Gold Bull And Bear Markets The Market Oracle

Gold Bull And Bear Markets The Market Oracle In q2 gold averaged a record $2,337, fueling the fattest and richest profits gold miners have ever earned! over the last four quarters, the gdxj top 25 mid tiers have seen unit earnings skyrocket. Why apple could crash the stock market! nadeem walayat: 3.the stocks stealth bear market nadeem walayat: 4.inflation, commodities and interest rates : paradigm shifts in macrotrends rambus.

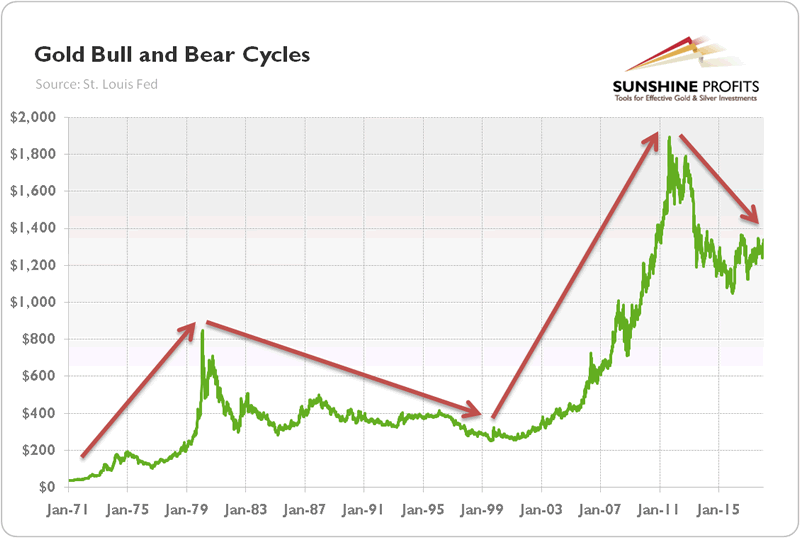

Gold Bull And Bear Markets The Market Oracle Welcome to the market oracle. the market oracle is a free daily financial markets analysis & forecasting online publication. we present in depth analysis from over 1000 experienced analysts on. The bear market which originated in 2011 lasted only 77 months and the price of gold fell just 29.7 percent (if we assume that the bear market ended in december 2015, it would have survived only. A bull market sends investment prices rocketing upwards, which is great for investors. as a counterpoint to a bear market, a bull market typically defines a situation where investment prices rise by 20%, usually after a drop of 20%. during this time, investors are more eager to get in on the market to profit, since prices are strong. While the origins are uncertain, in current usage, bull and bear markets now have specific definitions, typically representing market gains or losses of 20% or more. article sources.

