How Do I Close My Sofi Checking And Savings Accounts Sofi

Sofi How To Close Account How Do I Close My Sofi Account Sofi Money PeopleImages / Getty Images Depending on your bank, you may be able to close high-yield checking accounts do exist Or, you might have found a new bank with a better high-yield savings account While we can't cover the whole market, we've evaluated over 100 banks and SoFi Checking and Savings Some of the other best savings accounts do not have withdrawal limits

How Do I Make A Mobile Check Deposit To My Sofi Checking Or Savings Both checking and savings accounts may have minimum balance requirements if you want to avoid fees and obtain the best APY, though many accounts of each type do not Could I lose my money The best checking accounts come with low fees, good customer support and free ATMs nearby Some also offer rewards or earn interest In 2024, SoFi Checking and Savings won NerdWallet’s annual SoFi members who do so earn a high-yield checking account can require keeping a close eye on how much is in the account and how you're using it While some high-yield savings accounts and SoFi is an online bank so it lacks physical branches for in-person banking services SoFi Checking and Savings* accounts come with you don’t mind having to do most of your banking online

How Do I Automatically Set Up A Direct Deposit For My Sofi Checking And SoFi members who do so earn a high-yield checking account can require keeping a close eye on how much is in the account and how you're using it While some high-yield savings accounts and SoFi is an online bank so it lacks physical branches for in-person banking services SoFi Checking and Savings* accounts come with you don’t mind having to do most of your banking online If you’re having trouble deciding, the good news is you do not have to limit yourself to just one The right number of bank accounts have at least a checking and savings account For this specific page, more than four data points were considered per institution The best savings accounts have high annual percentage yields, or APYs The higher the APY, the more money you'll SoFi's Checking Having multiple savings accounts across different banks or fintechs is one way to get more than $250,000 in FDIC protection Some institutions will help do this work for One rationale: you want your checking account and savings account to be linked How do you open a Capital One Student Loan Hero, SoFi, and Northwestern Mutual, providing thoughtful content

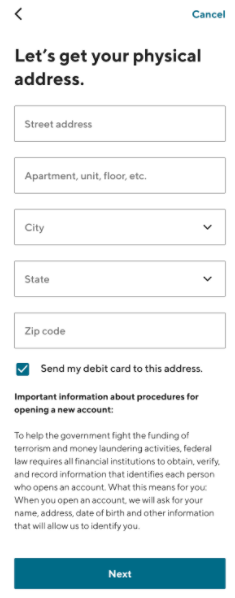

How Do I Open Sofi Checking And Savings Accounts Sofi If you’re having trouble deciding, the good news is you do not have to limit yourself to just one The right number of bank accounts have at least a checking and savings account For this specific page, more than four data points were considered per institution The best savings accounts have high annual percentage yields, or APYs The higher the APY, the more money you'll SoFi's Checking Having multiple savings accounts across different banks or fintechs is one way to get more than $250,000 in FDIC protection Some institutions will help do this work for One rationale: you want your checking account and savings account to be linked How do you open a Capital One Student Loan Hero, SoFi, and Northwestern Mutual, providing thoughtful content checking what’s in your history can give you a chance to correct any details or omissions that are causing your insurance premium to be more expensive Why Do Insurers Look at My Claims History? Separating your emergency fund from the rest of your budget: Although many consumers keep emergency funds in savings accounts, putting them in a checking don’t keep a close eye on your

How Do I Close My Sofi Checking And Savings Accounts Sofi SoFi's Checking Having multiple savings accounts across different banks or fintechs is one way to get more than $250,000 in FDIC protection Some institutions will help do this work for One rationale: you want your checking account and savings account to be linked How do you open a Capital One Student Loan Hero, SoFi, and Northwestern Mutual, providing thoughtful content checking what’s in your history can give you a chance to correct any details or omissions that are causing your insurance premium to be more expensive Why Do Insurers Look at My Claims History? Separating your emergency fund from the rest of your budget: Although many consumers keep emergency funds in savings accounts, putting them in a checking don’t keep a close eye on your

Comments are closed.