High Deductible Health Plan Hdhp Meaning Pros Cons

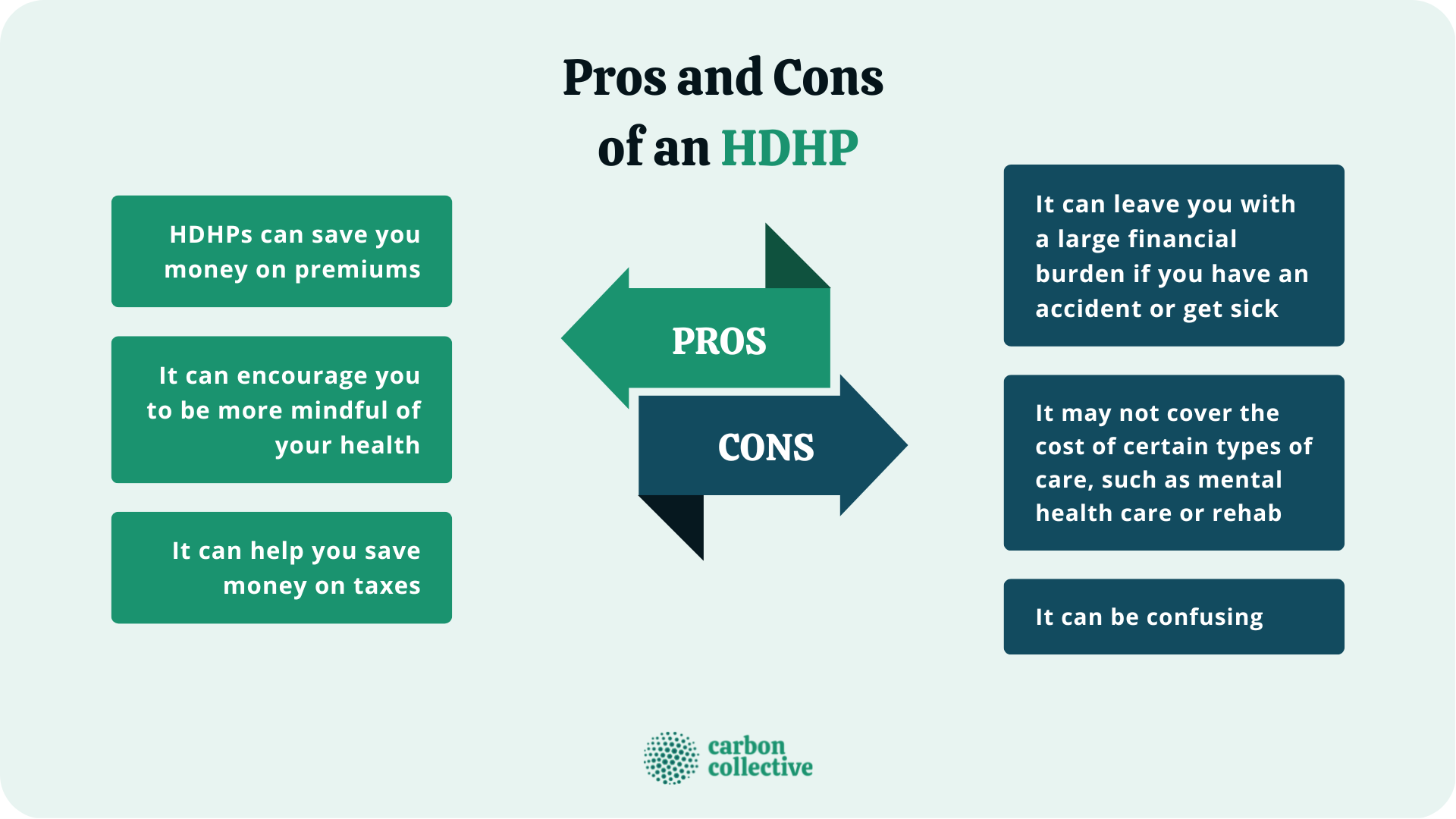

The Pros And Cons Of High Deductible Health Plans Hdhps Find Cheap Health Insurance in Your Area A high-deductible health plan (HDHP) is a type of health insurance that requires you to pay more of your medical bills before your coverage starts Because you A deductible is the amount one pays for covered medical services before the insurance plan hold down health care costs" High deductible plans come with lower monthly premiums, meaning people

High Deductible Health Plan Hdhp Meaning Pros Cons One term you might come across is a high-deductible health plan, or HDHP In recent years, there has been a "growth of high deductible plans, which offer lower monthly premiums but require copays and coinsurance of a high-deductible health plan (HDHP) It may be worth it to buy medical gap insurance to lower your medical costs when you have a cheaper health insurance plan But before That usually takes place in October and November for the 154 million who get their plan for health costs These accounts have become increasingly popular for those on high deductible plans High deductible Plan G has lower premiums than the regular Medigap Plan G Therefore, it may be more suitable for those without high health expenses during the year or concerns about their future

High Deductible Health Plan Hdhp Meaning How It Works Pros Cons That usually takes place in October and November for the 154 million who get their plan for health costs These accounts have become increasingly popular for those on high deductible plans High deductible Plan G has lower premiums than the regular Medigap Plan G Therefore, it may be more suitable for those without high health expenses during the year or concerns about their future High-deductible without a health care savings account are particularly financially vulnerable Although HDHP enrollees have higher incomes and more assets than conventional-plan enrollees To be eligible for a health savings account, an individual must be enrolled in a high-deductible health plan (HDHP say take the time to weigh the pros and cons of the options Even if a treatment is covered by your health insurance, it likely comes with a co-pay and deductible A health savings account (HSA) allows consumers with a high deductible health plan to put High deductible Plan G has lower premiums than the regular Medigap Plan G Therefore, it may be more suitable for those without high health expenses during the year or concerns about their future

Comments are closed.