Gst Goods And Services Tax

What Is Gst Goods And Services Tax Explained Atulhost Goods and services tax. help desk number: 1800 103 4786. Access the gst portal to login and manage your goods and services tax account.

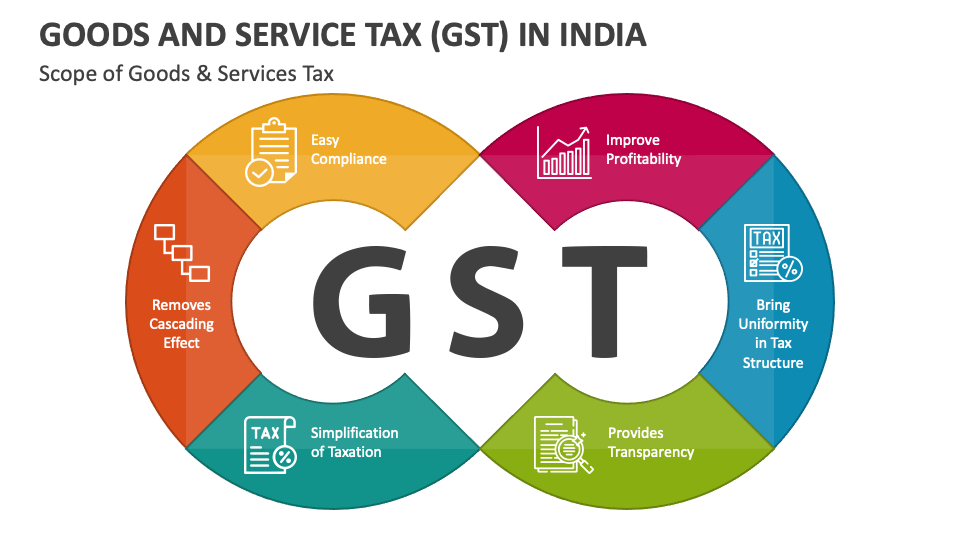

Goods And Services Tax Gst Geeksforgeeks Detailed information about goods and services tax (gst). 22410. explains how goods and services tax (gst) works and what you need to do to meet your gst obligations. The goods and services tax (gst) is an indirect federal sales tax that is applied to the cost of certain goods and services. the business adds the gst to the price of the product, and a customer. The full form of gst is goods and services tax. it is an indirect tax levied on the supply of goods and services across india. this comprehensive tax system is designed as a multi stage, destination oriented tax applied at each point of value addition in the supply chain. by replacing multiple indirect taxes—such as excise duty, value added. 22 07 2024 : refund of tax paid on inward supply of goods by canteen store department (form gst rfd 10a) 16 07 2024: integrated services from nic irp e invoice 1 and e invoice 2 portals. 14 07 2024: refund of additional igst paid on account of upward revision in prices of goods subsequent to exports.

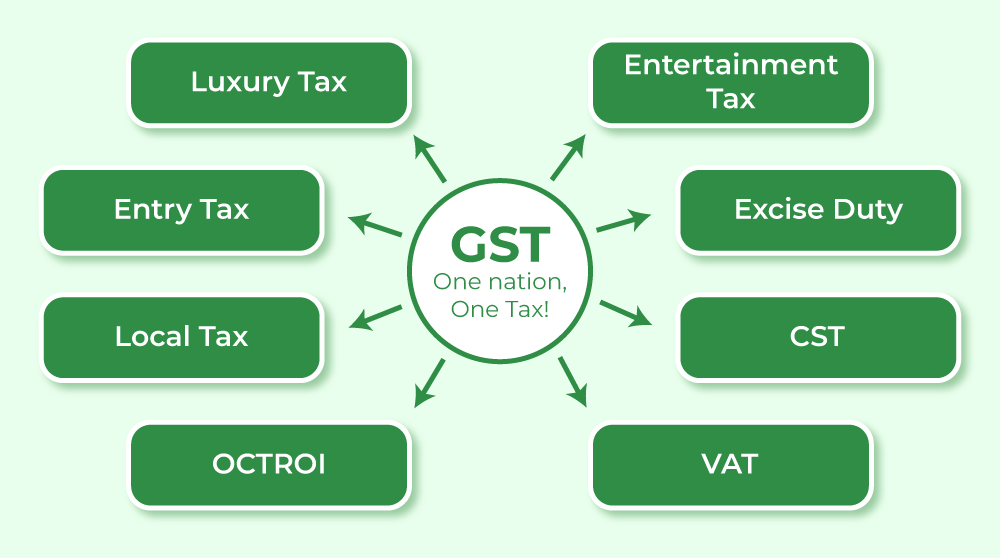

Goods And Services Tax Gst Meaning An Overview Tutor S Tips The full form of gst is goods and services tax. it is an indirect tax levied on the supply of goods and services across india. this comprehensive tax system is designed as a multi stage, destination oriented tax applied at each point of value addition in the supply chain. by replacing multiple indirect taxes—such as excise duty, value added. 22 07 2024 : refund of tax paid on inward supply of goods by canteen store department (form gst rfd 10a) 16 07 2024: integrated services from nic irp e invoice 1 and e invoice 2 portals. 14 07 2024: refund of additional igst paid on account of upward revision in prices of goods subsequent to exports. Press release of decisions of the 54th gst council. instruction no. 02 2024 gst guidelines for second special all india drive against fake registrations –reg. clarification regarding gst rates & classification (goods) based on the recommendations of the gst council in its 53rd meeting held on 22nd june, 2024, at new delhi –reg. Gst is known as the goods and services tax. it is an indirect tax which has replaced many indirect taxes in india such as the excise duty, vat, services tax, etc. the goods and service tax act was passed in the parliament on 29th march 2017 and came into effect on 1st july 2017. in other words, goods and service tax (gst) is levied on the.

Goods And Service Tax Gst In India Powerpoint And Google Slides Press release of decisions of the 54th gst council. instruction no. 02 2024 gst guidelines for second special all india drive against fake registrations –reg. clarification regarding gst rates & classification (goods) based on the recommendations of the gst council in its 53rd meeting held on 22nd june, 2024, at new delhi –reg. Gst is known as the goods and services tax. it is an indirect tax which has replaced many indirect taxes in india such as the excise duty, vat, services tax, etc. the goods and service tax act was passed in the parliament on 29th march 2017 and came into effect on 1st july 2017. in other words, goods and service tax (gst) is levied on the.

What Is Gst Goods And Services Tax Explained With Benefits

Comments are closed.