How Does A Credit Card Work Simple Guide And Definition

How Does A Credit Card Work Simple Guide And Definition A credit card is a small plastic card that lets you borrow money from a financial provider. if you borrow funds for a significant period of time, you’ll pay a fee for the privilege — called interest. use credit cards if you want a secure and convenient way to pay. they’re also excellent tools to build your credit score — a three digit. Wallethub senior researcher. credit cards work on a buy now pay later basis. when you use a credit card to make a purchase, you’re borrowing money from the credit card’s issuer to complete the transaction, and then repaying the amount at the end of the billing cycle, either in part or in full. if you pay a credit card’s bill in full each.

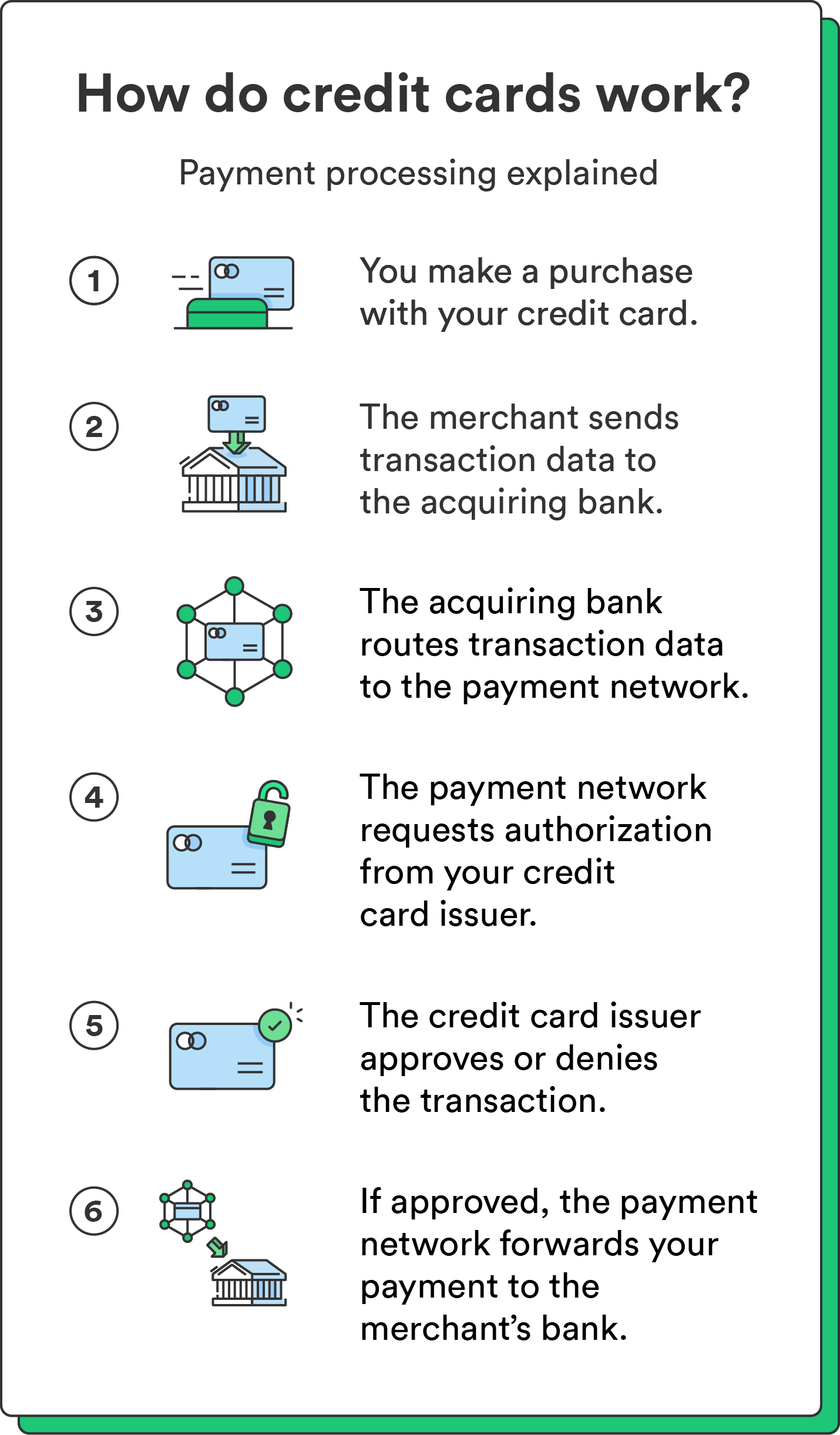

How Do Credit Cards Work The Beginners Guide Chime How credit cards work. at its core, the credit card process is pretty straightforward. you use the card to make a purchase, the issuer pays the retailer on your behalf, and you repay the issuer. When you make a purchase with a credit card, the merchant sends a request to your card issuer to check if your account is valid and has enough credit to cover the transaction. this is called authorization. once approved, the transaction amount is held in your account but not immediately transferred to the merchant. Key takeaways. credit cards are plastic or metal cards used to pay for items or services using credit. credit cards charge interest on the money spent. credit cards may be issued by stores, banks. Credit card vocabulary 101. here are some terms that will help you really understand how credit cards work: credit limit: the amount of money you can spend on your card at one time, or the size of your ongoing loan. it’s determined by the credit card issuer. the better your credit and the higher your income, the higher your credit limit may be.

Infographic What Is A Credit Card Easy Peasy Finance For Kids And Key takeaways. credit cards are plastic or metal cards used to pay for items or services using credit. credit cards charge interest on the money spent. credit cards may be issued by stores, banks. Credit card vocabulary 101. here are some terms that will help you really understand how credit cards work: credit limit: the amount of money you can spend on your card at one time, or the size of your ongoing loan. it’s determined by the credit card issuer. the better your credit and the higher your income, the higher your credit limit may be. A credit score is a rating that allows lenders, including card issuers, to determine your creditworthiness — or the risk they take on by approving you for a loan or credit card. two popular. The card issuer will divide this number by 365 (the number of days in the year) to come to a daily percentage rate that’s then applied to your account each day. as an example, if you had an apr of 15.99%, your daily interest rate that the card issuer would apply to your account each day would be around 0.04%.

How Does A Credit Card Work A Guide And Credit Card Definition Moneytips A credit score is a rating that allows lenders, including card issuers, to determine your creditworthiness — or the risk they take on by approving you for a loan or credit card. two popular. The card issuer will divide this number by 365 (the number of days in the year) to come to a daily percentage rate that’s then applied to your account each day. as an example, if you had an apr of 15.99%, your daily interest rate that the card issuer would apply to your account each day would be around 0.04%.

How Credit Cards Work Money World Basics

Comments are closed.