Fraud Alert Vs Credit Freeze Which Is Better How To Choose

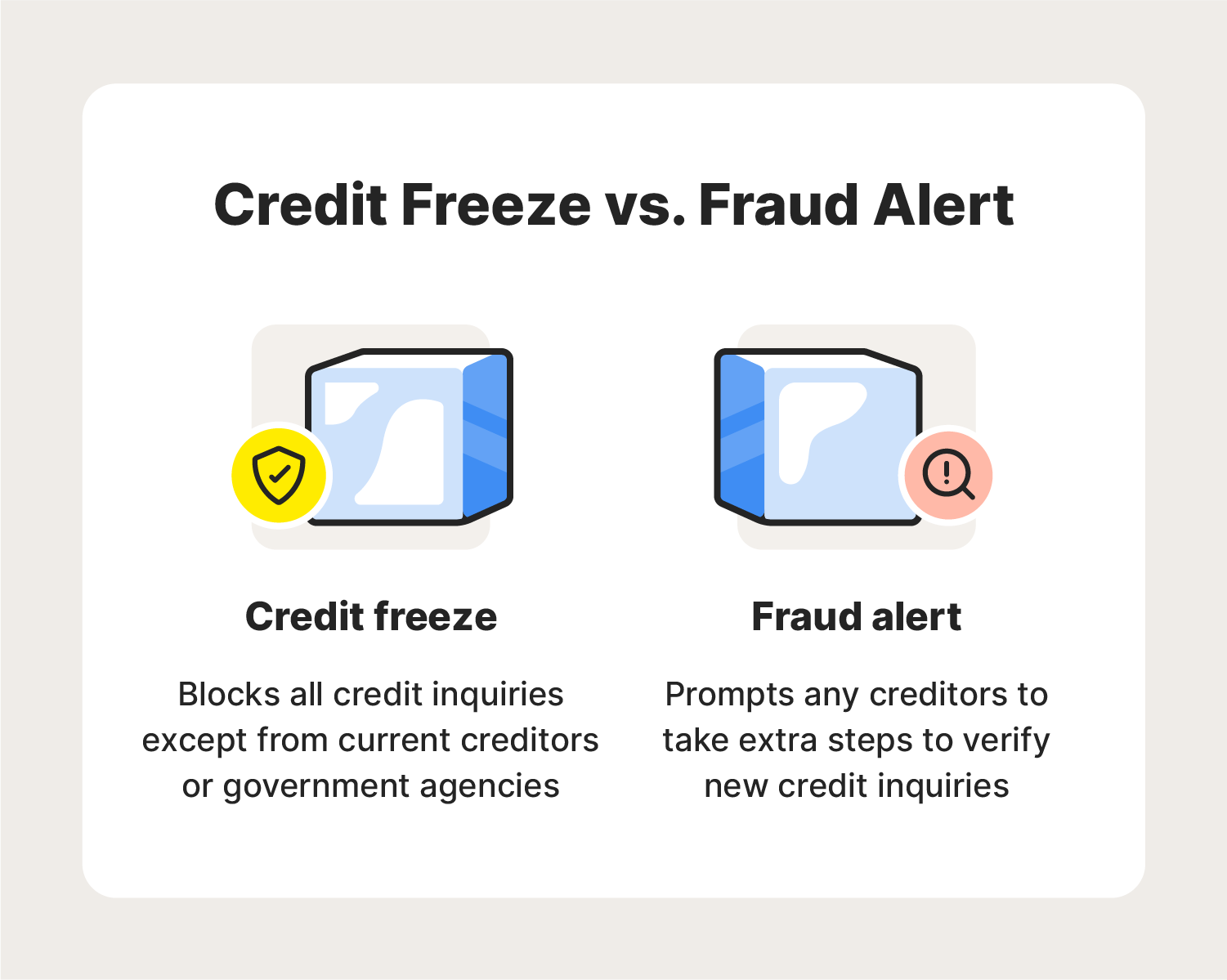

Fraud Alert Vs Credit Freeze Which Is Better How To Choose Fraud alerts and credit freezes help protect you from identity theft, either by alerting creditors to take extra steps to verify your identity or by hiding your credit report from potential. A fraud alert on your credit reports asks creditors to take steps to verify your identity before processing credit applications, while a credit freeze limits access to your credit report to help you avoid identity theft and fraud. let's take an in depth look at the differences and similarities between fraud alerts and credit freezes.

Fraud Alert Vs Credit Freeze Credello A security freeze placed on your credit file will block most lenders from seeing your credit history. that makes a freeze the single most effective way to protect against fraud. if a prospective. Credit freezes and fraud alerts can help. both are free and make it harder for identity thieves to open new accounts in your name. one may be right for you. credit freezes. a credit freeze is the best way you can protect against an identity thief opening new accounts in your name. when in place, it prevents potential creditors from accessing. It's simpler to put a credit fraud alert in place — you can do it with a single phone call — but a credit freeze offers better protection. nerdwallet recommends a credit freeze for most. Most secure: a credit freeze completely seals your credit history, making it one of the most secure protections against fraud. no renewals: a freeze lasts indefinitely. you won’t need to renew it. available to anyone: extended and active duty fraud alerts require proof of identity theft or military duty, respectively.

Difference Between Fraud Alert And Credit Freeze Hispanic Solutions Group It's simpler to put a credit fraud alert in place — you can do it with a single phone call — but a credit freeze offers better protection. nerdwallet recommends a credit freeze for most. Most secure: a credit freeze completely seals your credit history, making it one of the most secure protections against fraud. no renewals: a freeze lasts indefinitely. you won’t need to renew it. available to anyone: extended and active duty fraud alerts require proof of identity theft or military duty, respectively. It depends on your personal circumstances. both fraud alerts and credit freezes can make it harder for identity thieves to open new accounts in your name. with a fraud alert, you keep access to your credit. but freezes are generally best for people who aren’t planning to take out new credit. often, that includes older adults, people under. A credit freeze will stay on your credit report until you choose to remove it. you will need to notify equifax and experian individually if you want to freeze your credit with them. fraud alert vs. credit freeze: which is right for me? if you want more control over who can access your personal information, you may want to freeze your credit.

Credit Fraud Alert Credit Freeze Credit Lock What S The Difference It depends on your personal circumstances. both fraud alerts and credit freezes can make it harder for identity thieves to open new accounts in your name. with a fraud alert, you keep access to your credit. but freezes are generally best for people who aren’t planning to take out new credit. often, that includes older adults, people under. A credit freeze will stay on your credit report until you choose to remove it. you will need to notify equifax and experian individually if you want to freeze your credit with them. fraud alert vs. credit freeze: which is right for me? if you want more control over who can access your personal information, you may want to freeze your credit.

What Is A Credit Freeze And How Do I Do It Lifelock

Ppt Fraud Alert Vs Credit Freeze Whats The Difference Powerpoint

Comments are closed.