Guide On Return On Investment Roi Learn How To Calculate Roi With R

How To Calculate Return On Investment Roi Return on investment (roi) measures how well an investment is performing. find out how to calculate and interpret the roi of your current portfolio or a potential investment. The net return on the pp&e investment is equal to the gross return minus the cost of investment. net return = $75m – $50m = $25m. the net return of $25 million is then divided by the cost of investment to arrive at the return on investment (roi). return on investment (roi) = $25m ÷ $50m = 50%. given the $50 million net return and $25 million.

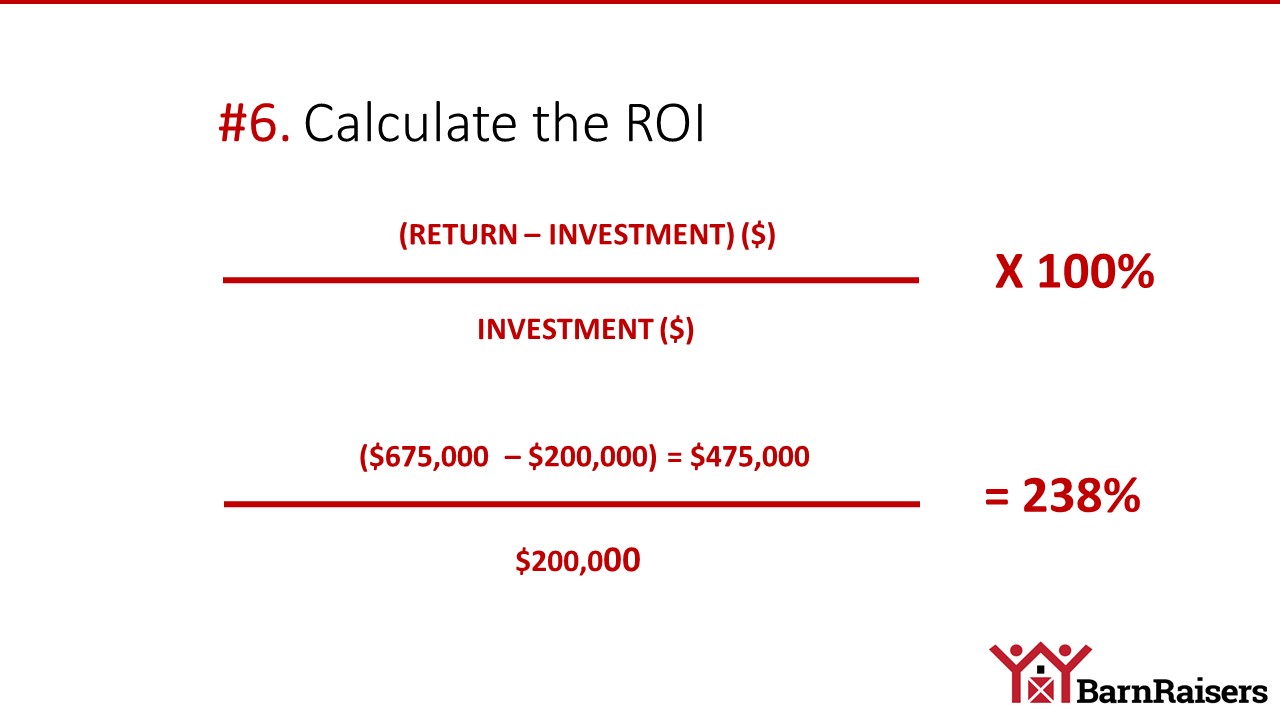

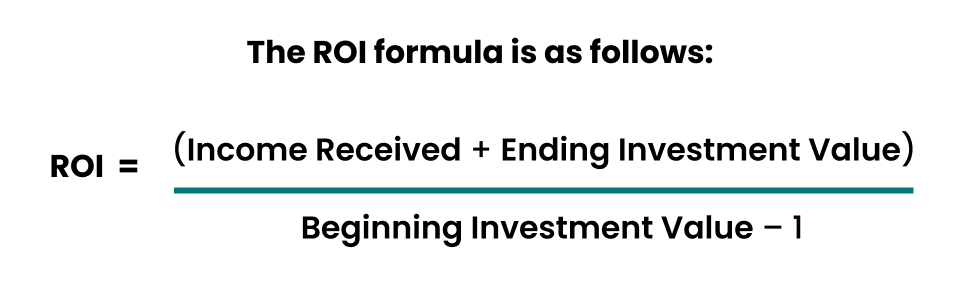

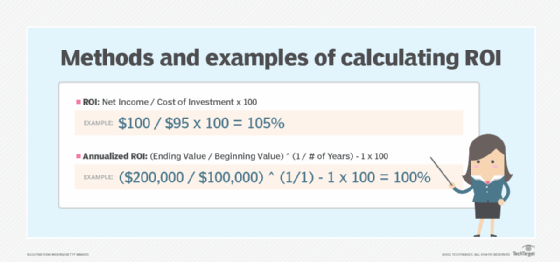

8 Surprisingly Simple Steps To Calculate Roi Return on investment (roi) is calculated by dividing the profit earned on an investment by the cost of that investment. for instance, an investment with a profit of $100 and a cost of $100 would. Roi = net income cost of investment. or. roi = investment gain investment base. the first version of the roi formula (net income divided by the cost of an investment) is the most commonly used ratio. the simplest way to think about the roi formula is taking some type of “benefit” and dividing it by the “cost”. To calculate roi, you divide the return on the investment by the cost of the investment. roi = return on investment cost of investment. one of the main reasons finance professionals use the roi metric is to compare various investment opportunities and to rank them according to risk and return. this metric is popular because of its. A higher roi indicates that the investment gains compare favorably to its cost, signifying a successful venture. conversely, a negative or low roi suggests that the returns do not justify the costs. essentially, roi acts as a lens, providing clarity on whether an investment is yielding a favorable return. types of roi simple roi.

Return On Investment Roi What It Is How To Calculate It To calculate roi, you divide the return on the investment by the cost of the investment. roi = return on investment cost of investment. one of the main reasons finance professionals use the roi metric is to compare various investment opportunities and to rank them according to risk and return. this metric is popular because of its. A higher roi indicates that the investment gains compare favorably to its cost, signifying a successful venture. conversely, a negative or low roi suggests that the returns do not justify the costs. essentially, roi acts as a lens, providing clarity on whether an investment is yielding a favorable return. types of roi simple roi. Return on investment is a very popular financial metric due to the fact that it is a simple formula that can be used to assess the profitability of an investment. roi is easy to calculate and can be applied to all kinds of investments. return on investment helps investors to determine which investment opportunities are most preferable or. Investing is a long game, measured in years. understanding your return on investment (roi) can help you achieve your goals. it all depends on your rate of return, your time horizon, taxes and a.

What Is Roi How To Calculate Return On Investment Return on investment is a very popular financial metric due to the fact that it is a simple formula that can be used to assess the profitability of an investment. roi is easy to calculate and can be applied to all kinds of investments. return on investment helps investors to determine which investment opportunities are most preferable or. Investing is a long game, measured in years. understanding your return on investment (roi) can help you achieve your goals. it all depends on your rate of return, your time horizon, taxes and a.

Comments are closed.