Guide To Mutual Funds Advantages And Types Of Mutual Funds

Guide To Mutual Funds Advantages And Types Of Mutual Funds Guide to mutual funds; etfs tend to have certain tax advantages and are often more cost efficient. investors can choose from many types of mutual funds, such as stock, bond, money market. Mutual funds come with many advantages, such as advanced portfolio management, dividend reinvestment, risk reduction, convenience, and fair pricing. disadvantages include high fees, tax.

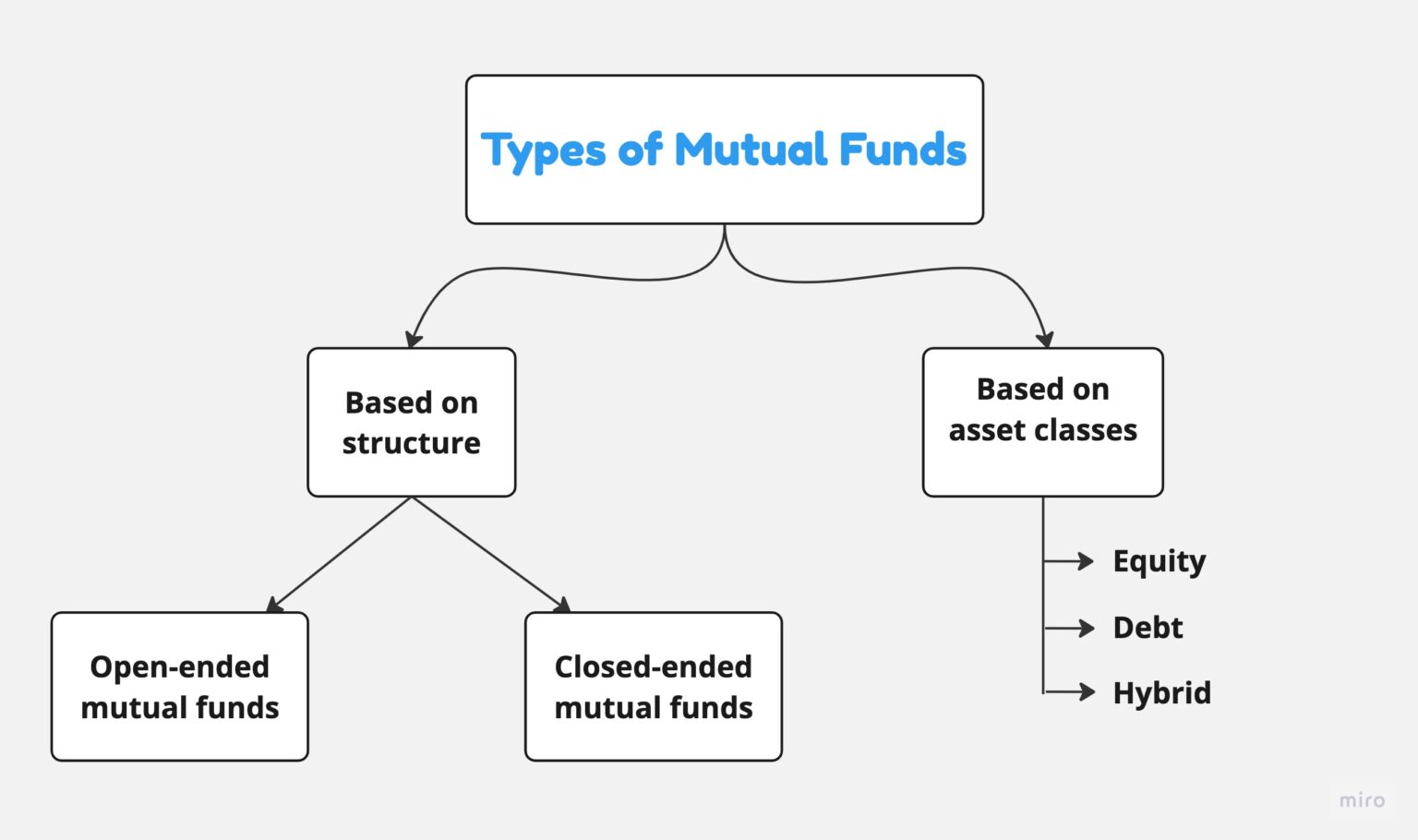

What Are Mutual Funds 10 Advantages Of Mutual Funds Mutual funds offer diversification or access to a wider variety of investments than an individual investor could afford to buy. investing with a group offers economies of scale, decreasing your. Mutual funds distribute taxable capital gains and dividends to shareholders each year. mutual funds trade once a day, resulting in reduced portfolio visibility during trading hours. expenses are deducted from the fund, which reduces the value of the portfolio. past performance measures such as 3 and 5 year returns, though past performance is. These funds can hold assets like bonds, stocks, commodities or a combination of several asset classes. you’ll want to do your research before investing in a fund and make sure you understand the. Mutual funds typically specialize in a particular area within their broader category, such as long term bonds or international stocks. balanced funds are a type of asset allocation fund that.

Guide To Mutual Funds Advantages And Types Of Mutual Funds These funds can hold assets like bonds, stocks, commodities or a combination of several asset classes. you’ll want to do your research before investing in a fund and make sure you understand the. Mutual funds typically specialize in a particular area within their broader category, such as long term bonds or international stocks. balanced funds are a type of asset allocation fund that. A mutual fund is a portfolio of investments that pools money from investors to purchase multiple securities. some mutual funds are actively managed with the aim to outperform the market. mutual. Index funds, a specific type of mutual fund, offer the advantages of low expense ratios, simplicity, and a passive investment strategy designed to replicate the performance of a market index, like the s&p 500. they stand out among other types of mutual funds for their cost effectiveness and straightforward approach to market performance tracking.

Types Of Mutual Funds A Comprehensive Guide A mutual fund is a portfolio of investments that pools money from investors to purchase multiple securities. some mutual funds are actively managed with the aim to outperform the market. mutual. Index funds, a specific type of mutual fund, offer the advantages of low expense ratios, simplicity, and a passive investment strategy designed to replicate the performance of a market index, like the s&p 500. they stand out among other types of mutual funds for their cost effectiveness and straightforward approach to market performance tracking.

Mutual Fund Meaning Types Advantages Key Terms And More

Comments are closed.