Good Faith Estimate Getting It Right Part2

Printable Good Faith Estimate Form Printable Forms Free Online Annemaria allen at the compliance group, inc. has created a training guide for the good faith estimate. annemaria has over 20 years of experience in the mort. Banning surprise bills, part 2: good faith estimates, external review, and more. katie keith. jack hoadley. kevin w. lucia. october 3, 2021 10.1377 forefront.20211001.811063. sections. add to.

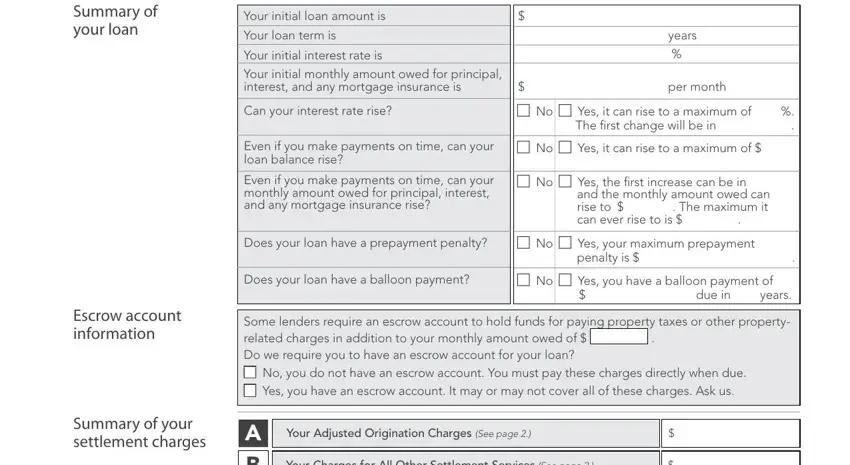

How Good Is The Good Faith Estimate Federal Reserve Bank Of Minneapolis You should get a good faith estimate if you schedule an appointment at least 3 business days in advance. you can ask your provider directly for an estimate if they don’t give one to you. when you schedule care 0 2 business days in advance, you aren't entitled to get a good faith estimate. when you schedule care 3 9 business days in advance. However, providing all patients with an accurate price estimate can be a hassle. the no surprises act good faith estimate requires you to provide uninsured and self pay patients a fair estimate of their health cost when they schedule a visit. the penalty for violations can be up to $10,000. Templates for the good faith estimate. physicians and medical malpractices will need to develop templates for the notice requirement (the right to ask for a good faith estimate) and for the good faith estimate itself. an experienced healthcare compliance lawyer can help you prepare the correct templates for both the notice and the estimate. Introduction. under section 112 of the no surprises act, beginning january 1, 2022, individual healthcare providers and facilities must provide a “good faith estimate” of the total expected charges to the patient’s plan or insurer (if the patient is insured and using his or her coverage) or directly to the uninsured or self pay patient upon request or scheduling of a service.

How To Create A Good Faith Estimate Templates for the good faith estimate. physicians and medical malpractices will need to develop templates for the notice requirement (the right to ask for a good faith estimate) and for the good faith estimate itself. an experienced healthcare compliance lawyer can help you prepare the correct templates for both the notice and the estimate. Introduction. under section 112 of the no surprises act, beginning january 1, 2022, individual healthcare providers and facilities must provide a “good faith estimate” of the total expected charges to the patient’s plan or insurer (if the patient is insured and using his or her coverage) or directly to the uninsured or self pay patient upon request or scheduling of a service. A good faith estimate provided to an uninsured (or self pay) individual doesn’t include expected charges from other providers and facilities that are involved in the individual’s care. • until rulemaking is issued regarding the requirement to provide a good faith estimate to an individual’s plan or coverage, hhs will defer enforcement of. The no surprises act, effective jan. 1, 2022, requires that healthcare providers include a “good faith estimate” that covers all relevant codes and charges. this was established to increase price transparency for patients. for a summary of the no surprises act, read our previous blog. in our recent webinar, hosted on december 15, 2021.

Good Faith Estimate Form тйб Fill Out Printable Pdf Forms Online A good faith estimate provided to an uninsured (or self pay) individual doesn’t include expected charges from other providers and facilities that are involved in the individual’s care. • until rulemaking is issued regarding the requirement to provide a good faith estimate to an individual’s plan or coverage, hhs will defer enforcement of. The no surprises act, effective jan. 1, 2022, requires that healthcare providers include a “good faith estimate” that covers all relevant codes and charges. this was established to increase price transparency for patients. for a summary of the no surprises act, read our previous blog. in our recent webinar, hosted on december 15, 2021.

Comments are closed.