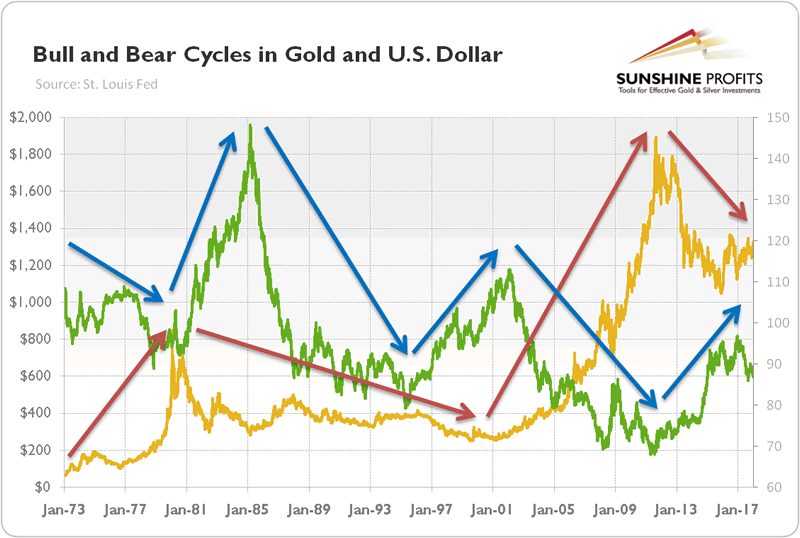

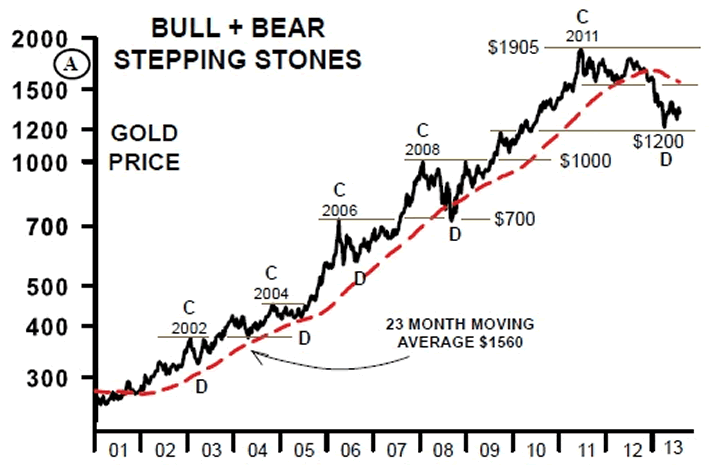

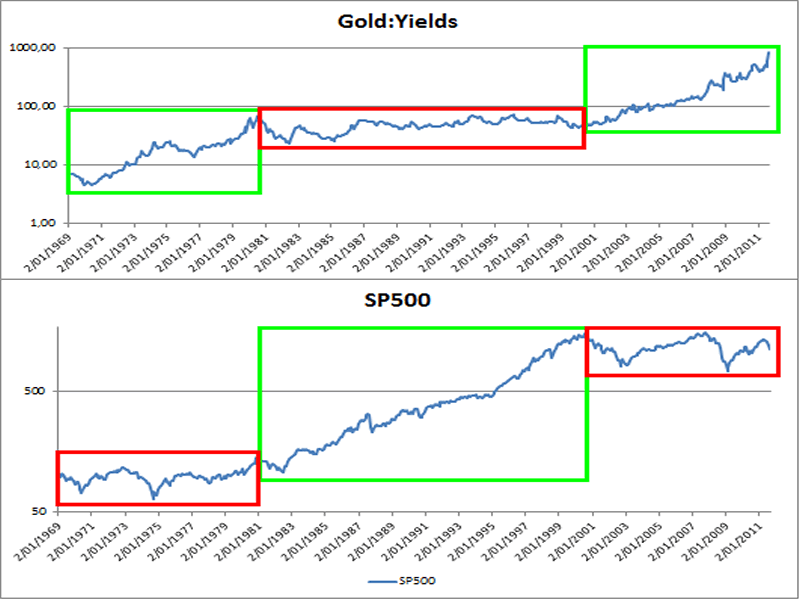

Gold At A Crossroads The Market Oracle A bull market sends investment prices rocketing upwards, which is great for investors. as a counterpoint to a bear market, a bull market typically defines a situation where investment prices rise by 20%, usually after a drop of 20%. during this time, investors are more eager to get in on the market to profit, since prices are strong. While the origins are uncertain, in current usage, bull and bear markets now have specific definitions, typically representing market gains or losses of 20% or more. article sources. Gold bull and bear market cycles over the past century, there have been three major long term stock bear market periods: 1) the great depression of the 1930s, 2) the "stagflationary" 1970s and 3. Bull markets tend to be longer than bear markets, although the duration can vary. using the s&p 500 as a benchmark, since 1942, the average bull market lasted 4.2 years while the average bear.

Bull And Bear Market Cases For Gold Silver And Stocks The Market Gold bull and bear market cycles over the past century, there have been three major long term stock bear market periods: 1) the great depression of the 1930s, 2) the "stagflationary" 1970s and 3. Bull markets tend to be longer than bear markets, although the duration can vary. using the s&p 500 as a benchmark, since 1942, the average bull market lasted 4.2 years while the average bear.

Comments are closed.