Gold Bull Market Gold Prices Market Consolidation Silver Bull Run

Gold Silver Bull Markets Past Potential Ahead Gld. . by mike maharrey. gold futures and silver futures have been on a tremendous run in 2024. in fact, they are the two best performing assets this year. as of the end of october, silver was up. Major banks expect gold to extend its record breaking price rally into 2025 because of a revival in large inflows to exchange traded funds (etfs) and expectations of additional interest rate cuts.

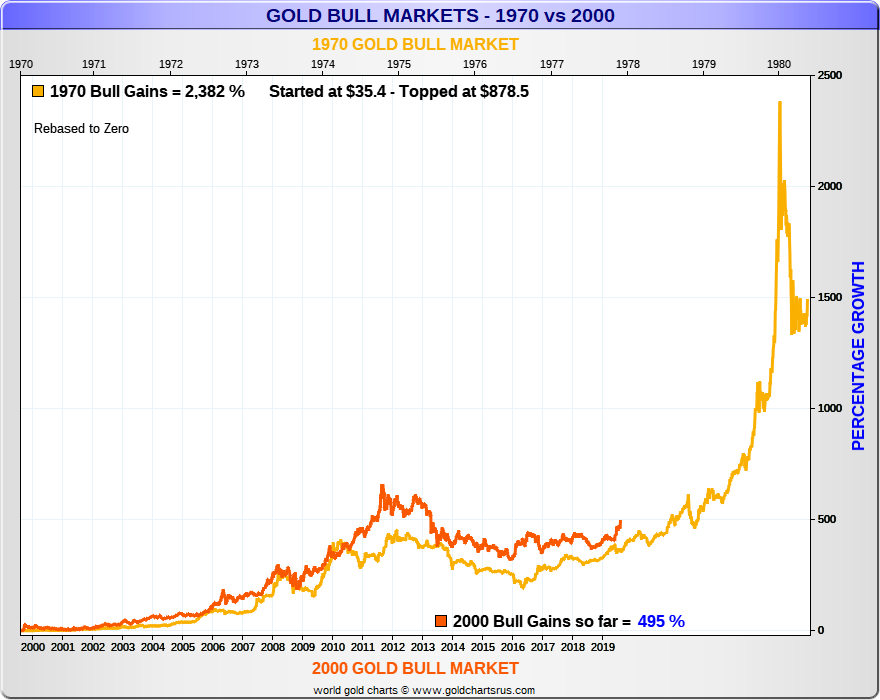

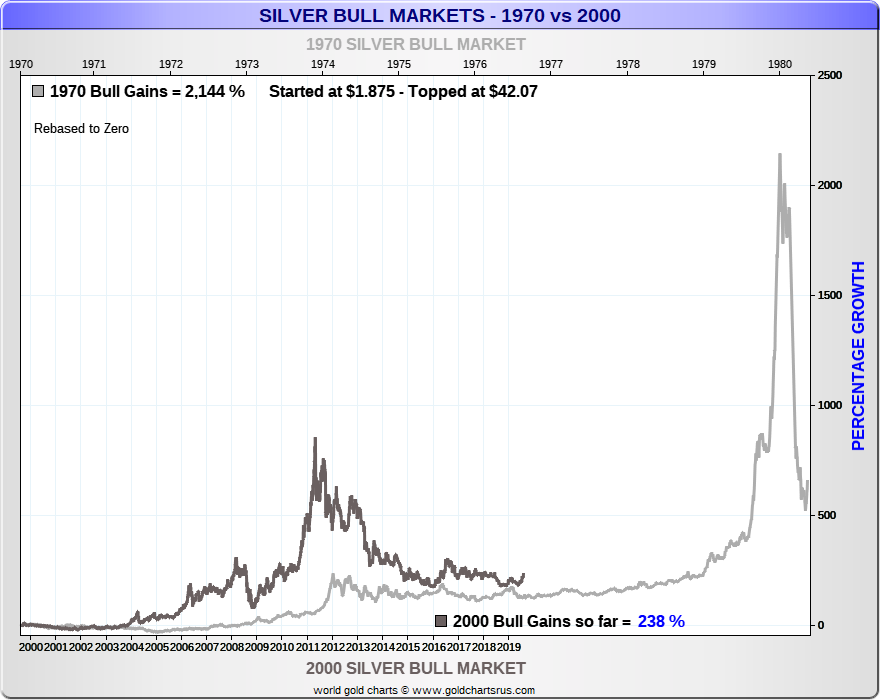

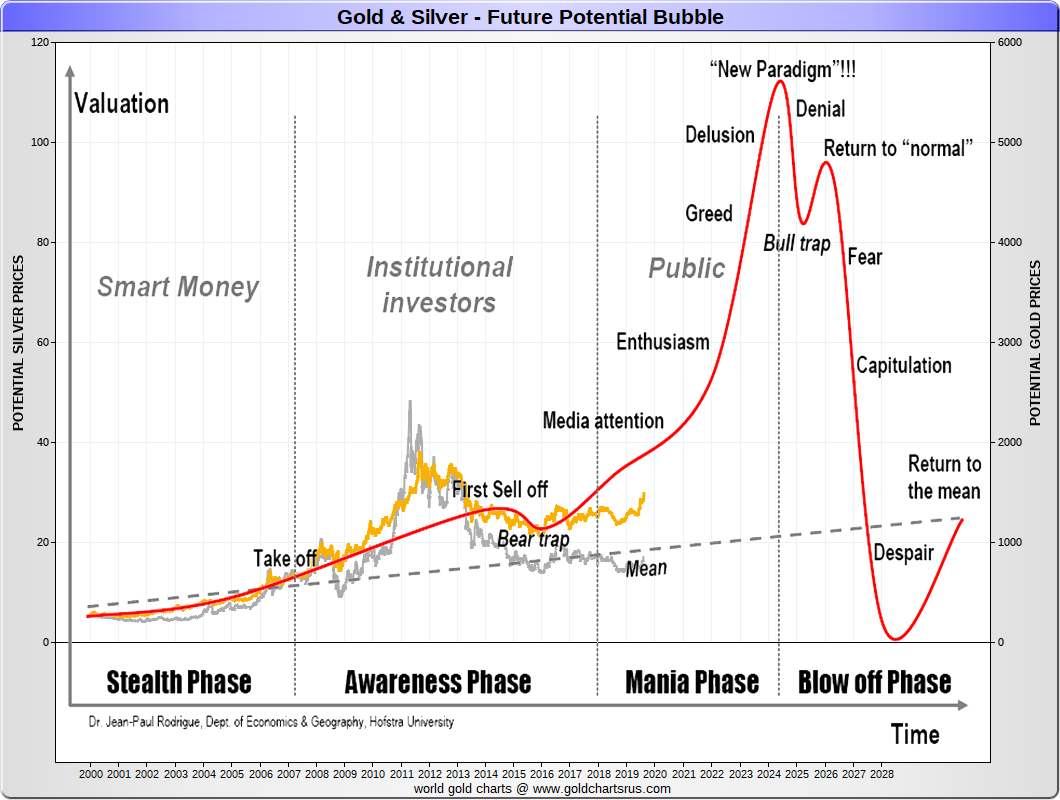

Gold Silver Bull Markets Past Potential Ahead Gold entered a bull market in july 2019 when it finally exited its 7 year basing channel at $1,370. here is the weekly gold chart and the channel from 2010 to 2021. notice the damage that occurred. Since mid 2020, there has been a strong resistance zone overhead from $2,000 to $2,100 that gold kept bumping its head on. on monday, march 4th, gold finally closed above that resistance zone on. The 1970s silver bull market drove a huge 2,460% return and the 2000s bull market drove a 790% return, much higher than the gold bull market returns. so far, silver is up 140% in the current bull. The rally for gold is still going strong, with most analysts expecting to see further gains, but after 30 record high settlements so far this year, investors should start to look out for certain.

Golden Opportunity Three Phases Of A Bull Market Gold Eagle The 1970s silver bull market drove a huge 2,460% return and the 2000s bull market drove a 790% return, much higher than the gold bull market returns. so far, silver is up 140% in the current bull. The rally for gold is still going strong, with most analysts expecting to see further gains, but after 30 record high settlements so far this year, investors should start to look out for certain. Gold’s bull market can be attributed to several factors, including negative real interest rates, expanding government debt and the ongoing de dollarization efforts by brics countries such as. Currently, gold is worth 3%, which goes to show there is ample upside for gold in this bull run. let’s also have a look at the value of the monetary gold supporting the us dollar broad money supply.

Gold Silver Bull Markets Past Potential Ahead Gold’s bull market can be attributed to several factors, including negative real interest rates, expanding government debt and the ongoing de dollarization efforts by brics countries such as. Currently, gold is worth 3%, which goes to show there is ample upside for gold in this bull run. let’s also have a look at the value of the monetary gold supporting the us dollar broad money supply.

Silver Insights Series Mapping Silver S Last Bull Run Vs Gold

Comments are closed.