Hmo Vs Ppo Health Insurance Plans Health Insurance Plans о

Ppo Vs Hmo Plans Abc Medicare Cheaper health insurance rates: hmo plans are usually a lower cost alternative to ppos. the average hmo rate is $427 monthly for an affordable care act (aca) plan for someone who is 30 years old. Hmos offered by employers often have lower cost sharing requirements (i.e., lower deductibles, copays, and out of pocket maximums) than ppo options offered by the same employer. however, hmos sold in the individual insurance market often have out of pocket costs that are just as high as the available ppos. how hmos work.

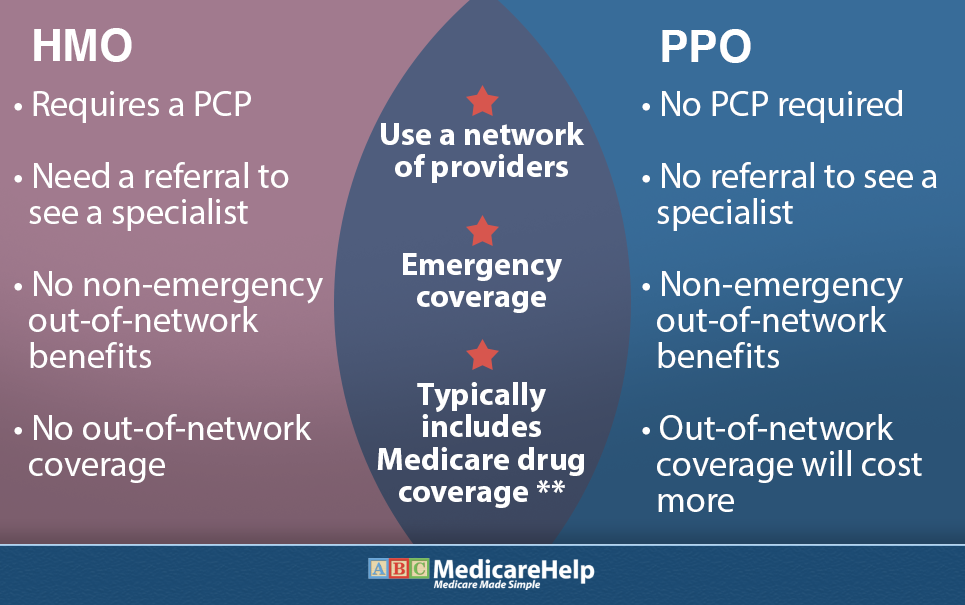

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical Pos plans. a point of service (pos) plan is a health insurance plan that partners with a group of clinics, hospitals and doctors to provide care. with this type of plan, you’ll pay less out of pocket when you get care within the plan's network. pos plans often require coordination with a primary care provider (pcp) for treatment and referrals. The price difference depends on the ppo health plan. you may still receive a negotiated rate on an out of network provider — or you could get stuck paying the entire bill. unlike an hmo, a ppo doesn’t restrict coverage to a specific service area. if you get ill or injured while traveling and must use an out of network provider, your ppo. Health maintenance organization (hmo) and preferred provider organization (ppo) are two of the most popular types of major medical health insurance plans. the major differences between hmo vs ppo plans can be found in the: size of the network. the cost of the plan. the ability to see specialists without referrals. the size of the in network. Hmo: a budget friendly plan. a health maintenance organization (hmo) plan is one of the most affordable types of health insurance. while it may have coinsurance, it generally has lower premiums and deductibles. it also often has fixed copays for doctor visits. it’s a good choice if you’re on a tight budget and don’t have many health issues.

Hmo Vs Ppo Health maintenance organization (hmo) and preferred provider organization (ppo) are two of the most popular types of major medical health insurance plans. the major differences between hmo vs ppo plans can be found in the: size of the network. the cost of the plan. the ability to see specialists without referrals. the size of the in network. Hmo: a budget friendly plan. a health maintenance organization (hmo) plan is one of the most affordable types of health insurance. while it may have coinsurance, it generally has lower premiums and deductibles. it also often has fixed copays for doctor visits. it’s a good choice if you’re on a tight budget and don’t have many health issues. Exclusive provider organization (epo): a managed care plan where services are covered only if you use doctors, specialists, or hospitals in the plan’s network (except in an emergency). health maintenance organization (hmo): a type of health insurance plan that usually limits coverage to care from doctors who work for or contract with the hmo. Hmos have more restrictions than ppos but are cheaper, costing an average of $41 less per month. health maintenance organizations (hmos) and preferred provider organizations (ppos) are insurance plans that cover basic and specialized health or dental care. the differences between hmo and ppo plans include where you can receive care and how they.

Comments are closed.