Has Headline Inflation Bottomed

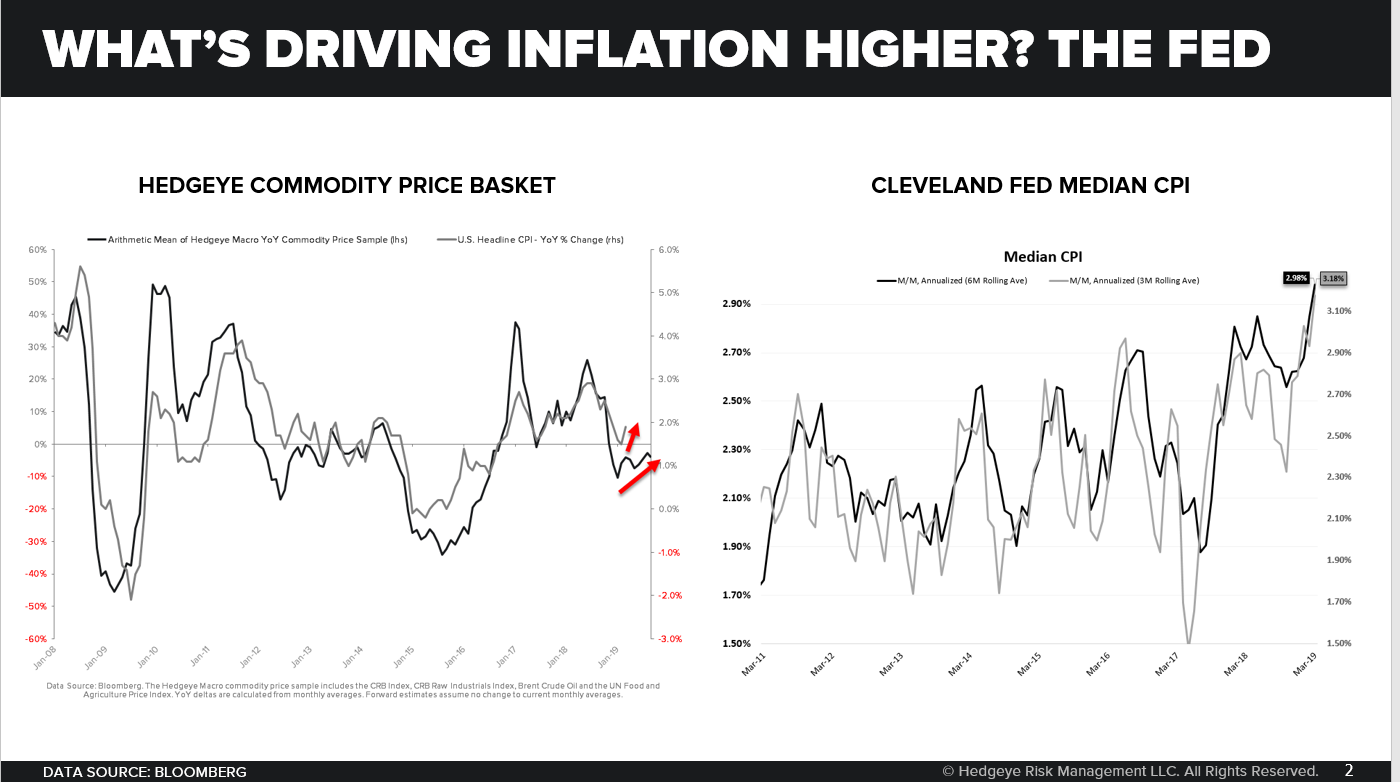

Headline Inflation And Inflation Expectations Download Scientific Diagram Headline inflation looks to have bottomed, while the stickier services heavy inflation measures below are slowly but surely losing downside momentum. click to read. As workers bargain for better pay, firms begin to increase prices. so, from this research, the authors find that three main components explain the rise in inflation since 2020: volatility of energy prices, backlogs of work orders for goods and service caused by supply chain issues due to covid 19, and price changes in the auto related industries.

Ppt Monetary Policy Inflation Powerpoint Presentation Free The bottom line . headline inflation is a raw figure that reflects changes in the consumer price index (cpi) throughout the entire economy. it differs from core inflation, which is cpi adjusted to. The standard cpi and pcepi measures of inflation shown in the first chart are often called “headline” inflation rates, in contrast to “core” measures of inflation—core cpi and core pcepi—that exclude the direct contributions of energy and food prices. core inflation is often described as a measure of “underlying” or “trend. Although headline inflation has fallen considerably in recent months, core inflation—which excludes volatile food and energy prices and is thought to be a better predictor of future inflation—remains elevated. core pcepi grew at an annualized rate of 4.3 percent in december 2022. Using core inflation to predict headline inflation. november 28, 2023. by michael mccracken , trần khánh ngân. in our previous on the economy blog post, we discussed the importance of current food inflation as a predictor of future inflation more generally. we noted that while food inflation used to be a weak predictor, it has become.

Headline Inflation What Is It Vs Core Inflation Current Rate Although headline inflation has fallen considerably in recent months, core inflation—which excludes volatile food and energy prices and is thought to be a better predictor of future inflation—remains elevated. core pcepi grew at an annualized rate of 4.3 percent in december 2022. Using core inflation to predict headline inflation. november 28, 2023. by michael mccracken , trần khánh ngân. in our previous on the economy blog post, we discussed the importance of current food inflation as a predictor of future inflation more generally. we noted that while food inflation used to be a weak predictor, it has become. Mean (or headline) pce inflation has typically fallen below median pce inflation, and since 2012 the difference has been large. to understand the reasons for this trend, we investigate which components of the headline measure are contributing to the difference. we find that energy components, which frequently undergo wide price swings, and electronics, which have been steadily decreasing in. The premise is that food and energy prices are volatile, which makes the headline measure a poor indicator of future inflation; therefore, monitoring core inflation is a better idea. a 2011 economic synopses essay (pdf), authored by michael mccracken, highlighted two weaknesses in this logic. one consideration is that over time, the volatility.

Has Headline Inflation Bottomed Mean (or headline) pce inflation has typically fallen below median pce inflation, and since 2012 the difference has been large. to understand the reasons for this trend, we investigate which components of the headline measure are contributing to the difference. we find that energy components, which frequently undergo wide price swings, and electronics, which have been steadily decreasing in. The premise is that food and energy prices are volatile, which makes the headline measure a poor indicator of future inflation; therefore, monitoring core inflation is a better idea. a 2011 economic synopses essay (pdf), authored by michael mccracken, highlighted two weaknesses in this logic. one consideration is that over time, the volatility.

Comments are closed.