How Do I Qualify For The Irs Saver S Credit And Reduce My Income Tax

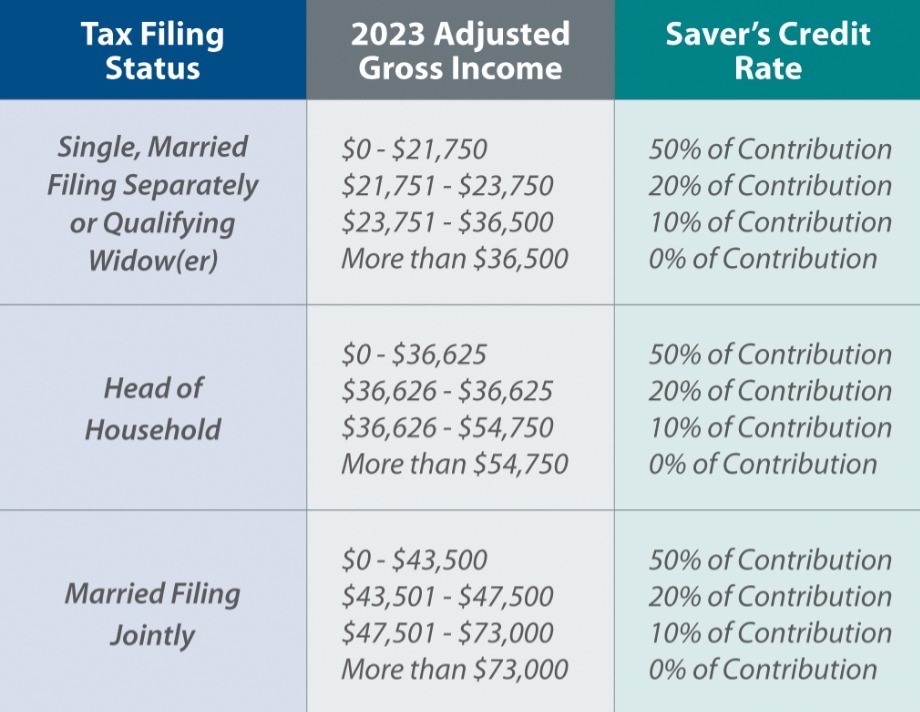

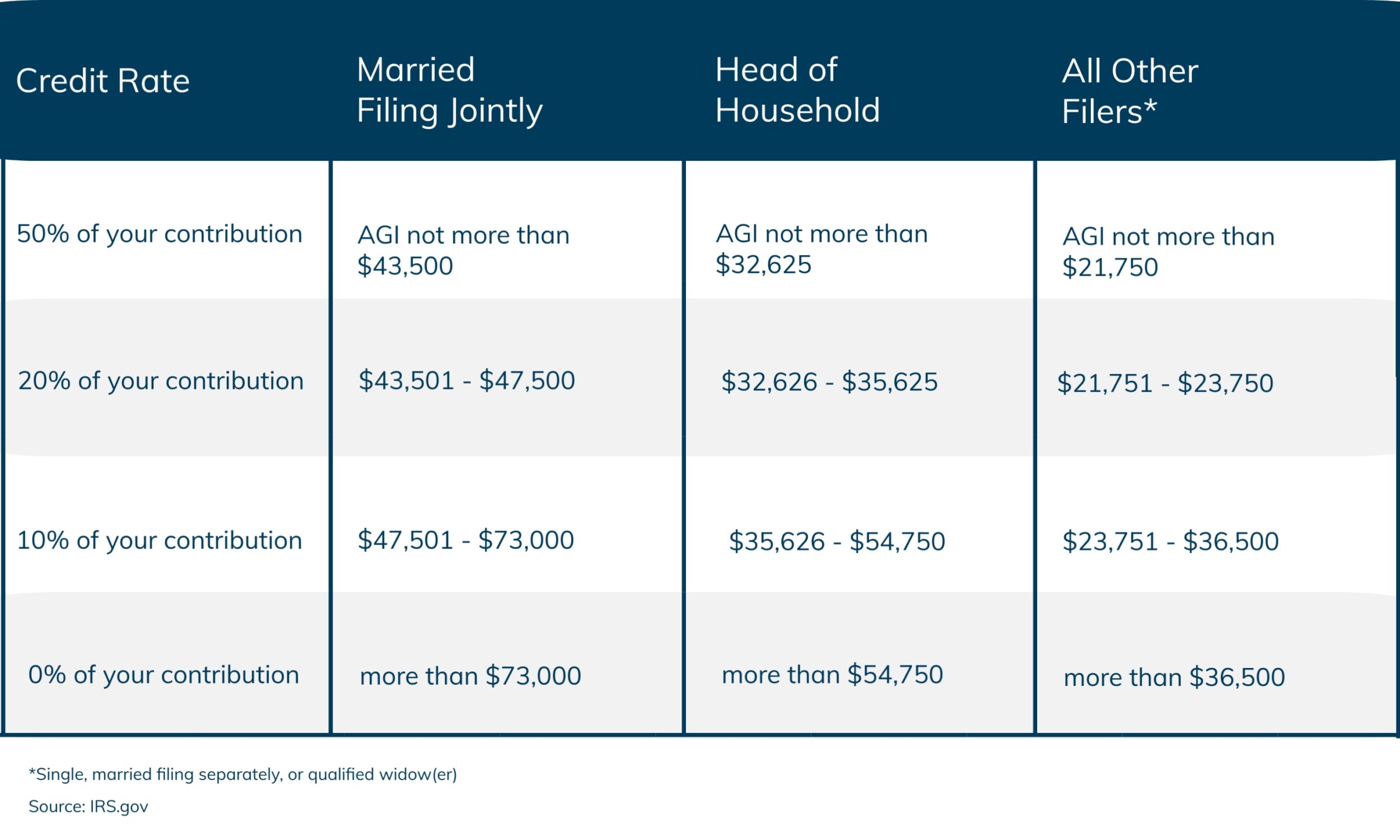

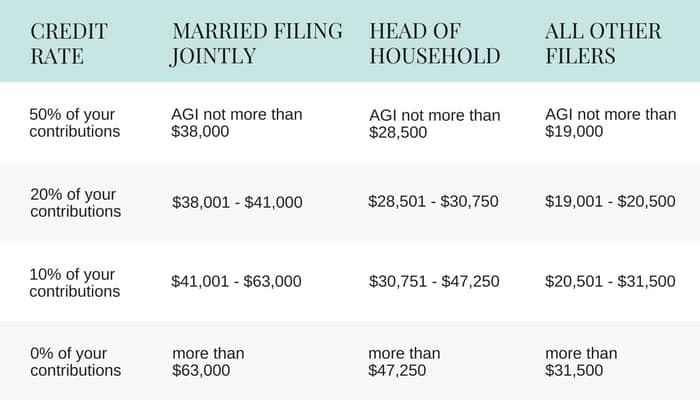

How Do I Qualify For The Irs Saver S Credit And Reduce My Income Tax The maximum contribution amount that may qualify for the credit is $2,000 ($4,000 if married filing jointly), making the maximum credit $1,000 ($2,000 if married filing jointly). use the chart below to calculate your credit. example: jill, who works at a retail store, is married and earned $41,000 in 2021. jill’s spouse was unemployed in 2021. The maximum saver's credit is $1,000 ($2,000 for married couples). the credit can increase a taxpayer's refund or reduce the tax owed but is affected by other deductions and credits. distributions from a retirement plan or able account reduce the contribution amount used to figure the credit. contribution deadlines.

What You Need To Know About The Saver S Credit The saver's credit is a tax credit that low and moderate income individuals may claim for qualified contributions to eligible retirement accounts. it is a nonrefundable credit, meaning it can only reduce taxes, even to a point where taxes may be reduced to $0. you may still receive a tax refund if you had taxes withheld greater than your tax. Saver’s credit rates for 2025. the adjusted gross income thresholds below apply to income earned in 2025, which is reported on tax returns filed in 2026. married filing jointly. 50% of. Anyone who plans to claim the saver's credit on their taxes will complete form 8880 and file it with their tax return. to be eligible for the saver's credit, you must: be at least 18 years old. The saver's credit is worth 10%, 20% or 50% of your retirement account contributions, with workers with the lowest income getting the biggest credit. retirement savers with an adjusted gross.

The Saver S Tax Credit What Is It And Do You Qualify The Budget Mom Anyone who plans to claim the saver's credit on their taxes will complete form 8880 and file it with their tax return. to be eligible for the saver's credit, you must: be at least 18 years old. The saver's credit is worth 10%, 20% or 50% of your retirement account contributions, with workers with the lowest income getting the biggest credit. retirement savers with an adjusted gross. A taxpayer's credit amount is based on their filing status, adjusted gross income, tax liability and amount contributed to qualifying retirement programs or able accounts. form 8880 is used to claim the saver's credit, and its instructions have details on figuring the credit correctly. in tax year 2020, the most recent year for which complete. The saver's credit is worth up to $2,000 ($4,000 if filing jointly). it helps low and moderate income individuals and couples save for retirement.

Comments are closed.