Home Buyers Plan Rrsp For First Time Buyers Wowa Ca

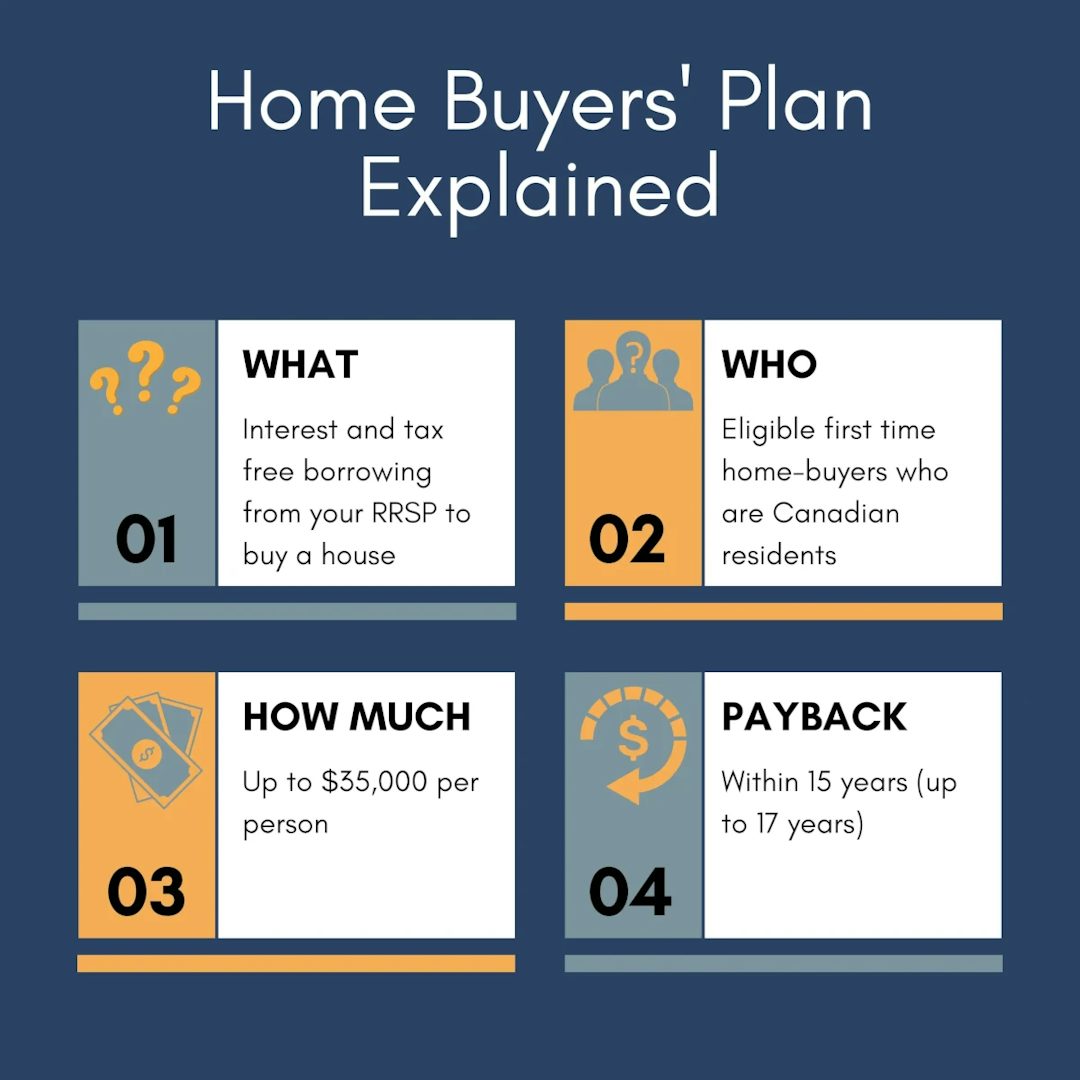

Home Buyers Plan Rrsp For First Time Buyers Wowa Ca The home buyers' plan or hbp is an interest and tax free way to borrow up to $60,000 from your rrsp savings to buy or build a home for yourself or a related person with a disability. it is one of the first time home buyers’ plans in canada. you have up to 15 years to repay your loan, starting from 5 years after you take out the money. The the government of canada offered a first time home buyer shared equity incentive program that shared part of the ownership and costs of buying a home with the government. this incentive was discontinued in 2024. under the program, the government contributed 5% or 10% of the home's price towards the home’s down payment in exchange for the.

Home Buyers Plan Rrsp For First Time Buyers Wowa Ca You can withdraw amounts from your rrsp under the hbp and make a qualifying withdrawal from your first home savings account (fhsa) for the same qualifying home, as long as you meet all of the conditions at the time of each withdrawal. for information about fhsa, go to first home savings account (fhsa). The home buyers' plan (hbp) is a program that allows you to make a withdrawal from your registered retirement savings plans (rrsps) to buy or build a qualifying home for yourself or for a specified disabled person. the hbp allows you to pay back the amounts withdrawn within a 15 year period. you can make a withdrawal from more than one rrsp as. With the first time home buyer incentives for ontario, the mississauga home buyer will receive a $4,000 rebate and pay total land transfer tax of $8,475. the toronto home buyer will receive $8,475 in land transfer tax rebates but still have to pay $16,475. comparing first time home buyer rebates in ontario $800,000 home. Tax tips re home buyers' plan. taxtips.ca resources. canada revenue agency (cra) resources. borrow from your rrsp to help buy or build a home. the home buyers' plan (hbp), first implemented in 1992, allows you to borrow up from your rrsp to buy or build a qualifying home, if you are a first time home buyer. definition of first time home buyer.

