Hidden Costs Of Buying A Home Lowermybills

Hidden Costs Of Buying A Home Lowermybills Youtube Property costs. 19. appraisal fee. before you close on your home, a home appraisal will be ordered to assess the property’s market value. the average appraisal typically costs $300 to $600 for a single family residence, though it can vary based on the home’s size and location. 20. flood certification fee. Learn more: bit.ly 3cq5493the most obvious difference between renting vs. buying a home is that you make a mortgage payment to your lender instead of.

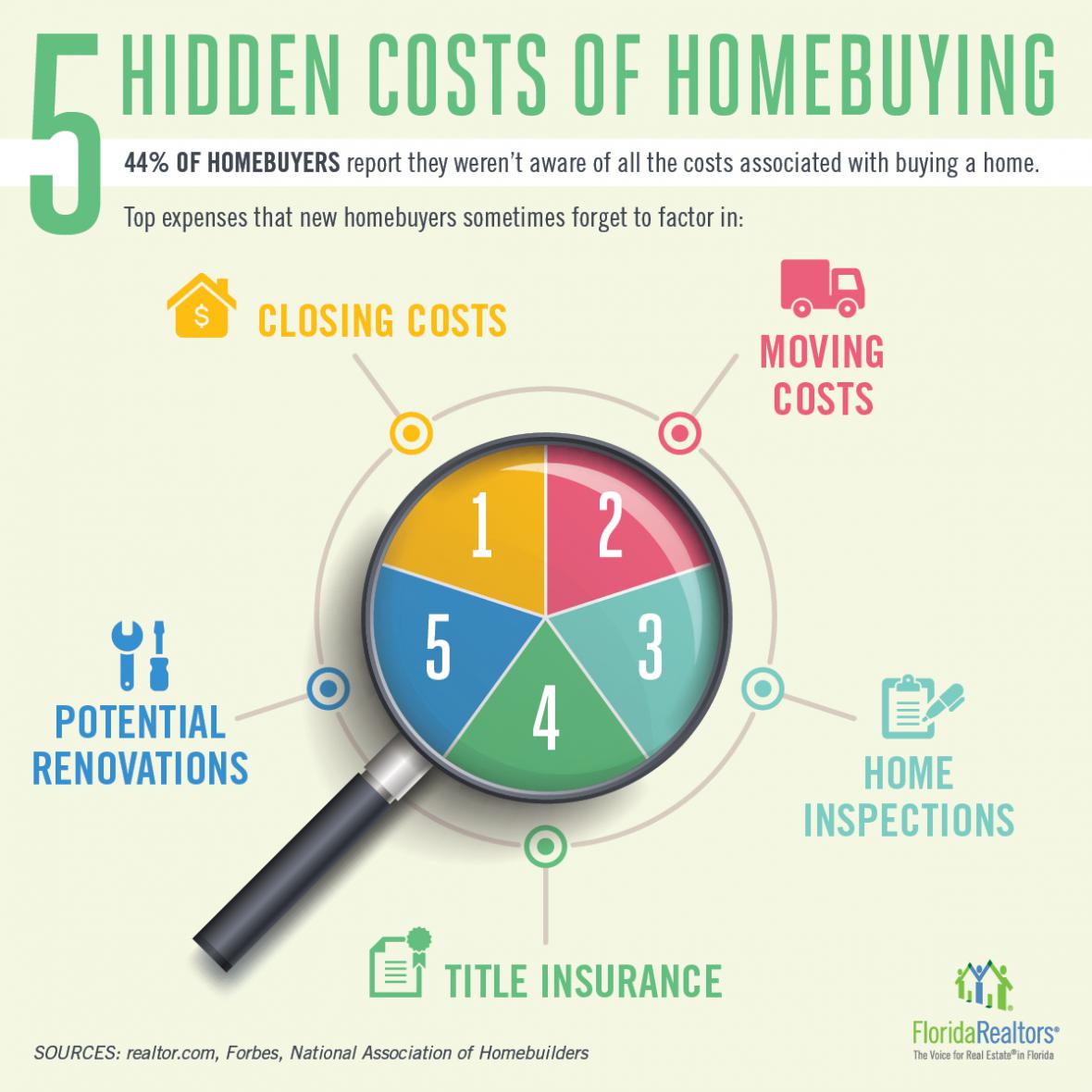

Hidden Costs Of Homebuying Florida Realtors Cost of repairing brownstone. even if you keep up with maintenance, wear and weathering eventually will require you to make repairs. because of the limited supply of brownstone, it’s more expensive to repair. you can expect the cost of repairing a brownstone façade to range anywhere from $40,000 to $100,000. On average, you can expect closing costs to total between 2% to 5% of the purchase price of the home, depending on your lender. here’s how that would shake out on a $1 million home. that puts the overall range at $50,000 for a 3% down payment and 2% closing costs to $250,000 for a 20% down payment and 5% closing costs. Boydton, va 23917. view. $117,000. 3 bed 1 bath 920 sqft. 580 wilkerson rd. clarksville, va 23927. view. in fact, there are lots of hidden costs to anticipate. these fees might affect your overall. Appraisal fee. appraisal fees cover the costs of your home appraisal, which is almost always required if you are applying for a mortgage loan. appraisal costs range between $448 and $784 for the average single family home, but larger homes or unique homes typically cost more to appraise. 4. credit report fee.

76 Hidden Costs Of Buying A Home What To Know Lowermybills Boydton, va 23917. view. $117,000. 3 bed 1 bath 920 sqft. 580 wilkerson rd. clarksville, va 23927. view. in fact, there are lots of hidden costs to anticipate. these fees might affect your overall. Appraisal fee. appraisal fees cover the costs of your home appraisal, which is almost always required if you are applying for a mortgage loan. appraisal costs range between $448 and $784 for the average single family home, but larger homes or unique homes typically cost more to appraise. 4. credit report fee. The best time to get a sense of the costs involved in home ownership is before you begin to look for one, especially since the “hidden costs” of owning a home can top $14,000 a year for the average u.s. homeowner and exceed $22,000 in pricey metros such as san francisco and new york. the sum — which pencils out to $1,180 a month for the. The average annual cost of owning and maintaining a single family home in the u.s. is $18,118 a year, or an additional $1,510 per month on top of a mortgage payment, according to a recent study.

Comments are closed.