Head And Shoulders Pattern Trading Strategy Guide How To Predict

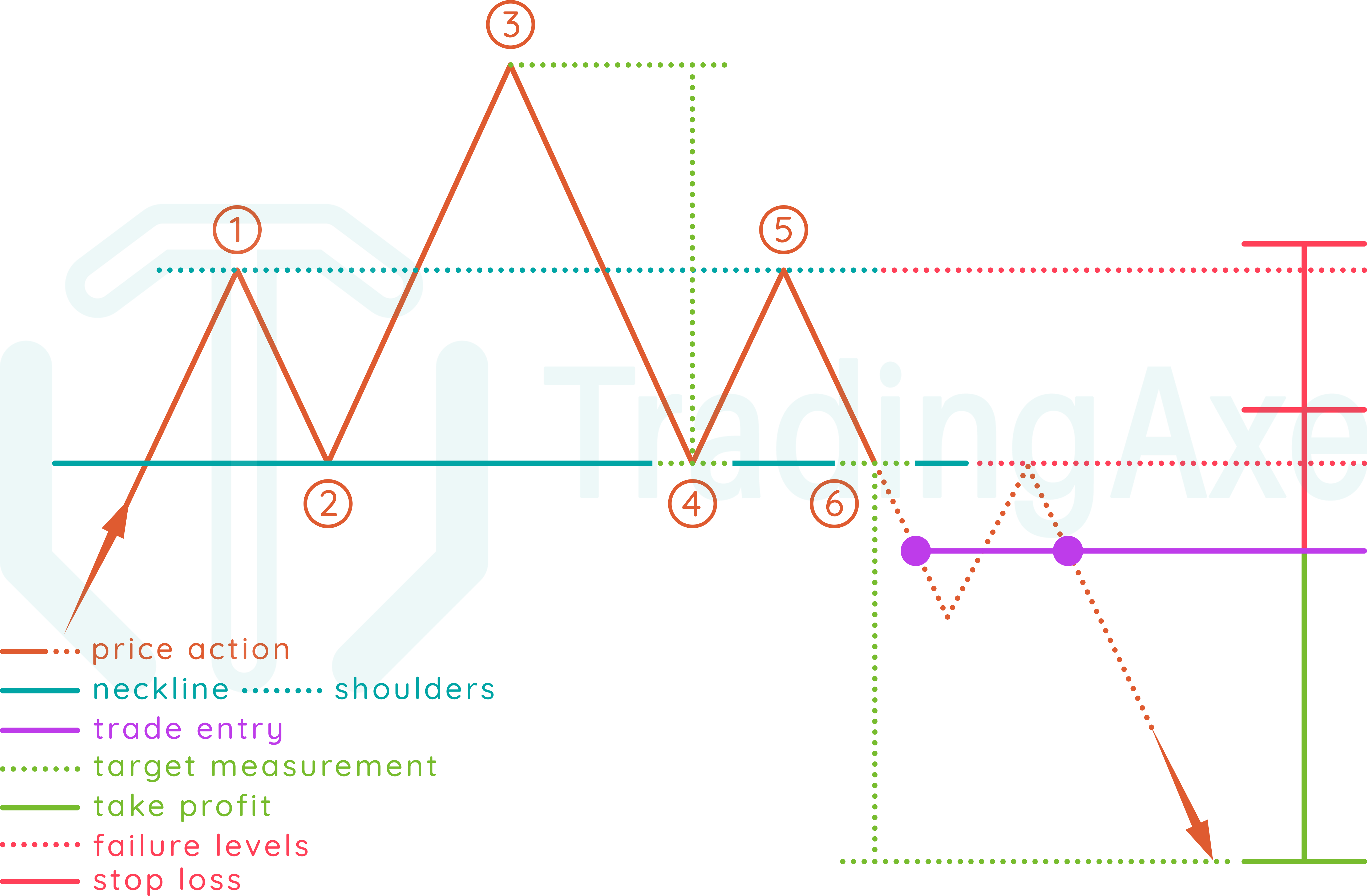

Head And Shoulders Pattern Trading Strategy Guide Pro Trading School This guide explores the pattern and how to use it in your trading strategy. the head and shoulders pattern signals a possible reversal in an asset's price trend. it has three peaks: a central peak (the head) with two lower peaks (the shoulders). this shoulders formation often indicates the end of an upward trend and the start of a potential. In summary, to identify and trade the head and shoulders pattern, we suggest you follow the steps below: identify three top levels after an uptrend that include left shoulder, head, and right shoulder. find the neckline support level. wait for the breakout to occur and place a selling order once a candle closes below the neckline.

Head And Shoulders Pattern Trading Strategy Guide Pro Trading School Trading the head and shoulders pattern. once you have identified the head and shoulders pattern, the next step is to develop a trading strategy. here are the main entry and exit points to consider: entry points: neckline break: enter the trade when the price breaks below the neckline. this is the most common entry point. The head and shoulders pattern is a crystal ball in the trading world, a respected component of technical analysis, known for its ability to hint at upcoming market shifts. it serves as a reliable guide, shedding light on potential price reversals and offering clarity to both novice and experienced traders alike. The head and shoulders chart pattern is used in technical analysis, often identifying the turning point of a trend. it is identified by three peaks; the middle peak, or head, is the highest and is flanked by two lower peaks, the shoulders. the pattern’s appearance is often an indication that the current trend of a stock is about to reverse. Guides aug 18, 2022. share. the head and shoulders pattern is regarded as one of the most trustworthy chart patterns in technical analysis. as a result, both beginner and experienced traders use it to their advantage to find new trading opportunities. this guide will define what is the head and shoulders pattern, describe how to interpret it.

Head And Shoulders Pattern Trading Strategy Synapse Trading The head and shoulders chart pattern is used in technical analysis, often identifying the turning point of a trend. it is identified by three peaks; the middle peak, or head, is the highest and is flanked by two lower peaks, the shoulders. the pattern’s appearance is often an indication that the current trend of a stock is about to reverse. Guides aug 18, 2022. share. the head and shoulders pattern is regarded as one of the most trustworthy chart patterns in technical analysis. as a result, both beginner and experienced traders use it to their advantage to find new trading opportunities. this guide will define what is the head and shoulders pattern, describe how to interpret it. The head and shoulders pattern is confirmed when the price breaks below the neckline, signaling a potential downtrend. traders often set price targets by measuring the vertical distance from the head to the neckline and projecting it downward from the breakout point. 2. trading strategies. The first step in placing the neckline is to locate the left shoulder, head, and right shoulder on the chart. we connect the low after the left shoulder with the low created after the head in the.

Head And Shoulders Pattern Trading Strategy Guide Pro Trading School The head and shoulders pattern is confirmed when the price breaks below the neckline, signaling a potential downtrend. traders often set price targets by measuring the vertical distance from the head to the neckline and projecting it downward from the breakout point. 2. trading strategies. The first step in placing the neckline is to locate the left shoulder, head, and right shoulder on the chart. we connect the low after the left shoulder with the low created after the head in the.

How To Trade Head And Shoulders Chart Pattern Tradingaxe

Comments are closed.