Global Structured Finance 2023 Outlook Acuity Knowledge Partners

Global Structured Finance 2023 Outlook Acuity Knowledge Partners The structured finance sector is expected to grow at a cagr of 12.7% over 2023 28 and was valued at usd1.1tn at end 2022, equivalent to c.1.2% of global gdp. global structured finance: 2023 outlook | acuity knowledge partners. Us outlook. us structured finance issuance declined 14.4% y y to usd510bn in 2023, with most asset classes recording a deterioration in performance. us auto lease abs issuance grew by a significant 38% y y to usd23.8bn in 2023 on the back of 13.1% growth in new vehicle sales to 15.5m units, driven by the easing of residual supply constraints.

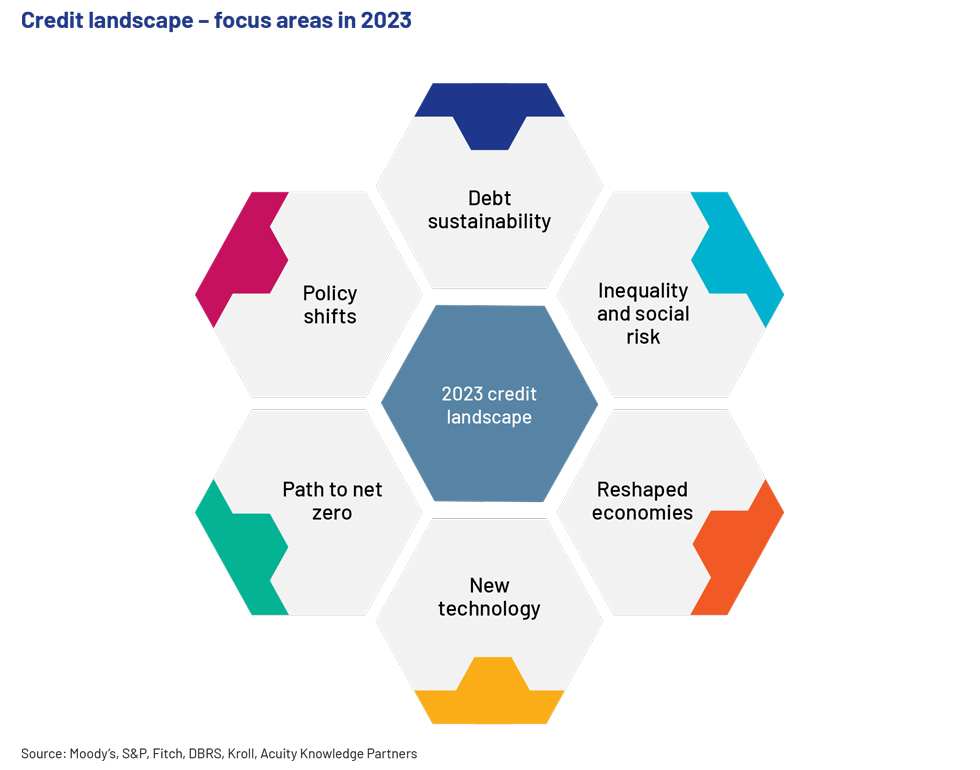

Global Structured Finance 2023 Outlook Acuity Knowledge Partners During 2022, global structured finance issuance totaled roughly $1,092 billion, down from the 2021 post global financial crisis (gfc) record of about $1,530 billion (see table and chart below). in 2022, the dip in global issuance volume was driven by a 24% year over year (y y) decline in the. Project finance – outlook for 2023. published on may 23, 2023 by karan arora and parushi kalra. sustainability, esg and green financing were the trends in 2022, as evidenced by the unprecedented deal numbers. ageing demographics and the “energy transition” are likely to have a significant impact on the global infrastructure sector in 2023. Global structured finance 2023 outlook. global structured finance issuance fell about 29% in 2022, and the declines were generally uniform in the largest global markets as high inflation, volatile interest rates, and geopolitical uncertainty kept issuers on the sidelines. we expect these conditions to continue to hamper issuance. our 2023. London, september 12, 2024 acuity knowledge partners (acuity), a leading provider of bespoke research, data management, analytics, talent and technology solutions to the financial services.

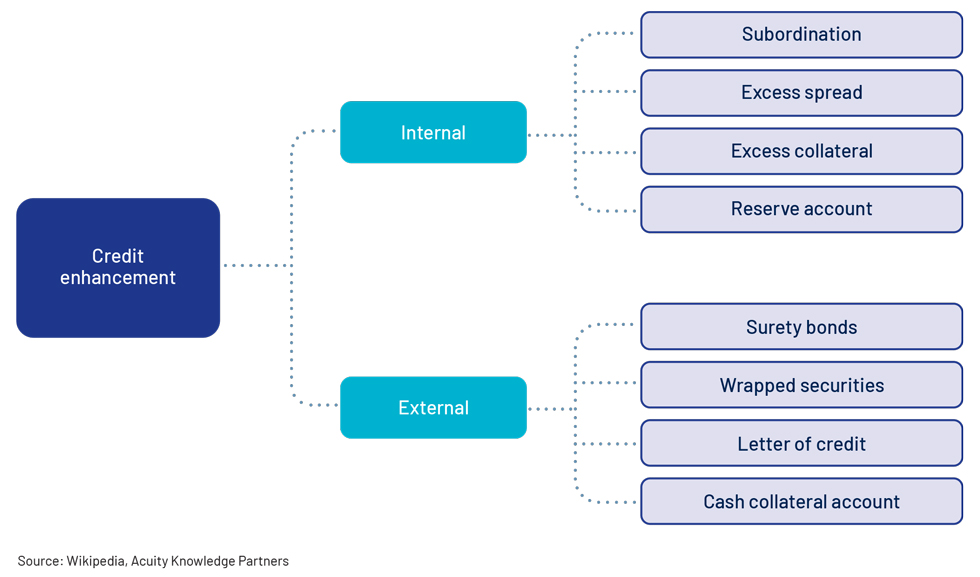

Global Structured Finance 2023 Outlook Acuity Knowledge Partners Global structured finance 2023 outlook. global structured finance issuance fell about 29% in 2022, and the declines were generally uniform in the largest global markets as high inflation, volatile interest rates, and geopolitical uncertainty kept issuers on the sidelines. we expect these conditions to continue to hamper issuance. our 2023. London, september 12, 2024 acuity knowledge partners (acuity), a leading provider of bespoke research, data management, analytics, talent and technology solutions to the financial services. Structured finance products, given their complex and variable nature, are sensitive to the continuous changes in the global economy. read the latest publication by our acuity knowledge partners. About us. acuity knowledge partners (acuity) is a leading provider of bespoke research, analytics and technology solutions to the financial services sector, including asset managers, corporate and investment banks, private equity and venture capital firms, hedge funds and consulting firms. its global network of over 6,000 analysts and industry.

Comments are closed.