How Do Macroeconomic Changes Affect The Performance Of Commercial Real

How Do Macroeconomic Changes Affect The Performance Of Commercial Real Comparing baseline to upside scenario, inflation increases from 2.38% to 2.6%. from the sensitivity analysis, rising inflation would lead to lower returns. but in the upside scenario, the gdp growth is higher, which is positive for returns. the combined impact of rising inflation and stronger gdp growth is shown in the bar chart. Results from deloitte’s 2025 commercial real estate outlook survey give some indication that commercial real estate owners and investors are hopeful that 2025 will emerge as a year of potential recovery over two years of muted revenues and pullbacks in spending. the survey collected input from more than 880 global chief executives and their.

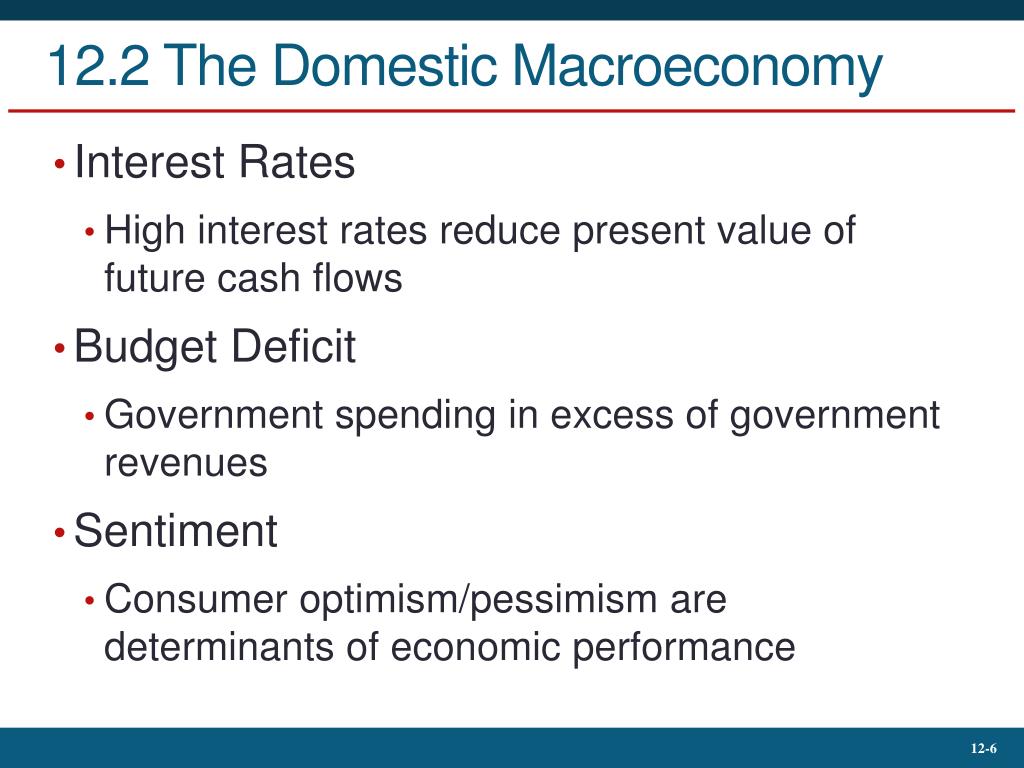

Ppt Macroeconomic And Industry Analysis Powerpoint Presentation Free Local economy should be an important determinant of commercial real estate (cre) performance. this paper empirically examines how the economic conditions of a metropolitan area drive the performance of cre in the area. this paper shows that areas with better economic conditions provide a higher total return on commercial properties than those with worse economic conditions. further analysis. Real estate cycles embrace change in rents, capital values and development activity with usually a clear link to the macroeconomic cycle. cycles can be traced back into history in many countries since the industrial revolution. the amplitude of these cycles varies, related to the causes and the local circumstances. Commercial real estate is highly sensitive to macroeconomic conditions. as the economy expands and contracts in cycles, so does the commercial property market. key macroeconomic factors like gdp growth, employment, interest rates, inflation, and consumer spending have an outsized influence on real estate asset values, income streams, operating expenses, and more. understanding these dynamics. The effects of the pandemic have been far reaching in all industries, but it seems clear that covid 19 has fundamentally changed the way real estate business is conducted. the demand for space has.

Explaining How Macroeconomic Performance Can Be Economics Tutor2u Commercial real estate is highly sensitive to macroeconomic conditions. as the economy expands and contracts in cycles, so does the commercial property market. key macroeconomic factors like gdp growth, employment, interest rates, inflation, and consumer spending have an outsized influence on real estate asset values, income streams, operating expenses, and more. understanding these dynamics. The effects of the pandemic have been far reaching in all industries, but it seems clear that covid 19 has fundamentally changed the way real estate business is conducted. the demand for space has. A strong local economy mi ght enhance the performance of companies. housed in commercial buildings. the changes in local economic conditions should have. compelling impacts on the perf ormance of. Interactions between the real estate markets and the macroeconomic environment. we study these interactions in the uk and the us in a frequency domain. there is a common trend that drives all the real estate markets in the long run. real estate markets in the uk and the us react differently to institutional shocks. different transmission channels during real estate crises in the two countries.

Explaining How Macroeconomic Performance Can Be Measured Tutor2u A strong local economy mi ght enhance the performance of companies. housed in commercial buildings. the changes in local economic conditions should have. compelling impacts on the perf ormance of. Interactions between the real estate markets and the macroeconomic environment. we study these interactions in the uk and the us in a frequency domain. there is a common trend that drives all the real estate markets in the long run. real estate markets in the uk and the us react differently to institutional shocks. different transmission channels during real estate crises in the two countries.

Macroeconomic Model Of Performance Influence Factors Source Authors

Comments are closed.