Hispanic Retirement Savings Gap Critical Insights

Hispanic Retirement Savings Gap Hispanic retirement savings gap—the study found that cities with a higher hispanic population have a lower number of employees saving for retirement. tellingly, the metro areas with the largest hispanic populations average less than one third of employees saving for retirement compared to the five metro areas with the smallest hispanic. Example beginning at age 40 assumes a beginning salary of $80,000 escalated 5% a year to age 45 then 3% a year to age 65. retirement savings is calculated as a flat savings rate of 15%. annual rate of return is assumed to be 7%, which is lower than the average annual return for the s&p 500 index between 1957 and 2021.

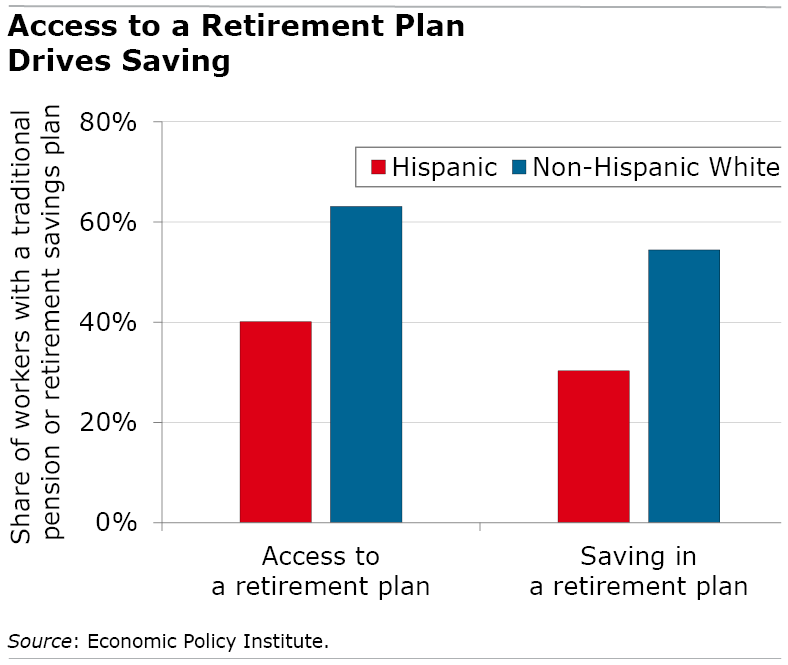

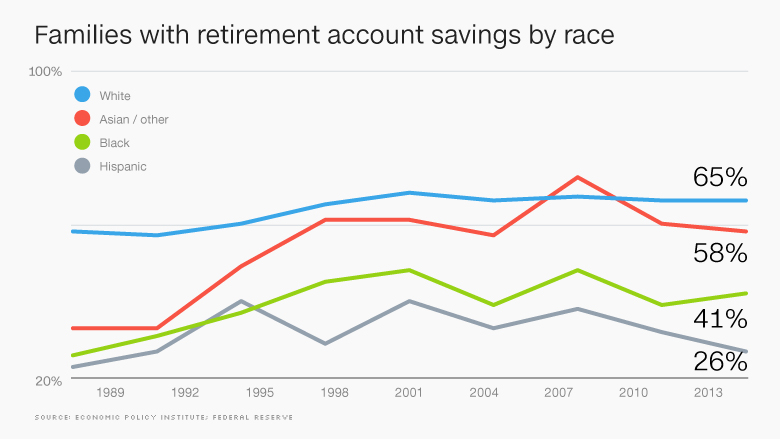

Hispanic Retirement Savings Gap Racial and ethnic disparities in retirement savings persist in the u.s. nearly 60% of white workers participate in a retirement plan,1 compared with 45% of black workers 33% of hispanic workers access to retirement plans helps to narrow the gap retirement plan participation among private sector workers ages 21–64 with plan access2. Council explored communications to retirement plan participants and in 2010 when you studied disparities for women and minorities as it relates to retirement savings. given that background, my focus today will be on the opportunities that exist within employer sponsored programs. the good news is that many employers are focused on de&i. Among workers making less than $25,000 a year, only 13.5% participate in a retirement plan. meanwhile, 82.2% of workers making more than $75,000 a year participate in a retirement plan. the relationship between income and retirement plan participation also helps to explain the racial gaps in retirement plan participation. Insights | addressing the retirement savings gap for hispanic americans start the conversation early financial professionals play a pivotal role in bridging the retirement savings gap for hispanic americans. it may be helpful to meet early and often to discuss your hispanic clients’ goals. here are some strategies you may consider.

The Myriad Stories Behind Hispanic Retirement Saving Center For Among workers making less than $25,000 a year, only 13.5% participate in a retirement plan. meanwhile, 82.2% of workers making more than $75,000 a year participate in a retirement plan. the relationship between income and retirement plan participation also helps to explain the racial gaps in retirement plan participation. Insights | addressing the retirement savings gap for hispanic americans start the conversation early financial professionals play a pivotal role in bridging the retirement savings gap for hispanic americans. it may be helpful to meet early and often to discuss your hispanic clients’ goals. here are some strategies you may consider. Inlation, amplifying the impact of the recent decrease in retirement savings on long term inancial security. decreased retirement savings were most common among hispanic workers—40% decreased their savings and more than half of those (24% of all employed hispanics) stopped saving completely in response to inlation. Their research found that among those nearing retirement, the typical white household has about five times more non social security retirement wealth ($176,900) than the typical hispanic household ($35,000) and about seven times more than the typical black household ($24,300). retirement savings exemptions predominantly favor upper income white.

The Retirement Crisis Facing Hispanics Inlation, amplifying the impact of the recent decrease in retirement savings on long term inancial security. decreased retirement savings were most common among hispanic workers—40% decreased their savings and more than half of those (24% of all employed hispanics) stopped saving completely in response to inlation. Their research found that among those nearing retirement, the typical white household has about five times more non social security retirement wealth ($176,900) than the typical hispanic household ($35,000) and about seven times more than the typical black household ($24,300). retirement savings exemptions predominantly favor upper income white.

Comments are closed.