Here S How E Commerce Giant Amazon Pays 0 00 In Tax Credit Yatra

Here S How E Commerce Giant Amazon Pays 0 00 In Tax Credit Yatra Such is the case with amazon, which instead of paying the legal income tax rate of 21% on its income. in 2018 it reported a refund of federal income taxes, estimated at 129 million dollars. that is, a tax rate of 0 1%. this is attributed by amazon to unspecified “tax credits” and a tax cut, for executive stock options, on its income statement. Amazon recorded a net federal tax credit for 2017 and 2018 and the company has paid a low tax rate for years. here's how it did it. the e commerce giant paid no federal taxes on last year's.

Here S How E Commerce Giant Amazon Pays 0 00 In Tax Credit Yatra In 2020, amazon‘s tax bill finally increased to $1.8 billion, but that still represented an effective tax rate of just 9.4%. that‘s less than half the 21% statutory rate for corporations. so on over $20 billion in u.s. profit in 2020, amazon should have owed over $4 billion based on the standard corporate rate. The federal statutory corporate tax rate is 21%. this means all companies are required to pay 21% of their u.s. profits in federal corporate income tax. however, the effective tax rate corporations actually pay tends to be much lower than 21% due to tax deductions and credits that reduce taxable income. Jeff bezos founded the e commerce giant in his garage 30 years ago. npr's andrew mambo talks with business reporter alina selyukh about how bezos built an empire and what's next for the company. Jeff bezos founded the e commerce giant in his garage 30 years ago. amazon is 30. here's how a book store it got a leg up on sales tax for a long time — as an online seller, amazon didn.

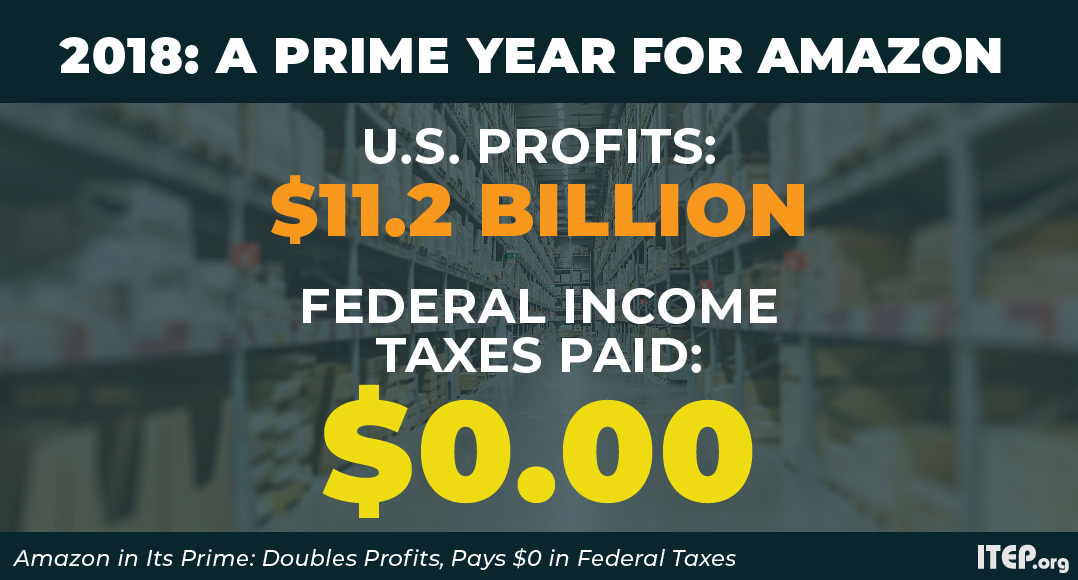

Here S How E Commerce Giant Amazon Pays 0 00 In Tax Credit Yatra Jeff bezos founded the e commerce giant in his garage 30 years ago. npr's andrew mambo talks with business reporter alina selyukh about how bezos built an empire and what's next for the company. Jeff bezos founded the e commerce giant in his garage 30 years ago. amazon is 30. here's how a book store it got a leg up on sales tax for a long time — as an online seller, amazon didn. Trickle down economics is the main point in bringing up the fact that amazon didn’t didn’t pay income tax for several years. they only paid 6% of their income in 2021 which is peanuts to them. nobody argues that they are willfully violating the tax code, rather that the tax code must change. February 16, 2019 at 8:00 a.m. est. amazon, the e commerce giant helmed by the world’s richest man, paid no federal taxes on profit of $11.2 billion last year, according to an analysis of the.

How E Commerce Giant Amazon Empowering Small Businesses Trickle down economics is the main point in bringing up the fact that amazon didn’t didn’t pay income tax for several years. they only paid 6% of their income in 2021 which is peanuts to them. nobody argues that they are willfully violating the tax code, rather that the tax code must change. February 16, 2019 at 8:00 a.m. est. amazon, the e commerce giant helmed by the world’s richest man, paid no federal taxes on profit of $11.2 billion last year, according to an analysis of the.

Amazon In Its Prime Doubles Profits Pays 0 In Federal Income Taxes

Comments are closed.