Funding Rounds Explained Seed Vs Series A Vs Series B Foundercrate

Funding Rounds Explained Seed Vs Series A Vs Series B Foundercrate Series b funding usually comes from larger venture capital firms and most series b rounds raise between $10 million and $50 million. the risks with series b funding are lower than seed and series a funding because the startup has a proven product and is growing rapidly. but there’s still a risk of failure. This comprehensive guide delves into the various factors influencing the average timeframe for different startup funding rounds, from seed to series a, b, and beyond. factors affecting funding round duration: several factors can influence the duration of a startup’s funding round, impacting the time it takes to secure the desired capital.

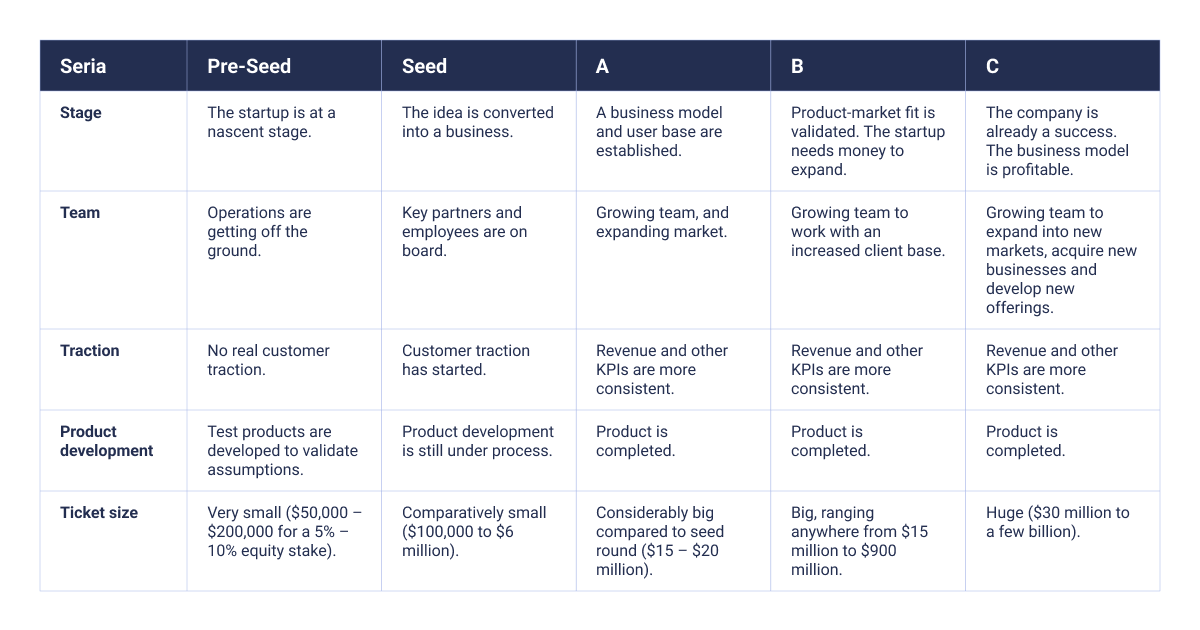

How Series A B C Funding Works For Your Startup A seed funding round can include as little as $20,000 and as much as $2 million—whatever it takes to get the company off the ground. investors who participate in seed funding rounds may do so via safes, or simple agreements for equity funding. to learn more about safes, see our guide to pre money safes vs. post money safes. These fundraising rounds allow investors to invest money into a growing company in exchange for equity ownership. the initial investment—also known as seed funding—is followed by various. Series b funding is the third official stage of the startup financing process and the second stage of venture capital financing, where a growing established startup company scores funding from venture capital firms to expand its operations in return for startup equity. series b funding is required to. scale up the startup operations. Startup funding explained: series a vs seed startups 101. from seed to ipo: a comprehensive guide to the different funding types for startup businesses conclusion. series a and series b funding are crucial steps in a startup's growth trajectory, each with its own set of challenges and requirements.