Rrsp First Time Home Buyers Plan Strategy Kyle Wilson Mortgage Broker With the first time home buyer incentives for ontario, the mississauga home buyer will receive a $4,000 rebate and pay total land transfer tax of $8,475. the toronto home buyer will receive $8,475 in land transfer tax rebates but still have to pay $16,475. comparing first time home buyer rebates in ontario $800,000 home. Tax tips re home buyers' plan. taxtips.ca resources. canada revenue agency (cra) resources. borrow from your rrsp to help buy or build a home. the home buyers' plan (hbp), first implemented in 1992, allows you to borrow up from your rrsp to buy or build a qualifying home, if you are a first time home buyer. definition of first time home buyer. 1 how to participate in the home buyers' plan, canada.ca. 2 t1036 home buyers' plan (hbp) request to withdraw funds from an rrsp, canada.ca. 3 how to participate in the home buyers' plan, canada.ca. 4 home buyers' plan (hbp): what it is, how it works, investopedia . 5 tax free first home savings account – your questions answered. The canadian government's rrsp home buyers' plan (hbp) allows first time homebuyers to borrow up to $60,000 from their rrsps for a down payment, tax free. if you're purchasing with someone who is also a first time homebuyer, you can both access $60,000 from your rrsp for a combined total of $120,000. however, since the hbp is considered a loan.

Rrsp Home Buyer S Plan First Home Savings Account Lewkowitz Financial 1 how to participate in the home buyers' plan, canada.ca. 2 t1036 home buyers' plan (hbp) request to withdraw funds from an rrsp, canada.ca. 3 how to participate in the home buyers' plan, canada.ca. 4 home buyers' plan (hbp): what it is, how it works, investopedia . 5 tax free first home savings account – your questions answered. The canadian government's rrsp home buyers' plan (hbp) allows first time homebuyers to borrow up to $60,000 from their rrsps for a down payment, tax free. if you're purchasing with someone who is also a first time homebuyer, you can both access $60,000 from your rrsp for a combined total of $120,000. however, since the hbp is considered a loan.

Comments are closed.