banking is currently used: payment initiation services. retailers can initiate payments directly from a customer’s bank account, bypassing the need for a traditional payment gateway. this method could lead to faster settlements and reduced transaction fees. account aggregation.

Everything You Need To Know About Open Banking According to a 2021 report by the financial brand, more than 2,500 european firms had registered as third party providers under psd2, and the global open banking market was expected to reach $43. Here are some of the ways open banking is currently used: payment initiation services. retailers can initiate payments directly from a customer’s bank account, bypassing the need for a traditional payment gateway. this method could lead to faster settlements and reduced transaction fees. account aggregation. 11 open banking use cases that serve smes and other businesses. 11 account to account payments. 13 small business payments. 15 credit scoring. 17 digital onboarding. 18 small business financial management. 19 banking without current accounts. 20 global developments in open banking. 20 regulatory and market led. Open banking is helping fuel a revolution in financial services. it can provide people with more convenient ways to view and manage their money and simpler ways to access credit. open banking can also power different kinds of payment services, such as payments in video games or business accounting apps. the practice is already helping to widen.

Comments are closed.