Guide To A 1031 Exchange Provident 1031

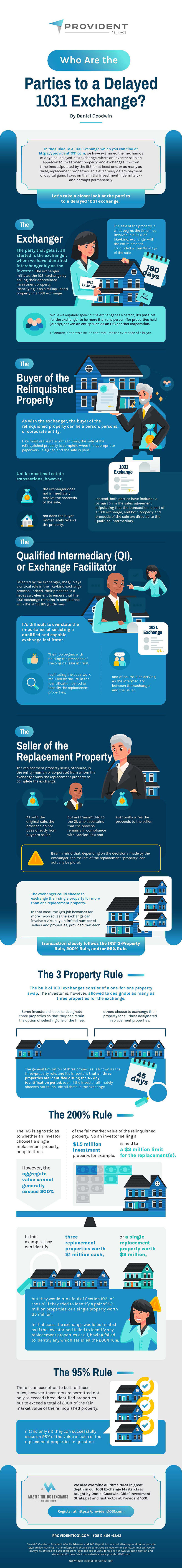

Guide To A 1031 Exchange Provident 1031 The exchanger initiates the 1031 exchange by selling their appreciated investment property, identifying it as a relinquished property in a 1031 exchange. the sale of the property is what begins the timelines involved in a 1031, or like kind, exchange, with the entire process concluded within 180 days of the sale. Rules of a 1031 exchange – part 1. dan dives deep into the rules of a 1031 exchange and the delaware statutory trust (dst). he provides insight into ways investors use this trust to their advantage. he also shares the personal story of sara, a client, and how these strategies changed her life. 3.

Guide To A 1031 Exchange Provident 1031 1031 exchange masterclass provident 1031. 1. getting started. in this class, dan will cover the concept of the 1031 exchange and basic strategies he has written about in kiplinger and u.s. news and world report and used to guide hundreds of clients in building wealth in real estate around the use of the 1031 exchange and the delaware. Named after the irs tax code section, a strategy called a 1031 exchange is used to defer taxes when selling an investment property by reinvesting the proceeds into a property type without incurring immediate capital gains taxes on the sale, as nesteggs ceo eachan fletcher explained. this method helps retain a portion of an investment's growth. A 1031 exchange, named after section 1031 of the u.s. internal revenue code, is a strategic tool for deferring tax on capital gains. you can leverage it to sell an investment property and reinvest. A 1031 exchange is a tax strategy named because of its inclusion in section 1031 of the irs tax code. it is also commonly known as a “starker exchange” or a “like kind exchange.”. in essence, a 1031 exchange allows an investor to “defer” paying any property taxes on the property when it is sold, as long as another like kind property.

Guide To A 1031 Exchange Provident 1031 A 1031 exchange, named after section 1031 of the u.s. internal revenue code, is a strategic tool for deferring tax on capital gains. you can leverage it to sell an investment property and reinvest. A 1031 exchange is a tax strategy named because of its inclusion in section 1031 of the irs tax code. it is also commonly known as a “starker exchange” or a “like kind exchange.”. in essence, a 1031 exchange allows an investor to “defer” paying any property taxes on the property when it is sold, as long as another like kind property. 1. 1031 exchanges are also known as 'like kind' exchanges, and that matters. section 1031 of the irc defines a 1031 exchange as when you exchange real property used for business or held as an. The 1031 exchange can be particularly helpful if you want to sell your property now, but you expect your capital gains tax rate to be lower in the future. for example, this may be beneficial if.

Guide To A 1031 Exchange Provident 1031 1. 1031 exchanges are also known as 'like kind' exchanges, and that matters. section 1031 of the irc defines a 1031 exchange as when you exchange real property used for business or held as an. The 1031 exchange can be particularly helpful if you want to sell your property now, but you expect your capital gains tax rate to be lower in the future. for example, this may be beneficial if.

Guide To A 1031 Exchange Provident 1031

Comments are closed.