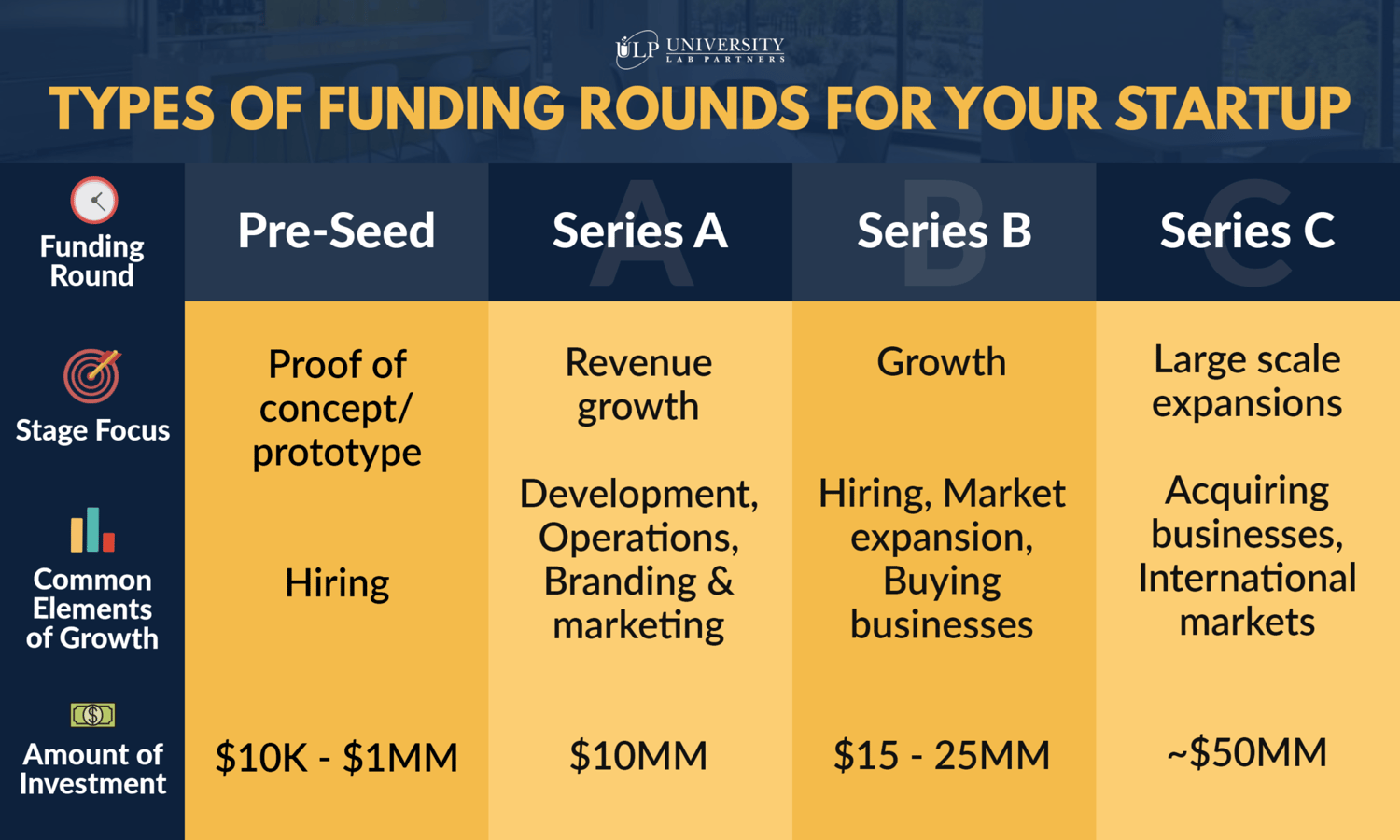

Startup Funding Rounds Seed Series A B C Sdh Series b funding is the third official stage of the startup financing process and the second stage of venture capital financing, where a growing established startup company scores funding from venture capital firms to expand its operations in return for startup equity. series b funding is required to. scale up the startup operations. Startup funding explained: series a vs seed startups 101. from seed to ipo: a comprehensive guide to the different funding types for startup businesses conclusion. series a and series b funding are crucial steps in a startup's growth trajectory, each with its own set of challenges and requirements. The basics of series funding rounds. series funding is a process through which startups and growing companies raise capital in different stages: series a, series b, series c, and so on. it typically begins with pre seed and seed funding, where initial capital for early stage startups is raised from sources like angel investors or accelerators. Series a funding round. the series a funding round represents the beginning of an upward trajectory for startups that can graduate from the seed funding stage into larger, more consolidated investments. financing & valuation in the series a round. in this round, investment isn’t made only based on an idea’s brilliance or a business plan’s.

Series A B C Seed Startup Funding Rounds Expert Guide The The basics of series funding rounds. series funding is a process through which startups and growing companies raise capital in different stages: series a, series b, series c, and so on. it typically begins with pre seed and seed funding, where initial capital for early stage startups is raised from sources like angel investors or accelerators. Series a funding round. the series a funding round represents the beginning of an upward trajectory for startups that can graduate from the seed funding stage into larger, more consolidated investments. financing & valuation in the series a round. in this round, investment isn’t made only based on an idea’s brilliance or a business plan’s.

Comments are closed.